Compensation decisions for the Group EC

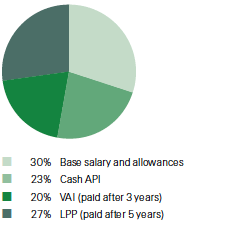

Compensation mix for Group EC

2013

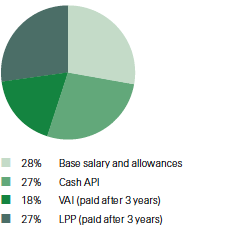

Compensation mix for Group EC

2012

The variable compensation awarded to all members of the Group EC (including the Group CEO) totalled CHF 30.0 million for 2013, compared to CHF 33.2 million in 2012. The following table covers payments to 16 members for 2012, of whom seven were employed for the full year. The 2013 payments cover 12 members who were all employed for the full year.

| Download |

|

|

16 members9 |

12 members |

||||||||||||||||||

|

CHF thousands1 |

2012 |

2013 |

||||||||||||||||||

|

||||||||||||||||||||

|

Base salary and allowances2,3 |

12 985 |

12 984 |

||||||||||||||||||

|

Funding of pension benefits |

1 656 |

1 914 |

||||||||||||||||||

|

Total fixed compensation |

14 641 |

14 898 |

||||||||||||||||||

|

Cash Annual Performance Incentive4,5 |

12 394 |

10 072 |

||||||||||||||||||

|

Value Alignment Incentive |

8 359 |

8 532 |

||||||||||||||||||

|

Leadership Performance Plan6 |

12 400 |

11 400 |

||||||||||||||||||

|

Total variable compensation |

33 153 |

30 004 |

||||||||||||||||||

|

Total fixed and variable compensation7 |

47 794 |

44 902 |

||||||||||||||||||

|

Compensation due to members leaving8 |

2 268 |

|

||||||||||||||||||

|

Total compensation |

50 062 |

44 902 |

||||||||||||||||||

Compensation decisions for the Group CEO

Michel M. Liès, Group CEO since February 2012

| Download |

|

CHF thousands1 |

20122 |

2013 |

||||||

|

||||||||

|

Base salary and allowances |

1 663 |

1 639 |

||||||

|

Funding of pension benefits |

175 |

177 |

||||||

|

Total fixed compensation |

1 838 |

1 816 |

||||||

|

Cash Annual Performance Incentive |

1 450 |

1 600 |

||||||

|

Value Alignment Incentive |

1 450 |

1 600 |

||||||

|

Leadership Performance Plan3 |

2 000 |

2 000 |

||||||

|

Total variable compensation |

4 900 |

5 200 |

||||||

|

Total compensation |

6 738 |

7 016 |

||||||

Additional information on compensation decisions

All amounts reported are gross (that is, before any statutory social security or tax deductions). Amounts reported under base salary and allowances include the base salary which is paid in cash, as well as benefits or allowances paid in cash.

Total fixed compensation (excluding funding of pension benefits) reflects the portion of the total compensation that is fixed and therefore not variable with performance. For 2013, the portion of Group EC compensation that is fixed amounts to 30% (compared to 28% for 2012).

The LPP 2013 represents the fair value of the LPP award granted in March 2013. This LPP may lead to a payment in March 2016, subject to return on equity and relative total shareholder return performance conditions from 2013 to 2015. In the same way, the LPP 2014 represents the fair value of the LPP award granted in March 2014, which may (subject to the performance conditions from 2014 to 2016) lead to vesting in March 2017. The LPP is described in detail in Leadership Performance Plan.

Each member of the Group EC (including the Group CEO) participates in a defined-contribution pension scheme. The funding of pension benefits shown in the table above reflects the actual employer contributions.

Other payments to members of the Executive Committee

During 2013, no payments (or waivers of claims) other than those set out in the "Compensation decision" tables were made to current members of the Group EC.

Shares held by members of the Group EC

The following table reflects total current Swiss Re share ownership by members of the Group EC as of 31 December:

| Download |

|

|

2013 |

|

Michel M. Liès, Group CEO |

171 947 |

|

Guido Fürer, Group Chief Investment Officer |

21 253 |

|

Agostino Galvagni, CEO Corporate Solutions |

108 060 |

|

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

16 335 |

|

Christian Mumenthaler, CEO Reinsurance |

50 984 |

|

Moses Ojeisekhoba, CEO Reinsurance Asia |

8 583 |

|

George Quinn, Group Chief Financial Officer |

96 506 |

|

Matthias Weber, Group Chief Underwriting Officer |

38 592 |

|

Thomas Wellauer, Group Chief Operating Officer |

17 708 |

|

Total |

529 968 |

Unvested restricted share units held by members of the Group EC

Prior to the introduction of the LPP, Swiss Re did not grant restricted share units (RSUs) on a regular basis, except for events such as exceptional business cycles, significant acquisitions or the replacement of forfeited equity for new executive hires.

The following table reflects unvested restricted share unit ownership by members of the Group EC as of 31 December:

| Download |

|

|

2013 |

|

Moses Ojeisekhoba, CEO Reinsurance Asia |

5 693 |

|

Total |

5 693 |

Vested options held by members of the Group EC

The following table reflects total vested option ownership by members of the Group EC as of 31 December:

| Download |

|

|

2013 |

|

Weighted average exercise price in CHF |

83.92 |

|

Michel Liès, Group CEO |

42 000 |

|

Guido Fürer, Group Chief Investment Officer |

7 500 |

|

George Quinn, Group Chief Financial Officer |

20 000 |

|

Matthias Weber, Group Chief Underwriting Officer |

7 000 |

|

Total |

76 500 |

Swiss Re granted options to senior management in the past and the last grant was made in 2006. The underlying exercise price for the outstanding option series has been adjusted for the special dividend payout in 2013. The remaining vested options held by active members of the Group EC will expire between 2014 and 2015, and have a weighted average exercise price of CHF 83.92 (within a range between CHF 78.52 and CHF 88.13) after the adjustment.

Long Term Incentive units held by members of the Group EC

The following table reflects total unvested Long Term Incentive units held by members of the Group EC as of 31 December. This includes both awards under the previous LTI and the current LPP:

| Download |

|

|

2013 |

|

Michel Liès, Group CEO |

108 795 |

|

David Cole, Group Chief Risk Officer |

69 280 |

|

John R. Dacey, Group Chief Strategy Officer, Chairman Admin Re® |

17 685 |

|

Guido Fürer, Group Chief Investment Officer |

47 760 |

|

Agostino Galvagni, CEO Corporate Solutions |

77 825 |

|

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

47 740 |

|

Christian Mumenthaler, CEO Reinsurance |

77 825 |

|

Moses Ojeisekhoba, CEO Reinsurance Asia |

34 915 |

|

George Quinn, Group Chief Financial Officer |

86 375 |

|

J. Eric Smith, CEO Swiss Re Americas |

34 915 |

|

Matthias Weber, Group Chief Underwriting Officer |

65 005 |

|

Thomas Wellauer, Group Chief Operating Officer |

77 825 |

|

Total |

745 945 |

Loans to members of the Group EC

In general, credit is secured against real estate or pledged shares. The terms and conditions of loans and mortgages are typically the same as those available to all employees of the Swiss Re Group in their particular locations to the extent possible. For example, in Switzerland fixed-rate mortgages have a maturity of five years and interest rates that correspond to the five-year Swiss franc swap rate plus a margin of 10 basis points.

Swiss-based variable-rate mortgages have no agreed maturity dates. The basic preferential interest rates equal the corresponding interest rates applied by the Zurich Cantonal Bank minus one percentage point. To the extent that fixed or floating interest rates are preferential, the value of this benefit has been included in the line item “base salary and allowances” above.

The following table reflects total mortages and loans for members of the Group EC (see Financial Statements, Note 13 for more details).

| Download |

|

CHF thousands |

2013 |

|

Total mortgages and loans to members of the Group EC |

3 956 |

|

Highest mortgages and loans to an individual member of the Group EC: |

|

|

Christian Mumenthaler |

1 919 |

|

Total mortgages and loans not at market conditions to former members of the Group EC |

4 300 |

Compensation for former members of the Group EC

During 2013, payments in the total amount of CHF 1.1 million were made to seven former members of the Group EC. This amount is made up of a pro-rata base salary payment, company contributions to social security and pension systems paid by Swiss Re in line with applicable laws, benefits in the context of the outstanding mortgages and loans not at market rates above, risk benefits as well as company commitments for tax related services.