Statement from the Group CEO

Michel M. Liès

Dear shareholders

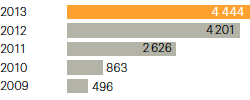

I am very pleased to report that all Business Units contributed to Swiss Reʼs very strong 2013 net income of USD 4.4 billion. These results would be gratifying in any year, though especially so in our 150th — they reveal the dynamism that underlies our durability.

Over 2013 our strategy remained unchanged. The point was execution. Execution led foremost to our excellent net income, led by another very strong performance by Property & Casualty Reinsurance with a 2013 net income of USD 3.3 billion. Corporate Solutions delivered continued profitable growth with a profit of USD 279 million. Admin Re® added USD 423 million to the Group result. Net income for Life & Health Reinsurance was USD 356 million.

“All Business Units contributed to Swiss Reʼs very strong 2013 net income of USD 4.4 billion.”

We also executed against our two capital and asset management goals published at our Investorsʼ Day in June 2013. The first was to reduce our debt by USD 4 billion by 2016, thereby increasing return on equity and earnings per share. Here we are well ahead of schedule. The second was to rebalance our assets so that we invest in a greater share of high-quality credit and equities. This goal was achieved.

Another area of execution was to invest in profitable growth, especially in high growth markets. We continue to expect that a large share of future growth in re/insurance will be in these markets. In addition to our organic expansion in these markets, in 2013 we took a stake in SulAmérica, a well-established and successful multiline insurer in Brazil. In China we invested in New China Life and in the Hong Kong-based insurer FWD Group. We also obtained a license in Singapore for Corporate Solutions.

Net income

(USD millions)

In Admin Re®, we will focus on the UK market for further acquisitions of closed life books going forward. There we already have a robust platform in place to take on additional business, and thus the maximum leverage for generating operational efficiencies. We have our eyes open for suitable opportunities and remain open to raising third-party capital to fund them. We may also make use of leverage for new business funding.

Internally we have started to enhance productivity. I remain firmly of the belief that we can perform and grow at the same time, and I have every confidence that we will deliver USD 250–300 million in cash savings by 2015 when compared to 2012.

We also have the task of addressing low returns in the Life & Health segment of Reinsurance. Although we made significant progress and remain on track to achieve our 10%–12% RoE target for this segment by 2015, we saw negative developments in the Australian group disability business. These latter developments required us to add USD 369 million to reserves in 2013. We are determined to meet these challenges and generate profitable new business going forward, especially in health.

Meanwhile low interest rates have played a large role in driving pension funds, hedge funds and others toward reinsurance, where returns are perceived to be comparatively high and not correlated to other assets, while barriers to entry remain low. This inflow of so-called alternative capital intensifies competition and increases pressure on our industryʼs profit margins.

We are not impervious to these forces. But in comparison to some small and medium-sized competitors, we believe we have more to offer than ‘just’ capacity. I am confident that we have an agile and flexible business model that will allow us to continue to profit in this challenging environment.

However, we need the best talent at hand. It is with regret that we say farewell to our Group Chief Financial Officer George Quinn, who has decided to pursue other opportunities from May 2014. We are grateful for the contribution George made over the last seven years. At the same time, I am pleased to announce that George can pass the baton to David Cole, our current Group Chief Risk Officer. With him, we could recruit an internal successor with the right skill profile for this key role, which underlines the quality of our own talent pool.

A final word on our brand. Some of you may have noticed our logo has evolved. The logo is the visual symbol of a much more powerful brand promise: We are smarter together. Our companyʼs success has always depended on our clientsʼ success — the new logo and promise are now fresh reminders of this essential relationship. As a shareholder I hope you come to see more and more how ʼsmarter togetherʼ is the mindset and common thread running through all of our thinking and behaviour, and ultimately underlying our results.

Smarter together? Weʼll need to be. Conditions for 2014 look challenging but weʼre ready to take them on.

Thank you for your continued support.

Zurich, 20 February 2014

![]()

Michel M. Liès

Group Chief Executive Officer