Property & Casualty

Performance

Net income for 2013 increased by USD 302 million to USD 3.3 billion compared to 2012, mainly driven by a decrease in income tax and a better underwriting result, partially offset by a reduction in net investment income.

The underwriting result for 2013 increased by 2% largely due to better than expected natural catastrophe experience, as well as increased premium volume, partially offset by higher acquisition costs, largely due to the expiry of a major quota share retrocession agreement at the end of 2012 and increased expenses.

Major natural catastrophe events in 2013 included floods in Central and Eastern Europe and Canada, hailstorms in Germany and winter storms in Europe. Large man-made losses included flooding at a Russian hydro power plant, a fire at a microprocessor plant in China and a marine loss in Japan.

Property & Casualty results

| Download |

|

USD millions |

2012 |

2013 |

Change in % |

|

Premiums earned |

12 329 |

14 542 |

18 |

|

|

|

|

|

|

Expenses |

|

|

|

|

Claims and claim adjustment expenses |

–6 306 |

–7 884 |

25 |

|

Acquisition costs |

–2 316 |

–2 761 |

19 |

|

Other expenses |

–1 325 |

–1 472 |

11 |

|

Total expenses before interest expenses |

–9 947 |

–12 117 |

22 |

|

|

|

|

|

|

Underwriting result |

2 382 |

2 425 |

2 |

|

|

|

|

|

|

Net investment income |

1 451 |

1 098 |

–24 |

|

Net realised investment gains/losses |

259 |

184 |

–29 |

|

Other revenues |

95 |

61 |

–36 |

|

Interest expenses |

–111 |

–207 |

86 |

|

Income before income tax expenses |

4 076 |

3 561 |

–13 |

|

Income tax expense |

–934 |

–249 |

–73 |

|

Income attributable to non-controlling interests |

–134 |

–1 |

–99 |

|

Interest on contingent capital instruments |

–18 |

–19 |

6 |

|

Net income attributable to common shareholders |

2 990 |

3 292 |

10 |

|

|

|

|

|

|

Claims ratio in % |

51.2 |

54.2 |

|

|

Expense ratio in % |

29.5 |

29.1 |

|

|

Combined ratio in % |

80.7 |

83.3 |

|

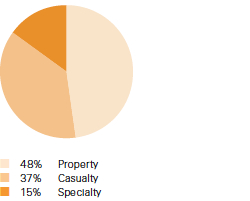

Net premiums earned

Premiums earned by line of business, 2013

(Total USD 14.5 billion)

Net premiums earned increased 18.0% to USD 14.5 billion in 2013, compared to USD 12.3 billion in 2012, mainly driven by the expiry of the quota share retrocession agreement and new business written in the Americas.

The composition of gross premiums earned by region only changed slightly year on year, with the Americas having a higher share of premiums in 2013 compared to 2012.

Based on gross premiums written before intra-group retrocession, the share of proportional business remained unchanged compared to 2012 at 61%.

Combined ratio

Property & Casualty Reinsurance reported a strong combined ratio of 83.3% in 2013, compared to 80.7% in the prior year. The increase was mainly due to lower net reserve releases from prior years and increased expenses.

The impact from natural catastrophes in 2013 was 2.9 percentage points below the expected level of 10.1 percentage points, and the favourable development of prior accident years improved the 2013 combined ratio by 7.4 percentage points compared to 8.1 percentage points in 2012.

Lines of business

Property

The property combined ratio improved to 71.8% in 2013, compared to 74.2% in 2012. Both periods benefited from benign natural catastrophe loss experience and favourable prior-year claims experience. 2013 included further positive development on Hurricane Sandy (2012) and on the floods in Thailand (2011).

Casualty

The casualty combined ratio for 2013 was 101.9%, compared to 94.0% in 2012. The increase was mainly due to reserve strengthening for US asbestos, negative impacts in motor due to the hailstorm in Germany and reserve strengthening in the UK and France.

Specialty lines

The specialty combined ratio increased to 74.5% in 2013, compared to 68.0% in 2012, mainly due to large man-made losses in marine and less favourable prior-year developments.

Expense ratio

The administrative expense ratio decreased to 10.1% in 2013, compared to 10.7% in 2012. The effect of higher absolute expenses due to strategic investments in high growth markets was more than offset by the increased premium volume year on year.

Investment result

The return on investments for 2013 was 2.8% compared to 3.2% in 2012, with the difference largely attributable to lower operating income resulting from the transfer of Principal Investments to the Group segment in the first quarter of 2013. Overall, net investment income decreased by USD 317 million compared to 2012, with most of the reduction due to lower mark-to-market gains on private equity investments, also due in part to the shift of Principal Investments to the Group.

The re-balancing of the portfolio contributed to a positive total return of 1.3%, despite higher interest rates. Specifically, increases in equities and alternative investments as well as the impact of the short duration position offset the reduction in net unrealised gains on fixed income securities. The transition from government bonds to corporate bonds also positively impacted total return.

Investment-related net realised gains were USD 380 million in 2013, mainly as a result of gains from the sale of government bonds related to the re-balancing of the investment portfolio, active management of the listed equity portfolio and the sale of real estate, partially offset by unfavourable movements in foreign exchange remeasurement. This compared to USD 384 million in 2012.

Return on equity

The return on equity for 2013 was 26.4%, compared to 26.7% in 2012. The decrease was mainly driven by an increase in net income that was more than offset by the impact of increasing average shareholders’ equity. Total equity for the business segment increased to USD 13.3 billion in 2013 from USD 12.4 billion in 2012. Foreign currency translation gains were more than offset by an increase in dividends and net unrealised losses.

Outlook

Other than loss-affected layers, natural catastrophe reinsurance rates are softening significantly for all regions due to the strong supply of traditional and alternative capacity in the market. Casualty rates are generally softening with the exception of Latin America, where rates are stable, and weather-affected motor rates, where there are some increases. Most proportional covers experienced flat to small commission increases for P&C. Our superior risk selection remains a key value driver in this environment.