Swiss Re maintains its commitment to creating long-term value

Dear shareholders,

2017 was a demanding year for our industry – and for Swiss Re. I’m sure you remember the news headlines about Cyclone Debbie in Australia, the hurricanes in the US and Caribbean, the earthquakes in Mexico or the wildfires in California. Above all else, disasters like these are human tragedies. I was troubled and deeply moved by the devastation to families and whole communities.

In such difficult times, we are here to help people and businesses get back on their feet. That has always been our purpose. And it’s what makes working here so rewarding for me personally. I’ll remember 2017 as another year of truth for Swiss Re: it was and remains our priority to support our clients and the people affected by severe natural catastrophes.

“Our strategy and near-term priorities set us up well to continue partnering with our clients and applying our knowledge to develop solutions that directly tackle the protection gap.“

Christian Mumenthaler

Group Chief Executive Officer

Despite the estimated large insurance claims of 2017, we reported a full year net income of USD 331 million. Our decisions in recent years to keep excess capital on our balance sheet and to be disciplined in our underwriting mean that – even after the losses – our capital position is very strong and our financial flexibility remains high. Our commitment to creating long-term value for you, our shareholders, as well as for our clients remains unchanged.

Unfortunately, last year’s natural disasters also highlighted the fact that a lot of people do not have insurance. That can be due to a variety of reasons, such as lack of access or awareness. In fact, the number of people around the world who are not protected has been increasing. This is due to population growth and more people living in areas that are prone to natural disasters – Florida is one example.

We’ve been determined to tackle this gap in insurance coverage – we call it the protection gap – for many years. In 2015, the global protection gap amounted to around USD 153 billion for natural catastrophe risk. In my opinion, this number is far too big. It represents too many people that will not have the financial support necessary to rebuild their lives when natural catastrophes strike in the future. It also represents a threat to entire economies.

Our industry plays a major role in ensuring financial stability and, therefore, we need to keep working hard to close this protection gap. This will require more than traditional reinsurance solutions. It’s my ambition over the coming years to strongly position Swiss Re as a risk knowledge company. What do I mean by this? I mean that Swiss Re applies its 154 years of risk knowledge and partners with our clients so that, together, we can develop innovative insurance solutions that reach more people. In doing so, we are making the world more resilient.

Moving the needle on investments

Swiss Re is among the first in the re/insurance industry to systematically integrate environmental, social and governance (ESG) benchmarks into its investment decisions.

Reducing risks

We’re in it for the long-run. And so are our investments. As an early adopter of ESG investment principles, Swiss Re is leading the way towards a more resilient future by increasing its environmental, social and governance accountability. Responsible investment has been for a long time part of our DNA, and our recent switch to ESG benchmarks has helped us further mitigate risk in our investments while still benefiting from the upside potential.

Further challenges

The integration of ESG considerations along the entire investment process makes economic sense, as it results in superior risk-adjusted returns over the long term. However, broader adoption of responsible investment approaches requires regulatory harmonisation, clear industry standards and consistent ESG integration in company analysis.

Swiss Re remains a leading player in the industry, supporting the development of robust regulatory and benchmarking frameworks with clear definitions, standards and methodologies that will also enable the creation of suitable investment products needed to secure widespread adoption of ESG criteria.

Growing impact

We continually explore options to further integrate ESG criteria into our investment decisions. With this move, we hope to encourage the development of business models that help make economies more resilient and improve longer-term financial market stability. The impact of applying ESG criteria into the entire USD 75 trillion institutional asset base could have a transformational effect on our world.

Innovative solutions to make the world more resilient

We made progress towards that goal in 2017. We co-led the World Bank’s Pandemic Emergency Financing Facility (PEF). In case of a disease outbreak, cash will be automatically paid to response agencies and national governments to finance emergency interventions. Payouts will be made when a set of pre-determined thresholds are met, such as number of deaths or infections within a given timeframe. PEF was developed in response to the Ebola crisis of 2014 where, as you may remember, response funds only became available months into the outbreak. PEF will allow funds to reach affected countries in as little as ten days. In that sense, we expect it to save lives and prevent an outbreak from becoming a larger international crisis.

Swiss Re Group priority

Solutions like this are only possible with the latest technology. And, in general, technology is having a big, mostly positive impact right across the insurance value chain. For example, Magnum – our underwriting software for life and health insurance products – enables our primary insurance clients to automate the risk assessment process, providing instant underwriting decisions. In 2017, Magnum processed more than 10 million applications globally. Furthermore, it provides our clients with meaningful data insights, so that they can better understand their customers and develop products that are even more tailored to their needs. At the same time, we gain insights into the drivers of profitability in the biometric risk business. In this way, we work together with our clients to extend insurance coverage.

Technology is also changing insurance distribution channels. Just as we can buy books or groceries online, you can easily buy life insurance online, too. Our digital life insurance platform, provided through our iptiQ business, makes it possible to reach the people who don’t buy insurance through traditional insurance distribution channels, such as agents – and for the price of a coffee per day. With the platform, our clients can take advantage of our technology and knowledge, but distribute products under their own brand. There’s great potential to provide security and peace of mind to millions of people.

At the same time, with digital solutions we’re improving our international business capabilities to better support our commercial insurance clients around the world. We work with our clients – from retail operators to real estate companies and from schools to hotels – to provide a better understanding of the current and future risks they face and develop innovative solutions that meet their specific needs and risk exposure. Insured businesses are more resilient businesses because in the event of a disaster, we help them get back to work and serving their own customers quicker.

Let me share a tangible example: when hurricanes Harvey, Irma and Maria hit last year, we received more than 200 loss notices from our commercial insurance clients in the days immediately after the hurricanes made landfall. To handle the claims quickly, we reallocated staff across regions and lines of business and we were able to get back to clients within one business day. In one case, we provided a fast, substantial payment to a school that was significantly damaged in one of the most affected areas. With this money, we helped the school start reconstruction quickly, and it’s on track to re-open in time to host the graduation ceremonies for its senior class.

Our financial performance in 2017

Full year net income

in USD millions, 2017

331

(2016: USD 3.6 billion)

After several years with below average natural catastrophe activity and corresponding very strong returns for shareholders in our property and casualty (P&C) businesses, the events of 2017 – totalling USD 4.7 billion in expected claims – took a toll on our results: P&C Reinsurance reported a loss of USD 413 million and Corporate Solutions reported a loss of USD 741 million. As the US is the largest market for our commercial business, Corporate Solutions’ result was particularly impacted by the natural catastrophes there. We remain fully committed to the Business Unit and, as we previously communicated, we have strengthened its capital position with a USD 1.0 billion capital injection.

Following such large re/insurance losses that affect the whole industry, the prices for re/insurance products tend to rise. In the January 2018 renewals, we saw a 2% increase in prices which was most pronounced in the property lines affected by natural catastrophe losses. This is positive for us, our industry and, in my view, is necessary. With the majority of loss affected property business in the US still to be renewed in July, we will keep steering pricing towards levels that are more appropriate for the risks we take on – also to ensure the long-term sustainability of the insurance value chain.

In contrast to our P&C businesses, our life and health businesses thrived in 2017. For the third year in a row, our Life & Health Reinsurance performance was strong and we increased our net income to USD 1.1 billion – a result we achieved through a strong investment performance and solid underwriting results. In Life Capital, our Business Unit which manages closed and open life and health insurance books, we generated gross cash of USD 998 million in 2017. We also achieved two important milestones in ReAssure, a UK subsidiary of Life Capital, through which we buy books of policies that are no longer sold by a life insurer but need to be actively managed until they close. I’m delighted that MS&AD, a Japanese insurance group that we’ve had a relationship with for 103 years, made a minority investment in ReAssure. This significantly boosts our capacity to finance closed books of business. And, you may have read that in late 2017 we purchased 1.1 million life insurance policies from Legal & General Group PLC, a UK financial service provider. We now protect 3.4 million people through ReAssure. At the same time, we generated significant growth in Life Capital’s individual and group life insurance businesses in 2017.

I’m also pleased that our investment performance for 2017 was very strong with an ROI of 3.9% and that we continued to pave the way in responsible investing. We are especially proud to be among the first in the industry to switch to benchmarks that systematically integrate environmental, social and governance (ESG) criteria. This helps generate sustainable long-term investment returns and reduces downside risks.

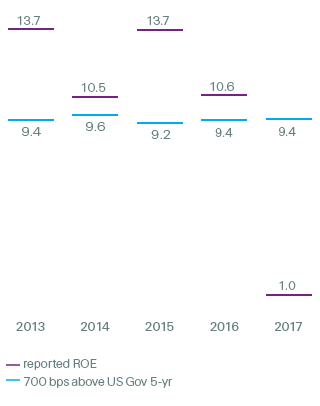

Our financial targets

Return on equity

(in %)

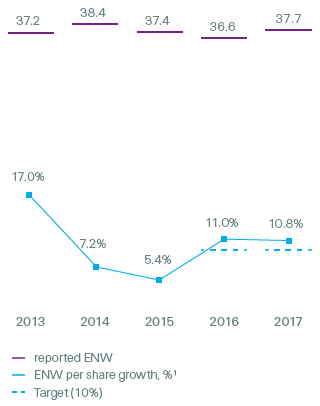

Economic net worth

(in USD billions)

1 The 10% ENW per share growth target is calculated as follows: (current-year closing ENW per share + current-year dividends per share) / (prior-year closing ENW per share + current-year opening balance sheet adjustments per share). This new target applies from 1 January 2016. The reported figures for 2013, 2014 and 2015 have been adjusted for consistency with the new target definition and are provided for reference purposes only.

Protection gap

For Swiss Re, the protection gap refers to underinsured risk pools around the globe that could potentially lead to high economic losses. Population growth, increasing human concentration in natural disaster-prone areas, or lack of awareness or perception of risk are some of the factors that can contribute to a widening protection gap worldwide. Swiss Re leverages over 150 years of re/insurance expertise to help society better manage its risks. Combining knowledge and technology advancements, we work with our clients and the relevant governmental institutions to develop innovative solutions that broaden the scope of our service coverage to help narrow the protection gap and contribute to making the world more resilient.

Risk pools

For Swiss Re, risk pools represent the landscape of insurable risks worldwide. They evolve constantly, requiring close monitoring of their scope, frequency and magnitude. The cyclicality of natural catastrophes, new and emerging risks, such as cybersecurity, changes in the regulatory environment and insurance buying behaviour are all factors that affect the size and nature of risk pools worldwide. As a risk knowledge company, we actively seek access to those risk pools, directly or through our clients, to further diversify our risk portfolio.

I am convinced that the outlook for our industry is now more positive than it has been in the last four years. I expect that changes in the market environment, such as adjusting price levels and increased interest rates, will be good for our business.

Our strategy and near-term priorities set us up well to continue partnering with our clients and applying our knowledge to develop solutions that directly tackle the protection gap. Even after 19 years with Swiss Re, I’m still impressed by my colleagues’ dedication to doing this every day – for that, I sincerely thank them. I also thank you, our shareholders, for your trust in us, the employees of your company, Swiss Re.

Zurich, 23 February 2018

Christian Mumenthaler

Group Chief Executive Officer