Compensation decisions for the Group EC

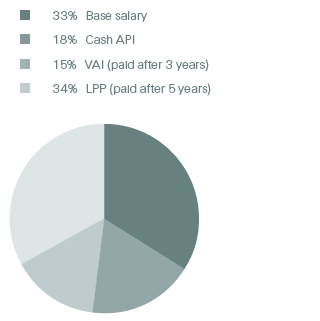

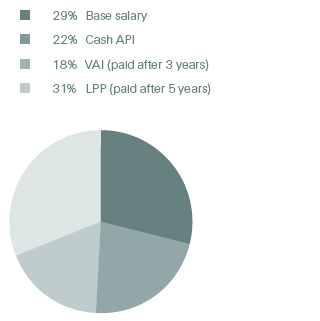

Compensation mix for Group EC

2017

2016

The following table covers payments to 14 members for 2017 of whom 12 were active members of the Group EC for the full year. The 2016 payments also cover 14 members of whom 12 were active members of the Group EC for the full year.

| Download |

|

14 members |

14 members1 |

||||||||||||||

CHF thousands |

2016 |

2017 |

||||||||||||||

|

||||||||||||||||

Base salaries |

13 224 |

12 995 |

||||||||||||||

Allowances2 |

2 745 |

861 |

||||||||||||||

Funding of pension benefits |

2 139 |

2 132 |

||||||||||||||

Total fixed compensation |

18 108 |

15 988 |

||||||||||||||

Cash Annual Performance Incentive3 |

9 867 |

7 069 |

||||||||||||||

Value Alignment Incentive3 |

8 396 |

5 931 |

||||||||||||||

Leadership Performance Plan4 |

14 150 |

13 450 |

||||||||||||||

Total variable compensation |

32 413 |

26 450 |

||||||||||||||

Total fixed and variable compensation5 |

50 521 |

42 438 |

||||||||||||||

Compensation due to members leaving6 |

909 |

721 |

||||||||||||||

Total compensation7 |

51 430 |

43 159 |

||||||||||||||

The total API amount for 2017 for the Group EC including the Group CEO is CHF 13.0 million which represents a 28.8% decrease when compared to 2016 (CHF 18.3 million). The Compensation Committee and the Board of Directors carefully considered the performance of the Group EC in 2017 and despite several performance highlights across the Group concluded that a balanced but substantive reduction in annual variable compensation was warranted given the aggregate performance of the Swiss Re Group.

Compensation decisions for the highest paid member of the Group EC

The table below shows the compensation paid to Christian Mumenthaler, Group CEO (in the role since 1 July 2016):

| Download |

CHF thousands |

2016 |

2017 |

||||||||

|

||||||||||

Base salary |

1 300 |

1 400 |

||||||||

Allowances1 |

43 |

35 |

||||||||

Funding of pension benefits |

178 |

178 |

||||||||

Total fixed compensation |

1 521 |

1 613 |

||||||||

Cash Annual Performance Incentive2 |

1 113 |

810 |

||||||||

Value Alignment Incentive2 |

1 113 |

810 |

||||||||

Leadership Performance Plan3 |

2 500 |

2 000 |

||||||||

Total variable compensation |

4 726 |

3 620 |

||||||||

Total compensation4 |

6 247 |

5 233 |

||||||||

Additional information on compensation decisions

For US GAAP and statutory reporting purposes, VAI and LPP awards are accrued over the period during which they are earned. For the purpose of the disclosure required in this Compensation Report, the value of awards granted is included as compensation in the year of performance for the years 2016 and 2017 respectively.

Each member of the Group EC including the Group CEO participates in a defined contribution pension scheme. The funding of pension benefits shown in the previous two tables reflects the actual employer contributions.

Other payments to members of the Group EC

During 2017, no payments (or waivers of claims) other than those set out in the section “compensation disclosure and shareholdings in 2017” were made to current members of the Group EC or persons closely related.

Shares held by members of the Group EC

The following table reflects Swiss Re share ownership by members of the Group EC as of 31 December:

| Download |

Members of the Group EC |

2016 |

2017 |

||

|

||||

Christian Mumenthaler, Group CEO |

63 854 |

68 775 |

||

David Cole, Group Chief Financial Officer |

68 061 |

82 982 |

||

John R. Dacey, Group Chief Strategy Officer |

7 526 |

23 671 |

||

Guido Fürer, Group Chief Investment Officer |

56 156 |

61 077 |

||

Agostino Galvagni, CEO Corporate Solutions |

79 670 |

94 591 |

||

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

46 817 |

49 020 |

||

Thierry Léger, CEO Life Capital |

57 610 |

49 841 |

||

Moses Ojeisekhoba, CEO Reinsurance |

27 895 |

36 194 |

||

Jayne Plunkett, CEO Reinsurance Asia |

29 095 |

34 288 |

||

Edouard Schmid, Group Chief Underwriting Officer |

n/a |

29 161 |

||

J. Eric Smith, CEO Reinsurance Americas |

13 984 |

21 400 |

||

Matthias Weber, former Group Chief Underwriting Officer1 |

25 750 |

n/a |

||

Thomas Wellauer, Group Chief Operating Officer |

130 224 |

105 390 |

||

Total |

606 642 |

656 390 |

||

Leadership Performance Plan units held by members of the Group EC

The following table reflects total unvested LPP units (RSUs and PSUs) held by members of the Group EC as of 31 December:

| Download |

Members of the Group EC |

2016 |

2017 |

Christian Mumenthaler, Group CEO |

75 458 |

108 779 |

Michel Liès, former Group CEO |

64 125 |

n/a |

David Cole, Group Chief Financial Officer |

49 426 |

57 825 |

John R. Dacey, Group Chief Strategy Officer |

49 426 |

57 825 |

Guido Fürer, Group Chief Investment Officer |

53 765 |

68 394 |

Agostino Galvagni, CEO Corporate Solutions |

49 426 |

57 825 |

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

39 540 |

46 259 |

Thierry Léger, CEO Life Capital |

43 011 |

54 715 |

Moses Ojeisekhoba, CEO Reinsurance |

43 011 |

54 715 |

Jayne Plunkett, CEO Reinsurance Asia |

33 130 |

43 149 |

Patrick Raaflaub, Group Chief Risk Officer |

29 791 |

54 715 |

Edouard Schmid, Group Chief Underwriting Officer |

n/a |

39 678 |

J. Eric Smith, CEO Reinsurance Americas |

39 540 |

46 259 |

Matthias Weber, former Group Chief Underwriting Officer |

49 426 |

n/a |

Thomas Wellauer, Group Chief Operating Officer |

49 426 |

57 825 |

Total |

668 501 |

747 963 |

Loans to members of the Group EC

As per Art. 27 of the Articles of Association, credits and loans to members of the Group EC may be granted at employee conditions applicable for the Swiss Re Group, with a cap on the total amount of such credits and loans outstanding per member.

In general, credit is secured against real estate or pledged shares. The terms and conditions of loans and mortgages are typically the same as those available to all employees of the Swiss Re Group in their particular locations to the extent possible.

Swiss-based variable-rate mortgages have no agreed maturity dates. The basic preferential interest rates equal the corresponding interest rates applied by the Zurich Cantonal Bank minus one percentage point. Where fixed or floating interest rates are preferential, the value of this benefit has been included under “allowances” in the tables covering compensation decisions for Group EC members.

The following table reflects total mortgages and loans for members of the Group EC as of 31 December:

| Download |

CHF thousands |

2016 |

2017 |

Total mortgages and loans to members of the Group EC |

0 |

914 |

Highest mortgages and loans to an individual member of the Group EC: |

|

|

Edouard Schmid, Group Chief Underwriting Officer |

n/a |

914 |

Total mortgages and loans not at market conditions to former members of the Group EC |

4 300 |

4 300 |