Capital management

Superior capitalisation despite a challenging year.

Despite the large industry losses from natural catastrophe events, Swiss Re has remained strongly capitalised throughout 2017, allowing us to respond to potential market developments while continuing to repatriate excess capital to our shareholders.

Superior capitalisation despite severe events

Swiss Re’s policy of ensuring superior capitalisation at all times has meant that even in the face of large insurance claims from the 2017 natural catastrophe events, we maintain a very strong capital position and high financial flexibility. Our financial strength enables us to respond to potential market developments in the aftermath of such severe events and to stay committed to creating long-term shareholder value.

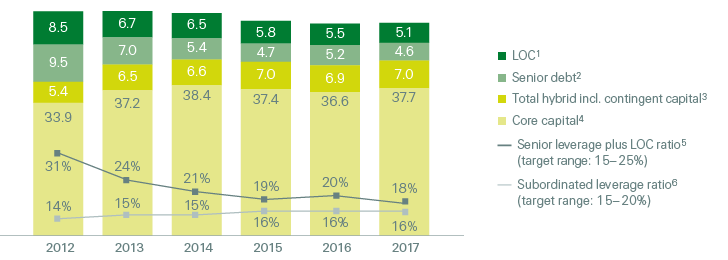

Target leverage maintained

USD billions

1 Unsecured LOC capacity and related instruments (usage is lower).

2 Senior debt excluding non-recourse positions.

3 Includes SRL’s pre-funded dated subordinated debt facilities and contingent capital instruments accounted for as equity.

4 Core capital of Swiss Re Group is defined as economic net worth (ENW).

5 Senior debt plus LOCs divided by total capital.

6 Subordinated debt divided by sum of subordinated debt and ENW.

Key achievements in 2017

In June 2017, Swiss Re Ltd established a USD 750 million truly perpetual pre-funded subordinated debt facility that has a fixed credit spread for life providing the Group with a permanent source of ‘on-demand’ non-dilutive capital irrespective of market conditions at the time. This is our fourth pre-funded subordinated debt facility, bringing the total amount of such facilities to USD 2.65 billion, further enhancing the Group’s financial flexibility while increasing its resilience.

Swiss Reinsurance Company Ltd redeemed three subordinated debt instruments totalling USD 0.9 billion on their first call date and further reduced senior leverage by USD 1.0 billion due to maturities.

The Group capital structure is comfortably within the senior leverage (15–25%) and subordinated leverage (15–20%) target ranges, providing further financial flexibility.

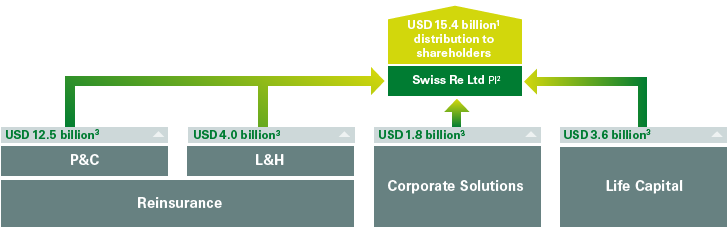

Business Unit structure and capital allocation

Our Business Unit structure enables us to allocate capital opportunistically to maximise shareholder returns. Following the string of severe natural disasters and supported by the Group’s strong capitalisation, we strengthened Corporate Solutions’ capital position in 2017. This underlines our commitment to the Business Unit’s long-term strategy, given the attractiveness of the commercial insurance market. Furthermore, the Group continues to invest in the growth of Life Capital’s open book businesses, while we remain disciplined in repatriating excess capital to our shareholders.

Distribution to shareholders since year end 2012 (USD)

15.4 billion

The cash dividends paid to Swiss Re Ltd since 2012 totalled USD 22.4 billion, providing the basis for the Group’s high financial flexibility. The total amount of capital returned to shareholders since the implementation of the new Group structure in 2012 is USD 15.4 billion.

External dividends to shareholders

Based on the Group’s capital strength, the Board of Directors proposes an increase in the 2017 regular dividend to CHF 5.00 per share, up from CHF 4.85 in 2016. In addition, the Board of Directors proposes a public share buy-back programme of up to CHF 1.0 billion purchase value, commencing at the discretion of the Board of Directors after the AGM’s approval.

Unlike prior years, beyond the Board and regulatory approval and considering the capital management priorities, there will be no other preconditions to the commencement of the proposed share buy-back programme.

Swiss Re Group’s capital adequacy

Regulatory capital requirements

Swiss Re is supervised at the Group level and for its regulated legal entities domiciled in Switzerland by FINMA. FINMA supervision comprises minimum solvency requirements, along with a wide range of qualitative assessments and governance standards.

Swiss Re provides regulatory solvency reporting to FINMA under the rules of the Insurance Supervision Ordinance. This SST report is based on an economic view. We calculate available capital based on our Economic Value Management (EVM) framework and required capital under the SST using our internal risk model (see EVM performance and EVM financial information for further information on EVM). The minimum requirement for the SST is a ratio of 100%. Swiss Re’s SST ratio materially exceeds the minimum requirement.

Capital returned to shareholders since new structure created in 2012

1 Reflects total external dividend and public share buy-back programmes between January 2012 and December 2017.

2 Principal Investments has paid to Group dividends of USD 0.5bn between January 2012 and December 2017.

3 Internal dividend flows from January 2012 to December 2017.

Swiss Re’s capital management aims to ensure our ability to continue operations following an extremely adverse year of losses from insurance and/or financial market events.

Rating agency capital requirements

Rating agencies assign credit ratings to the obligations of Swiss Re and its rated subsidiaries.

The agencies evaluate Swiss Re based on a set of criteria that include an assessment of our capital adequacy.

Each rating agency uses a different methodology for this assessment; A.M. Best and S&P base their evaluation on proprietary capital models.

A.M. Best, Moody’s and S&P rate Swiss Re’s financial strength based upon interactive relationships. The insurance financial strength ratings are shown in the table below.

On 24 November 2017, S&P affirmed the AA– financial strength of Swiss Re and its core subsidiaries. The outlook on the rating is “stable”. The rating reflects Swiss Re’s extremely strong capital adequacy in excess of the ‘AAA’ benchmark and competitive position build on market leadership, long-standing reputation, and wide distribution networks across both life and non-life reinsurance.

On 7 December 2017, A.M. Best upgraded Swiss Re’s long-term issuer credit rating to “aa” from “aa–” and affirmed the A+ (superior) financial strength of Swiss Re and its core subsidiaries. The rating outlook is “stable”. The rating is a result of Swiss Re’s balance sheet strength, which A.M. Best categorises as strongest, as well as strong operating performance, very favourable business profile and very strong enterprise risk management.

On 19 December 2017, Moody’s affirmed Swiss Re’s insurance financial strength rating and outlook at “Aa3” stable. The rating reflects Swiss Re’s excellent market position, very strong business and geographic diversification and strong balance sheet in terms of capital and financial flexibility.

Swiss Re’s financial strength ratings

| Download |

As of 31 December 2017 |

Financial strength rating |

Outlook |

Last update |

Moody’s |

Aa3 |

Stable |

19 December 2017 |

Standard & Poor’s |

AA– |

Stable |

24 November 2017 |

A.M. Best |

A+ |

Stable |

7 December 2017 |