Financial highlights and attribution of Group income

The financial figures in the table at the top provide information on the scale of the Swiss Re Group and income generated: total capitalisation broken down in terms of debt and equity, sales/revenues, operating costs and net income.

The information in the lower table shows the distribution of Group income to key stakeholders (employees, government and shareholders).

| Download |

USD millions |

2015 |

2016 |

Total assets |

196 135 |

215 065 |

Total investments |

137 810 |

155 016 |

Total liabilities |

162 529 |

179 349 |

Total debt |

12 812 |

11 351 |

Common shareholders’ equity |

32 415 |

34 532 |

|

|

|

Total revenues |

35 714 |

43 786 |

Premiums earned and fee income |

30 214 |

33 231 |

- P&C Reinsurance |

15 090 |

17 008 |

- L&H Reinsurance |

10 616 |

11 527 |

- Corporate Solutions |

3 379 |

3 503 |

- Life Capital |

1 129 |

1 193 |

|

|

|

Total expenses |

–30 395 |

–39 414 |

Claims and claim adjustment expenses |

–9 848 |

–12 564 |

Life and health benefits |

–9 080 |

–10 859 |

Net income |

4 597 |

3 558 |

| Download |

USD millions (unless otherwise stated) |

2015 |

2016 |

||||||

|

||||||||

Income before tax and variable compensation |

5 758 |

4 773 |

||||||

Variable compensation1 |

510 |

466 |

||||||

Income tax expense |

651 |

749 |

||||||

US GAAP net income attributable to shareholders |

4 597 |

3 558 |

||||||

of which paid out as dividend2 |

1 561 |

1 572 |

||||||

of which share buy-back |

1 018 |

1 0173 |

||||||

of which added to retained earnings within shareholders’ equity |

2 018 |

969 |

||||||

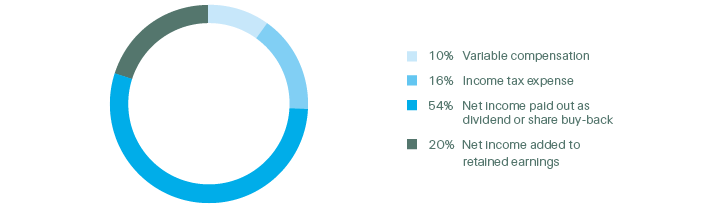

Attribution of 2016 Group income

(in USD millions)