Responsible investment

Investment mix

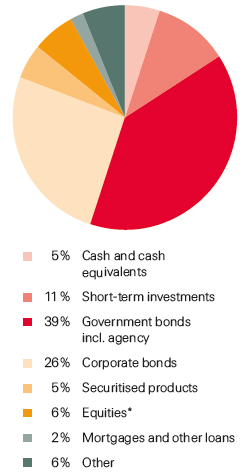

as of 31 December 2014

(Total: USD 125.4 bn; assets for own account only, excluding unit-linked and with-profit)

* Listed equities, hedge fund equities, private equity and Principal Investments

Asset-liability management (ALM) is the cornerstone of our investment philosophy. Premiums generated by our underwriting activities are invested in assets whose cash flows match the durations and currencies of our re/insurance liabilities, to meet future claims and benefits. As a result, we have an overweight of higher-quality fixed income investments with stable long-term returns. At the end of 2014, such investments accounted for 72% of our total assets under management1.

Swiss Re is committed to investing its assets responsibly through a controlled and structured investment process, which integrates environmental, social and governance (ESG) criteria. We believe that considering these factors can have a positive impact on the long-term financial performance of our investment portfolio. Thus, we apply sustainability-related risk information consistently across our entire investment portfolio.

We also remain engaged on long-term investment themes, and particularly on infrastructure as an asset class: Re/insurance companies are well suited to bridging the emerging infrastructure financing gap due to the long-term nature of their underlying business; however, the right pre-conditions have to be set. Swiss Re recognises this and contributes to ongoing policy dialogue on a global level. For instance, we recently issued a joint publication with the Institute of International Finance (IIF), “Infrastructure Investing. It matters.” (see “Selected communication products in 2014”) and support the World Bank’s recently established Global Infrastructure Facility as an advisor (see “Our Collaboration with the World Bank”).

1 Asset classes considered consist of government bonds (incl. agency), corporate bonds, securitised products, and mortgages and other loans.