Financial strength and capital management

Maintained very strong capital position

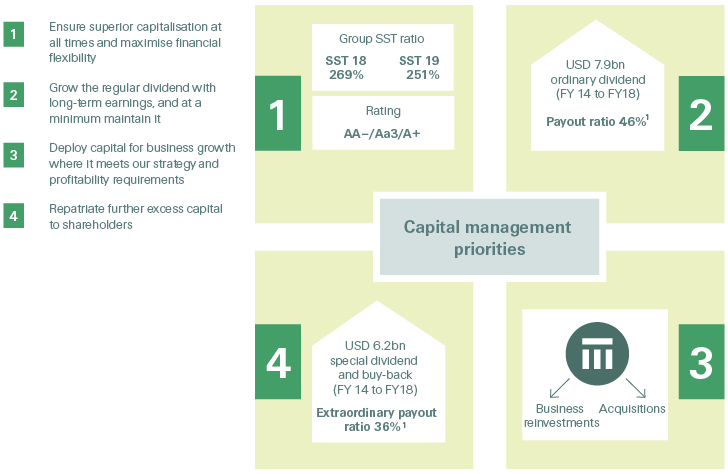

Swiss Re remained strongly capitalised throughout 2018 despite large industry losses, allowing us to deploy capital for potential market developments while continuing to repatriate excess capital to our shareholders.

Robust capitalisation despite large events

Swiss Re’s policy of ensuring superior capitalisation at all times has meant that even in the face of large insurance losses in two consecutive years, the Group maintains a very strong capital position and high financial flexibility. Swiss Re’s financial strength enables the Group to stay committed to creating sustainable long-term shareholder value by growing the regular dividend.

Swiss Re’s capital management priorities aim to ensure the ability to continue operations following an extremely adverse year of losses from insurance and/or financial market events. Swiss Re’s Group Board of Directors has also defined an SST capitalisation target of 220% for the Swiss Re Group.

The below subsections describe Swiss Re’s capitalisation according to the SST and the financial strength ratings.

1 Payout ratio calculated as capital repatriation over total contribution to ENW; assumes AGM approval of the proposed ordinary dividend of CHF 5.60 per share and the unconditional share buy-back of up to CHF 1bn