The Sensitive Business Risk process

219

Sensitive business transactions referred to our team of sustainability experts

(309 in 2015)

7 137

Due diligence checks carried out by our underwriters to detect potential sustainability risks

(3 550 in second half of 2015, after introduction)

Each of the two umbrella policies and seven sector guidelines of our Sustainability Risk Framework contains criteria and qualitative standards which define precisely when a transaction may present a “sustainability risk”. We assess such transactions through our Sensitive Business Risk (SBR) process, which consists of two due diligence mechanisms – the SBR online assessment tool and the SBR referral tool.

The online tool, which we first introduced in mid-2015, enables our underwriters to screen all transactions for their possible impacts on the local environment and on the human rights of the people and workforces affected. It is easy to access, provides clear guidance on what to assess in further detail and ensures consistent documentation in our standard underwriting tools. At the same time, it enables our central sustainability management unit to incorporate relevant new information by adjusting key policy parameters and making these effective “at the push of a button”.

If the initial screening reveals any potential issues, our underwriters carry out further due diligence measures. Finally, they transfer the most critical transactions through the SBR referral tool to our team of sustainability experts, who conduct targeted research to decide whether the transaction at hand is acceptable on ethical grounds.

This decision takes the form of a binding recommendation either to go ahead with the transaction, to go ahead with certain conditions attached, or to abstain. If there is disagreement about the recommendation, the case can be escalated to the next management level and, ultimately, to the Group Chief Risk Officer and the Group Executive Committee.

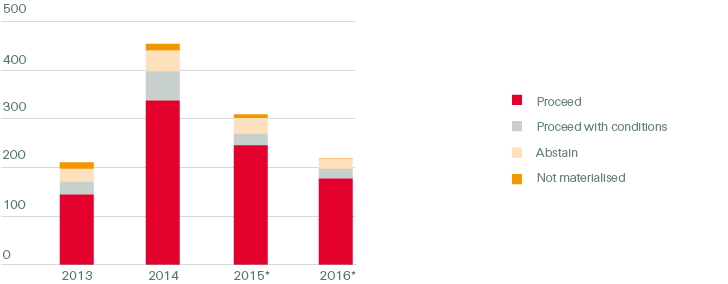

The online SBR assessment tool is now fully implemented. In 2016, our underwriters used it to carry out sustainability checks on a 7 137 transactions. As the tool precisely identifies those transactions that require further assessment from our sustainability experts, the number of referrals has fallen since its introduction in mid-2015. Of the 219 transactions referred in 2016, we issued negative recommendations in 21 cases and positive recommendations with conditions attached in 20 cases.

When making these decisions, we refer to internationally recognised ethical principles. Swiss Re complies with the UN Guiding Principles on Business and Human Rights (the Ruggie Framework) and is a signatory to the UN Global Compact, which derives its human rights principles from the Universal Declaration of Human Rights, its labour principles from the ILO Declaration on Fundamental Principles and Rights at Work, its environment principles from the Rio Declaration on Environment and Development and its anti-corruption principles from the United Nations Convention against Corruption.

This web of ethical principles helps us to make decisions that are aligned with universal fundamental rights. However, this is not sufficient for decisions in a business context. We also need to consider the social and economic implications of our decisions in their respective cultural contexts and, last but not least, the implications for our business. Balancing these different aspects requires us to carefully and consistently assess transactions and their local effects, often in collaboration and dialogue with external experts and local stakeholders.

Thus, our decisions are neither subjective nor entirely objective. In essence, they reflect our recognition of global fundamental rights, of human suffering and our commitment to limiting unwanted negative impacts of our business transactions, either by withdrawing or by influencing our clients’ behaviour.

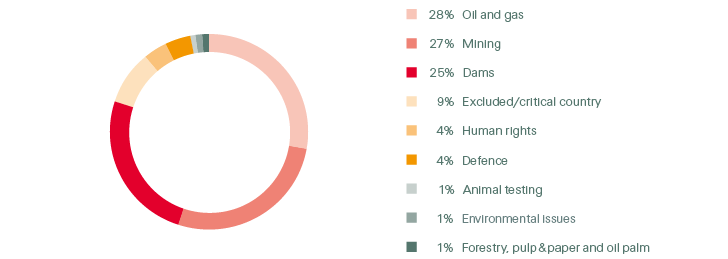

Sensitive Business Risks referred to our expert team in 2016

Number of Sensitive Business Risk referrals

* Starting in mid-2015, we have refined our SBR process, which has led to a decrease in the number of referrals

Integrating anti-bribery & corruption guidance

Swiss Re prohibits all forms of bribery and corruption, as expressed by our Code of Conduct. We clearly state this position and explain what it means for daily business conduct through our Group Anti-Bribery and Corruption (ABC) Policy and detailed Group ABC Guidelines (see Compliance: Code of Conduct). In 2016, we took further steps to mitigate our potential exposure to bribery and corruption risks by integrating corresponding guidance in our SBR assessment tool, thus ensuring appropriate due diligence on our counterparties.

This guidance specifies both the countries and industries with a heightened risk of bribery and corruption, and instructs our underwriters how to carry out additional due diligence in order to assess the risk. In grave cases, our due diligence procedure leads to an automatic requirement to abstain from the transaction. If there is disagreement about this, the transaction needs to be discussed with our internal legal and compliance team who can provide additional advice.