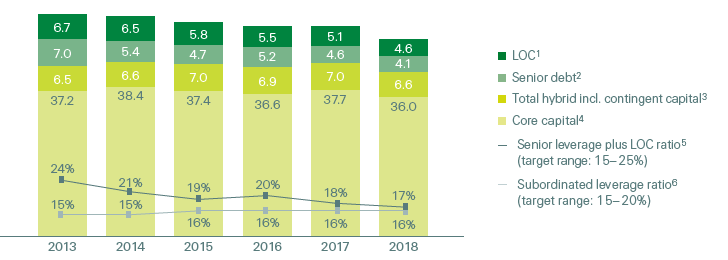

Maintenance of target capital structure

Having achieved the Group’s target capital structure in 2016, the focus is now on maintaining it.

In June 2018, Swiss Re Ltd issued a USD 500 million 6 year non-dilutive senior exchangeable bond with anytime issuer stock settlement at a coupon of 3.25%. This new issuance in the equity-linked capital market provides Swiss Re with valuable, cost efficient contingent capital, further enhancing the Group’s financial flexibility. The new bond replaced the CHF 320 million perpetual subordinated notes with anytime issuer stock settlement issued in 2012 by Swiss Reinsurance Company Ltd, which were redeemed in September 2017.Swiss Reinsurance Company Ltd further reduced subordinated leverage by USD 750 million by redeeming its second series of perpetual subordinated notes with anytime issuer stock settlement on their first call date in September 2018.

The Group’s leverage is comfortably within target capital structure senior leverage target range (15–25%) and at within the subordinated leverage target range (15–20%), providing the Group with additional financial flexibility.

Target Leverage maintained

USD billions

1 Unsecured LOC capacity and related instruments (usage is lower).

2 Senior debt excluding non-recourse positions.

3 Includes SRL’s pre-funded dated subordinated debt facilities and contingent capital instruments accounted for as equity.

4 Core capital of Swiss Re Group is defined as economic net worth (ENW).

5 Senior debt plus LOCs divided by total capital.

6 Subordinated debt divided by sum of subordinated debt and ENW.