Responsible investment

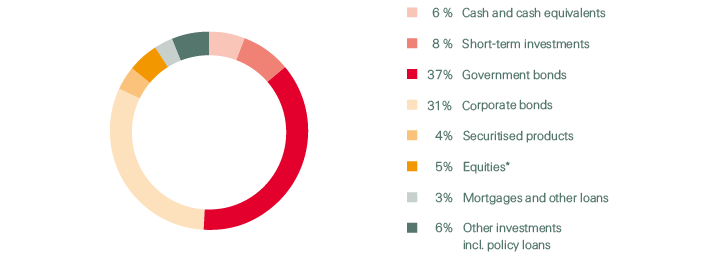

Asset-liability management (ALM) is the cornerstone of our investment philosophy. To meet future claims and benefits, we invest the premiums generated by our underwriting activities in assets whose cash flows match the durations and currencies of our re/insurance liabilities. Generally, we invest more in higher-quality fixed income securities with stable long-term returns. At the end of 2016, such investments accounted for 75% of our total assets under management1.

We are committed to investing our assets responsibly via a controlled and structured investment process, integrating environmental, social and governance (ESG) criteria. Such criteria can have a positive impact on the long-term financial performance of our investment portfolio. Thus, we apply sustainability-related risk information consistently across our entire investment portfolio.

1 Asset classes considered are government bonds (incl. agency), corporate bonds, securitised products, and mortgages and other loans.

Overall investment portfolio

USD 130.5 bn, as of 31 December 2016

* Includes equity securities, private equity and Principal Investments