Swiss Solvency Test (SST)

SST ratio 2019

251%

Swiss Re is supervised at the Group level and for its regulated legal entities domiciled in Switzerland by FINMA. FINMA supervision comprises minimum solvency requirements, along with a wide range of qualitative assessments and governance standards.

Based on current SST rules introduced in 2017, the ratio is calculated as SST risk-bearing capital (SST RBC) minus the market value margin (MVM), divided by SST target capital (TC) minus the MVM.

The Group SST 2019 report will be filed with FINMA in April 2019. Accordingly, the information presented below is based on currently available figures and may differ from the information included in the final Group SST 2019 report.

In SST 2019, the solvency of Swiss Re Group remains at a very strong level of 251% and comfortably above the target of 220%. In a challenging year with large losses Swiss Re was able to generate a positive underwriting contribution. This is also reflected in a relative increase of insurance risk in the overall risk profile. Capital repatriation, the redemption of a subordinated instrument and depressed financial markets resulting in negative contribution from investments ultimately lead to a decrease in the overall SST ratio.

Swiss Re Group SST Ratio

| Download |

USD millions |

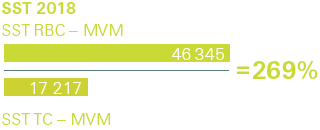

SST 2018 |

SST 2019 |

Change |

SST risk-bearing capital – market value margin |

46 345 |

40 637 |

–5 708 |

SST target capital – market value margin |

17 217 |

16 188 |

–1 029 |

SST ratio |

269% |

251% |

–18pp |