Compensation context and highlights in 2013

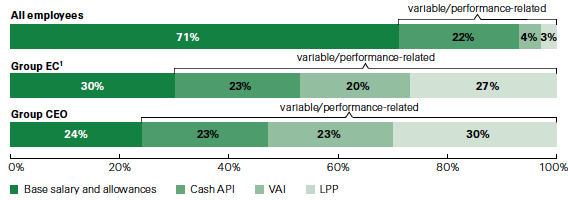

Pay for performance

The Compensation Committee ensures that executive management compensation is linked to the business performance of Swiss Re by delivering a substantial portion of compensation in the form of variable and performance related incentives.

| Download |

|

|

Fixed |

Variable/performance-related |

of which deferred |

||

|

|||||

|

All employees |

71% |

29% |

23% |

||

|

Group EC1 |

30% |

70% |

66% |

||

|

Group CEO |

24% |

76% |

69% |

||

1 Including Group CEO

The Compensation Committee monitors how compensation develops against specific business metrics including net income and EVM profit.

| Download |

|

USD million (unless otherwise stated) |

2011 |

2012 |

change |

2013 |

change |

||||||

|

|||||||||||

|

US GAAP net income |

2 626 |

4 201 |

60% |

4 444 |

6% |

||||||

|

EVM profit |

–1 704 |

4 152 |

– |

4 007 |

|

||||||

|

Dividend payments to shareholders (CHF)1 |

3.00 |

3.50 |

17% |

3.85 |

10% |

||||||

|

Financial Strength Rating (Standard & Poor’s) |

AA– |

AA– |

|

AA– |

|

||||||

|

Total equity |

31 287 |

34 026 |

9% |

32 977 |

–3% |

||||||

|

Number of employees |

10 788 |

11 193 |

|

11 574 |

|

||||||

|

Aggregate compensation for all employees (CHF) |

1 775 |

2 032 |

14% |

2 067 |

+2% |

||||||

|

Group EC members2,3 |

9 |

16 |

|

12 |

|

||||||

|

Aggregate Group EC compensation (CHF)3 |

35 |

50 |

43% |

45 |

–10% |

||||||

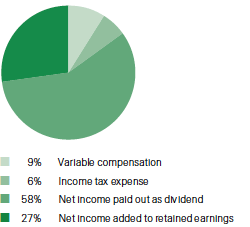

Attribution of Group income to key stakeholders

| Download |

|

USD million (unless otherwise stated) |

2011 |

% |

2012 |

% |

2013 |

% |

||

|

||||||||

|

Income before tax and variable compensation |

3 029 |

100% |

5 872 |

100% |

5 262 |

100% |

||

|

Variable compensation |

326 |

11% |

546 |

9% |

506 |

9% |

||

|

Income tax expense |

77 |

3% |

1 125 |

19% |

312 |

6% |

||

|

US GAAP net income attributable to shareholders |

2 626 |

|

4 201 |

|

4 444 |

|

||

|

of which paid out as dividend (incl. special dividend) |

1 134 |

37% |

2 760 |

47% |

3 0361 |

58% |

||

|

of which added to retained earnings within shareholders’ equity |

1 492 |

49% |

1 441 |

25% |

1 408 |

27% |

||

In early 2013, Swiss Re completed the implementation of the compensation framework review initiated in 2011, with the objective to further strengthen the link between variable pay and performance.

Key developments

Background and context

In 2011, based on feedback from shareholders and regulators, the Board of Directors initiated a full review of the compensation framework for the Group. This review recommended several planned interventions in the performance and compensation area, with the objective to strengthen the link between pay and performance. Most of the changes have been implemented in 2012, including the launch of the new two-dimensional performance management system, the introduction of the Target Annual Performance Incentive (TAPI) for senior management, the new long-term incentive Leadership Performance Plan (LPP) and the new Global Share Participation Plan (GSPP).

Activities in 2013

Compensation changes

- Further embedding of two-dimensional performance management, ensuring a balance between measuring the achievement of performance objectives and the demonstration of appropriate behaviours.

- Full implementation of TAPI. Eligible employees have now been communicated a target incentive that influences the level of payout when business and individual objectives are achieved.

- Transparent methodology for the determination of the Annual Performance Incentive (API) pools, thus creating a stronger link between variable compensation and performance.

Specific compensation plans

- For the LPP, introduction of an additional two-year holding period for members of the Group EC and Group Management Board (GMB) starting with the 2014 award.

- Updated vesting curve on the Performance Share Unit (PSU) component of the LPP with vesting beginning at median.

- Introduction of the GSPP in order to encourage participation in Swiss Re’s future and to increase alignment with shareholders’ interests.

Regulatory oversight

- Continued interaction with FINMA in 2013.

- Continued monitoring of Solvency II developments to ensure alignment of our compensation framework with the current draft of requirements.

- Preparation of an implementation plan with regard to the Ordinance.

Annual General Meeting

- As in previous years, the Compensation Report 2012 was subject to a consultative vote. At the Annual General Meeting on 10 April 2013, the Report was approved by 90% of shareholder votes (up from 81% in 2012).

- At the Annual General Meeting on 11 April 2014, the Compensation Report 2013 will be subject to a consultative vote.

Outlook 2014

In 2014, the Compensation Committee will continue implementing the provisions of the Ordinance, focusing on:

- Yearly and individual election of the members of the Board of Directors and of the Compensation Committee, as well as the Chairman of the Board of Directors, by the Annual General Meeting of shareholders.

- Inclusion of the overarching compensation principles in the Articles of Association.

- Introduction of the binding shareholders’ vote on compensation at the Annual General Meeting in 2015.

- Adjustments to the Compensation Report to align with the new provisions as of the reporting year 2014.

- Adjustments to employment contracts of the Group EC members in line with the requirements of the Ordinance.

Split of 2013 Group income (in USD million)