Life & Health

Performance

Net income was USD 356 million for 2013, compared to USD 739 million for 2012. The reduction was primarily due to a large reserve addition of USD 369 million for Australian group disability business, the impact of business recaptured in the first quarter of 2013 and lower realised gains, partly offset by one-time tax benefits and lower interest expense from capital structure optimisation in 2013.

Operating income was USD 592 million for 2013 compared to USD 885 million for 2012. Excluding the impact of reserve strengthening for the Australian group disability business, operating income in 2013 was higher due to more favourable experience on Variable Annuities and the pre-2004 guaranteed minimum death benefit (GMDB) business. In addition, the pre-2004 US individual life business gradually improved and asset re-balancing resulted in higher investment income.

Operating income is calculated as a net of total revenues (before non-participating realised gains/losses) and total expenses before interest expenses.

Life & Health results

| Download |

|

USD millions |

2012 |

2013 |

Change in % |

|

Revenues |

|

|

|

|

Premiums earned |

9 050 |

9 967 |

10 |

|

Fee income from policyholders |

72 |

56 |

–22 |

|

Net investment income – non-participating |

1 365 |

1 442 |

6 |

|

Net realised investment gains/losses – non-participating |

562 |

269 |

–52 |

|

Net investment result – unit-linked and with-profit |

222 |

249 |

12 |

|

Other revenues |

1 |

0 |

– |

|

Total revenues |

11 272 |

11 983 |

6 |

|

|

|

|

|

|

Expenses |

|

|

|

|

Life and health benefits |

–6 787 |

–8 075 |

19 |

|

Return credited to policyholders |

–271 |

–286 |

6 |

|

Acquisition costs |

–1 787 |

–1 698 |

–5 |

|

Other expenses |

–1 419 |

–1 490 |

5 |

|

Total expenses |

–10 264 |

–11 549 |

13 |

|

|

|

|

|

|

Income before income tax expenses |

1 008 |

434 |

–57 |

|

Income tax expense |

–231 |

–30 |

–87 |

|

Interest on contingent capital instruments |

–38 |

–48 |

26 |

|

Net income attributable to common shareholders |

739 |

356 |

–52 |

|

|

|

|

|

|

Management expense ratio in % |

7.9 |

8.3 |

|

|

Operating margin in % |

8.6 |

5.2 |

|

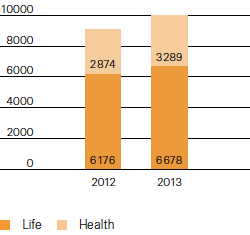

Premiums earned and fee income

Premiums earned by L&H segment, 2012–2013

(USD millions)

Premiums earned and fee income increased 9.9% to USD 10.0 billion for 2013, compared to USD 9.1 billion for 2012. The increase was primarily driven by the business recaptured in the first quarter of 2013, rate increases in the yearly-renewable term business in the US and higher health premiums in Europe and Asia, including a new large health transaction in Asia.

Operating margin

The operating margin was 5.2% for 2013 compared to 8.6% for 2012. The decrease was primarily due to reserve strengthening for the Australian group disability business and the adverse performance of the US individual life business recaptured in the first quarter of 2013.

Operating margin is calculated as operating income divided by total operating revenues. Total operating revenues are total revenues excluding unit-linked and with-profit revenues and non-participating realised gains/losses.

Expense ratio

The management expense ratio increased marginally to 8.3%, compared to 7.9% in 2012, reflecting higher expenses for growth initiatives.

Lines of business

Operating income for the Life segment declined 8.2% to USD 381 million for 2013, compared to an income of USD 415 million in 2012. The lower result in 2013 was driven primarily by the business recaptured in the first quarter of 2013 and by mortality experience which was less favourable than expected in 2013 as compared to 2012. This was mostly offset by year-on-year favourable experience on Variable Annuities and the pre-2004 GMDB business, the positive impact from recaptures in Europe and the gradually improving but still unfavourable pre-2004 US individual life results.

Operating income for the Health segment declined 55.1% to USD 211 million for 2013, compared to USD 470 million for 2012. This was primarily driven by the reserve strengthening in the Australian group disability business, partially offset by less unfavourable morbidity experience in 2013.

Investment result

The return on investments for 2013 was 4.1%, compared to 4.7% in 2012, reflecting a reduction in the investment result of USD 216 million, mainly driven by lower realised gains from the sales of government bonds as compared to 2012. Net investment income improved by USD 107 million, largely driven by the re-balancing of the portfolio into additional corporate bonds and loans as well as some equity and alternative investment exposure.

Investment-related net realised gains were USD 386 million in 2013, mainly from mark-to-market gains on hedging positions and favourable movements in foreign exchange remeasurement. This compared to USD 709 million in 2012.

The total return was –1.5%, primarily due to interest rate increases, the effects of which are more pronounced in L&H due to the longer duration of the fixed income portfolio.

Shareholders’ equity

Return on equity was 5.4% for 2013 compared to 8.9% in 2012.

Shareholders’ equity declined to USD 6.2 billion as of 31 December 2013 from USD 8.3 billion as of 31 December 2012, mainly due to dividends of USD 966 million being paid to Group and a USD 1.4 billion increase in unrealised losses on available for sale securities, partially offset by net income.

Outlook

Growth in the traditional life business is expected to be muted as cession rates are expected to decrease as primary insurers retain more risk. The low interest rate environment will continue to have an unfavourable impact on the growth of long-term life business for our cedants.

We will continue to write new business at attractive rates, including through large transactions. Swiss Re aims to offer solutions and services in several attractive, growing markets where major demographic and socioeconomic trends are leading to increased demand for health insurance, including in Asia. We experienced difficulties in our Australian group disability business and have initiated changes in our pricing and product design to mitigate similar issues on future sales.

The new L&H business management team is focused on proactively managing the in-force business in order to improve profitability. Good progress is being made on actions outlined at the Investors’ Day in June 2013 and we expect the implementation of these strategies to begin to materialise in 2014.