Capital management

We actively steer our capital to maximise financial flexibility and to ensure that all Group companies are adequately capitalised at all times.

During 2013, Swiss Re maintained its strong capitalisation and directed excess funds from its Business Units to the Group’s holding company, Swiss Re Ltd. This active capital management allows us to return capital to our shareholders via a proposed regular dividend for 2013 of CHF 3.85 per share and an additional special dividend of CHF 4.15 per share.

Swiss Re’s capital strength was underlined by Moody’s upgrade of Swiss Reinsurance Company Ltd’s financial strength rating to Aa3 in December 2013.

Optimising the capital structure

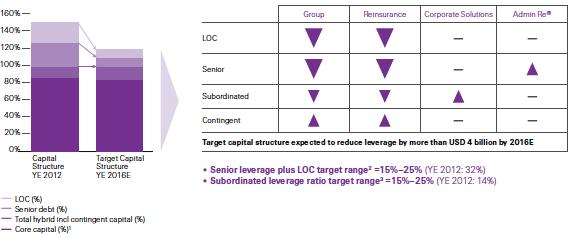

Swiss Re’s level of capitalisation and its capital structure are driven by regulatory and rating capital requirements, and management’s view of risks and opportunities arising from our underwriting and investing activities. As announced at the June 2013 Investor’s Day, we continue to implement a target capital structure that aims to operate efficiently within these constraints by maximising financial flexibility. The implementation of the target capital structure focuses on the reduction of senior leverage, including LOCs, and the issuance of contingent capital to replace traditional subordinated debt. These actions are expected to reduce total leverage by more than USD 4 billion by the end of 2016, while increasing returns to shareholders by improving RoE and earnings per share.

2016E target capital structure and how we plan to achieve it

1 Core capital of Swiss Re Group is defined as Economic Net Worth (ENW)

2 Senior debt plus LOCs divided by total capital

3 Subordinated debt divided by sum of subordinated debt and ENW

Contingent capital

Swiss Reinsurance Company Ltd issued two contingent capital instruments in 2013. These incorporate a full write-off of principal upon the occurrence of specified triggers. The first instrument, issued in March, has a face value of USD 750 million. Principal is written off if the issuer’s SST ratio falls below 125%. The second, issued in October, has a face value of CHF 175 million and principal is written off if the issuer’s SST ratio falls below 135%, or an Atlantic hurricane causes insured industry losses above those of a 1-in-200 year event (subject to an annual reset assessment to adjust for changes in insured values while neutralising any impact due to model changes). These instruments are structured to qualify for regulatory capital credit and thus increase the Group’s capital resources and flexibility.

Senior deleveraging

As part of the deleveraging strategy announced at the June 2013 Investor’s Day, Swiss Re launched an “any-and-all” public tender offer resulting in the repurchase of USD 713 million (in carrying value, USD 527 million in notional terms) of senior legacy debt assumed as part of the 2006 acquisition of GE Insurance Solutions. This liability management exercise reduced long-dated senior debt at a limited premium. In addition, senior leverage maturities totalled USD 1.6 billion and a USD 2.0 billion reduction in LOCs was also completed in 2013.

Legal entity capital management

Our regulated subsidiaries are subject to local regulatory requirements, which for our EU subsidiaries will include Solvency II. At the subsidiary level we set target capital at a level tailored to each entity’s business and the market environment in which it operates. Our underwriting and investment decisions are steered so as to make capital and liquidity fungible to the Group wherever possible, while complying with local regulations and client needs. Cash dividends paid to the Group’s parent holding company, Swiss Re Ltd, totalled USD 2.8 billion in 2013.

External dividends to shareholders

Based on our strong capital position and retained earnings of USD 30.8 billion for 2013, the Board of Directors proposes a regular dividend of CHF 3.85 per share for 2013, up from the previous year’s dividend of CHF 3.50 per share. In addition, Swiss Re proposes to pay a special dividend of CHF 4.15 per share for 2013 (a special dividend of CHF 4.00 per share was paid for 2012). If approved, the combined 2013 dividends will represent a total return of capital to shareholders of approximately USD 3.1 billion. Our priority remains to achieve our financial targets while providing a sustainable, growing dividend.

Swiss Re Group’s capital adequacy

Regulatory capital requirements

Swiss Re is supervised at Group level and for its regulated legal entities domiciled in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). FINMA supervision comprises minimum solvency requirements, along with a wide range of qualitative assessments and governance standards.

Swiss Re provides regulatory solvency reporting to FINMA under the rules of Solvency I and the SST. The SST is based on an economic view. We calculate available capital based on our Economic Value Management (EVM) framework and required capital under the SST using our internal risk model (see Economic Value Management for further information on EVM). The minimum requirement for Solvency I and the SST is a ratio of 100%. Swiss Re’s Solvency I and SST ratios both materially exceed the minimum requirement.

Swiss Re’s capital management aims to ensure our ability to continue operations following an extremely adverse year of losses from insurance and/or financial market events.

Swiss Re’s capital adequacy

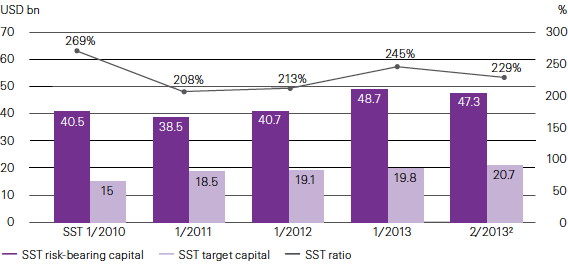

Swiss Re holds excess capital under all relevant capital adequacy requirements such as the SST (see chart below), Solvency I and Standard & Poor’s AA rating.

Group capitalisation — Swiss Solvency Test1 (SST)

1 SST RBC is based on the preceding (half-) year-end capital position (minus projected dividends). SST target capital reflects a 12-month forward-looking view.

2 SST 2/2013 as filed with FINMA at the end of October 2013, consolidated Group view based on a projection for mid-2013 to mid-2014. The impact of March 2013 USD 750 million and October 2013 CHF 175 million subordinated contingent write-off securities are not reflected in SST 2/2013.

Rating agency capital requirements

Rating agencies assign credit ratings to the obligations of Swiss Reinsurance Company Ltd (Swiss Re) and its rated subsidiaries.

The agencies evaluate Swiss Re based on a set of criteria that include an assessment of our capital adequacy.

Each rating agency uses a different methodology for this assessment; A.M. Best and Standard & Poor’s (S&P) base their evaluation on proprietary capital models.

A.M. Best, Moody’s and S&P rate Swiss Re’s financial strength based upon interactive relationships. The insurance financial strength ratings are shown in the table below.

On 10 December 2013, Moody’s upgraded Swiss Reinsurance Company Ltd’s insurance financial strength rating to Aa3. The outlook on the rating is “stable”. This upgrade reflects Swiss Re Group’s improved financial profile, notably with respect to profitability and financial flexibility, whilst maintaining an overall excellent market position and strong business diversification.

On 18 December 2013, S&P affirmed the AA- financial strength of Swiss Reinsurance Company Ltd (Swiss Re) and its core subsidiaries. The outlook on the rating is “stable”. The rating affirmation predominantly reflects S&P’s view that the Group continues to have an extremely strong competitive position and capital adequacy.

On 31 January 2014, A.M. Best affirmed the A+ financial strength rating of Swiss Reinsurance Company Ltd and its subsidiaries. The outlook for the rating is “stable”. The rating reflects the Swiss Re Group’s excellent consolidated risk-adjusted capitalisation, strong operating performance and superior business profile as a leading global reinsurer.

Swiss Re’s financial strength ratings

| Download |

|

As of 14 February 2014 |

Financial strength rating |

Outlook |

Last update |

|

Moody’s |

Aa3 |

Stable |

10 December 2013 |

|

Standard & Poor’s |

AA– |

Stable |

18 December 2013 |

|

A.M. Best |

A+ |

Stable |

31 January 2014 |