The global economy and financial markets

Swiss Re delivered a Group net income of USD 421 million, in a year marked by large claims, volatile equity markets and significant impact from a US GAAP accounting change.

Divergent growth trends caused financial market performance to vary by region.

Growth accelerated in the US, but slowed in other major economies. Long-term bond yields increased modestly in the US along with central bank interest rates, while yields were unchanged or slightly lower elsewhere. Global equity markets ended the year in negative territory.

Global economy

Tax cuts and increased public spending provided a boost to the US economy, lifting real GDP growth from already robust levels in 2017 to close to 3% in 2018. Growth in the Euro area remained strong in the first half of the year, but slowed in the second half, averaging 1.8% in 2018 after 2.4% the year before. Meanwhile, economic growth in the UK continued to soften in 2018, from 1.8% to 1.4%, as uncertainty around Brexit weighed on investment and elevated inflation continued to erode real wages, which in turn dampened consumer spending. Japan’s GDP growth also slowed from 1.9% to 0.7% as both domestic and external demand weakened (see economic indicators table).

Inflation continued to climb in most markets, driven by rising oil prices. Underlying inflation (excluding energy prices) remained more moderate. We saw signs of increasing price pressure, particularly in the US, where tight labour markets led to wage increases. US average hourly earnings growth, for example, reached 3.3% in October, a level last seen almost a decade ago, and stayed elevated through year-end.

Economic growth in emerging markets varied by country. The emerging Asia region continued to outperform as growth in India accelerated to 7.3% and the Chinese economy slowed only moderately to 6.6%. Growth in China was supported by accommodative monetary policy and fiscal measures intended to offset slowing external demand and adverse trade policies. Growth in EU member countries in Central and Eastern Europe slowed along with western European markets, while the Russian economy accelerated modestly. Political and economic crises triggered either a sharp growth slowdown or recession in some emerging economies, such as Turkey, Argentina and Venezuela. Only modest growth in Brazil also contributed to sub-par performance in Latin America.

US 10-year Treasury bond yield

Year-end 2018

2.7%

German 10-year Bund yield

Year-end 2018

0.2%

Interest rates

The major central banks normalised monetary policy to varying degrees during the course of 2018. The US Federal Reserve (Fed) proceeded on its gradual rate hiking path with four steps of 25 basis points each. The Bank of England raised interest rates once, while European Central Bank (ECB) interest rates remained in negative territory. The ECB tapered its asset purchases in 2018, and suspended them by the end of the year. The Bank of Japan continued its expansionary monetary policy, targeting long-term yields at a level close to zero.

After easing monetary policy in 2017 and into 2018, some emerging market central banks, including Russia, India and South Africa, started to tighten monetary policy in the second half of 2018. This was done to stem capital outflows and currency depreciation as well as contain inflation. The Chinese central bank cut the reserve requirement ratio twice in 2018 to support bank lending and growth.

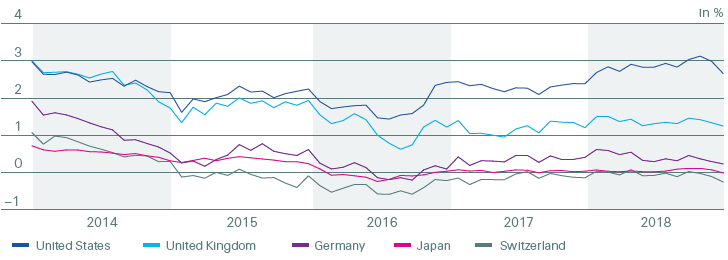

US long-term government bond yields continued to rise along with central bank interest rates for most of the year, but reversed part of the increase in the final two months. The US 10-year yield ended the year at 2.7%, up some 30 basis points over the past 12 months. Long-term yields in other major markets were stable or slightly lower in 2018 (see interest rates chart). The German 10-year government bond ended the year at 0.2%, the UK yield at 1.3% and the Japanese yield at 0%.

Interest rates for 10-year government bonds 2014–2018

Source: Datastream

Stock market performance

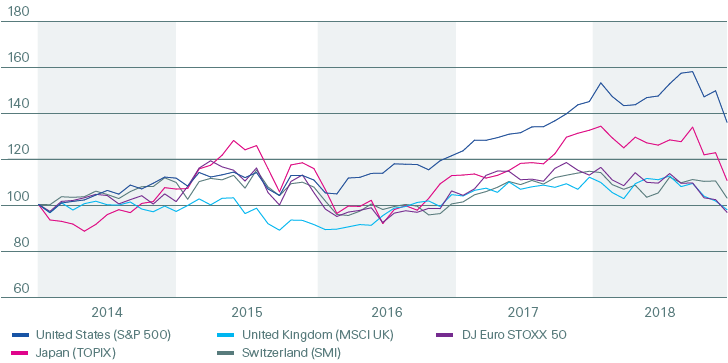

The economic environment proved to be challenging for global stock markets, particularly in the final quarter of the year. Slowing growth, increasing (albeit still moderate) inflationary pressures, and the gradual end of expansionary monetary policy weighed on markets. Political and policy uncertainties added to the negative sentiment. Specifically, trade tensions between the US and China heated up over the summer, raising fears of a global trade war that could negatively affect global growth and trigger inflation. Meanwhile, a government coalition in Italy initially pursued a fiscal agenda after the Italian elections in May that was in breach of EU budget rules. Financial market contagion from the budget crisis in Italy was limited, though, and agreement with the EU was reached in December. Meanwhile, uncertainty around the UK’s exit from the European Union remained elevated throughout the year. Finally, political turmoil in some emerging markets, including Turkey and Argentina, triggered fears of a broader emerging market crisis. US stock markets benefited from strong domestic growth and corporate earnings boosted by tax cuts. US stocks were up almost 10% at the end of September before falling sharply in the final quarter, ending the year down 6%. Other major indices declined even more sharply. The Swiss Market Index lost 10% over the year, the MSCI UK 13%, the Eurostoxx50 was down 14% while the Japanese TOPIX fell 18% (see stock markets chart).

Stock markets 2014–2018

Source: Datastream

Currency movements

The US dollar strengthened during most of 2018 on the back of rising interest rates and stronger growth in the US, before losing some ground in December. The US dollar ended the year up 6% versus the British pound, 5% versus the euro and 1% versus the Swiss franc, whereas it lost 3% versus the Japanese yen.

Economic risks affecting re/insurers

Downside risks increased during the course of 2018 and remain elevated looking ahead. We see some upside potential from supportive fiscal policies and a de-escalation of trade conflicts. Overall, however, risks seem skewed to the downside.

The biggest longer-term risk is an escalation of current trade tensions to a global trade war. This would have a significant effect on growth. The US decision to impose higher trade tariffs on Chinese imports has increased the risk, once again, of a sharp slowdown in China. Before trade tensions escalated, sustained economic growth, progress in reducing corporate debt and de-risking of wealth-management products had lowered the risk. A “hard landing” in China could send shock waves across the global economy and financial markets.

In the US, inflation could increase more sharply than expected if the record-low level of unemployment leads to significantly higher wages. This could force the Fed to tighten monetary policy more aggressively and lead to a (temporary) spike in long-term bond yields as investors realise that the Fed is behind the curve. We could see a boom-and-bust cycle with a period of stronger growth and high inflation, followed by a sharp slowdown or even a recession. US overheating risks could spread across the globe, with a spike in bond yields and a stronger US dollar as the catalysts for contagion. Monetary policy errors elsewhere could also have severe consequences for economic growth and financial markets.

Finally, there are numerous political risks that could affect the economic outlook. Brexit-related uncertainty continues to weigh on economic activity in the UK and negative effects could spread across Europe if the UK were to exit the European Union in a disorderly fashion. Also, upcoming EU parliament election could embolden eurosceptic parties across Europe. Coupled with a flaring up of the budget conflict in Italy, this could re-ignite Euro area break-up fears and destabilise financial markets.

Re/insurers could be affected by volatility in asset prices and slower growth in the affected markets. A “flight to quality” could lead to a sustained drop in interest rates and exacerbate the challenges from the persistent low yield environment. A scenario of unexpectedly high inflation, however, could have a sizeable impact on re/insurance claims, especially in casualty lines. A more positive scenario of stronger growth and contained inflation would be beneficial for the re/insurance industry. Investment yields would improve, albeit only slowly, and premium volumes would rise along with economic activity. China could maintain growth of near 7% rather than slow gradually, benefiting Asia overall and global commodity exporters in particular.

Economic indicators 2017–2018

| Download |

|

USA |

Eurozone |

UK |

Japan |

China |

|||||||||||||

|

2017 |

2018 |

2017 |

2018 |

2017 |

2018 |

2017 |

2018 |

2017 |

2018 |

||||||||

|

||||||||||||||||||

Real GDP growth1 |

2.2 |

2.9 |

2.4 |

1.8 |

1.8 |

1.4 |

1.9 |

0.7 |

6.9 |

6.6 |

||||||||

Inflation1 |

2.1 |

2.4 |

1.5 |

1.7 |

2.7 |

2.5 |

0.5 |

1.0 |

1.5 |

2.1 |

||||||||

Long-term interest rate2 |

2.4 |

2.7 |

0.4 |

0.2 |

1.2 |

1.3 |

0.0 |

0.0 |

3.9 |

3.3 |

||||||||

USD exchange rate2,3 |

– |

– |

120 |

114 |

135 |

127 |

0.89 |

0.91 |

15.4 |

14.5 |

||||||||