Growth and strengthening of the framework

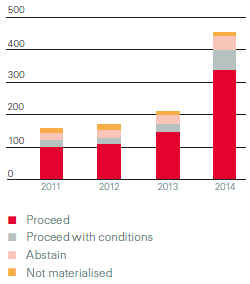

454

Total number of business transactions referred to the Sensitive Business Risks process in 2014

(210 in 2013)

In 2014, the number of transactions referred to the SBR process rose to 454, more than double the number of the previous year. We issued negative recommendations in 43 cases and positive recommendations with conditions in 60 cases.

This strong increase was due to a combination of factors: our continued expansion in high growth markets, where regulation tends to be less stringent, and our continuing efforts to raise awareness of sustainability risks and to provide appropriate training to our underwriting community (see section below).

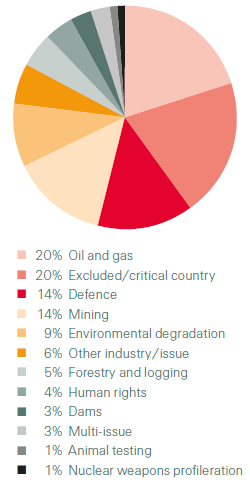

Sensitive Business Risk referrals 2014

Number of Sensitive Business

Risk referrals

In view of the steady rise in the number of SBRs, we wanted to establish the approximate percentage of all potentially sensitive transactions that are currently referred to the SBR process. Therefore, we screened all of our business transactions according to four “sensitivity” parameters: countries, country/industry combinations, companies and individual projects. We found that, according to these criteria, around 3 700 of the business transactions we completed in 2014 (in both our Reinsurance and Corporate Solutions Business Units) had to be considered to contain at least some degree of sustainability risk.

Given the total of 454 SBR referrals in 2014, this means that around 12% of all our potentially sensitive transactions were centrally assessed by the sustainability management team at our headquarters. The remaining transactions were examined locally by the responsible business teams, based on the eight policies of our Sustainability Risk Framework.

Creation of an SBR expert network

In response to the steady rise in SBR referrals across all geographical areas, in 2014 we decided to strengthen the Sustainability Risk Framework at our locations by setting up an SBR expert network to provide permanent points of contact. These experts from Risk Management will act as interfaces between the headquarter-based Sustainability Management team and our local underwriting teams. Their responsibilities include awareness raising, organising trainings, facilitating SBR assessments and maintaining contact with regional stakeholders.

Independent internal reviews

In 2014, we started to formally cooperate with our internal Business Risk Review (BRR) unit. A BRR is an independent quality assessment of underwriting and costing activities to review the quality of the technical work carried out and the decisions made, including checking whether mandatory underwriting standards have been adhered to.

During a BRR, our underwriting teams are now automatically asked a number of specific questions about their potential exposure to sustainability risks. The results and recommendations for improvement are reported to the Sustainability Management team, which can then take appropriate action if it detects potential problem areas.