Strengthening risk resilience:

2016 highlights

Throughout our long history, we have provided our clients with financial protection against risk. Traditionally, our most important client groups are insurers and large corporations. We offer them a wide range of products covering many different types of losses.

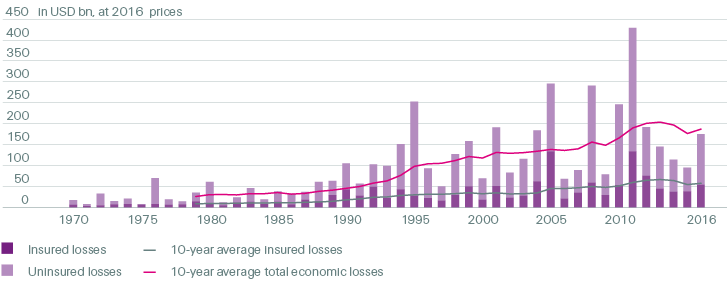

However, there remains significant unmet demand for effective, commercially viable re/insurance protection. As the graph below illustrates, the gap between total economic losses and insured losses remains substantial. Given this protection gap, we look beyond our established client base and traditional business model. In particular, we aim to expand re/insurance protection by focusing on underinsured risks, new markets, different clients and innovative risk transfer products. Many of these solutions help our clients to better cope with climate-related threats.

Some of the pioneering transactions we completed in 2016 are outlined below.

Insured losses vs uninsured losses, 1970–2016

Source: Swiss Re Economic Research & Consulting

Helping to make New Orleans more resilient

More than ten years have passed since September 2005 when Hurricane Katrina hit New Orleans, causing massive damage through the ensuing storm surge and flooding. Culminating its fight back from disaster, the city’s leadership launched Resilient New Orleans (“Resilient Nola”, www.resilientnola.org) in 2015, the world’s first comprehensive urban resilience strategy.

We have played a prominent part in this initiative, joining up with utility company Veolia to help make the city’s vital systems more resilient to disasters, on the one hand, and to facilitate speedy relief and recovery on the other. At a ceremony celebrating Resilient Nola’s first anniversary in September 2016, the key measures of the project were presented to the public. Since then, the baseline exposure and existing resilience of all the city’s water, sanitation and related energy assets has been assessed to today’s risk as well as the risk in 30 years’ time, based on Swiss Re’s proprietary catastrophe modelling and climate risk analysis.

With this analysis in hand, New Orleans is exploring ways to utilise the capacity of the private sector to ensure the city can respond faster after a disaster and safeguard its economic future.

Protecting homeowners in the UK against flood risk

In the UK, we started to provide support to Flood Re (www.floodre.co.uk), a pioneering scheme to make flood insurance more affordable for residential homeowners at risk. In recent years, floods have risen in frequency and intensity in the UK, causing unprecedented damage. Given the impact of climate change on northern European winter storms, this trend will likely continue or even increase.

Based on a partnership between the UK government and the insurance industry, Flood Re manages a central fund that allows insurers to pass on the flood risk of individual policies. When a homeowner suffers damage from flooding and makes a valid claim, the scheme reimburses the respective insurer out of this fund. This reduces insurance premiums for flood-prone homes.

Swiss Re supports the programme as a lead reinsurer. In total, Flood Re has secured GBP 2.1 billion of reinsurance cover, making it one of the five largest natural disaster schemes in the world. Ultimately, it is expected to reach some 350 000 households in the UK through cheaper flood insurance, providing valuable learnings for other countries at high risk of flooding.

Supporting a national rice insurance scheme in Thailand

Thailand is one of the world’s top rice producers. Rice farming is prevalent across the entire country and provides large parts of the population with their livelihoods. However, rice farmers in the country face the latent threat of natural disasters, in particular floods and droughts. To address this, a rice insurance scheme, complementing the Government Disaster Relief Programme, was launched together with the Thai General Insurance Association (www.tgia.org) a decade ago, offering further financial assistance to farmers whose crops have been damaged by destructive weather conditions.

Unfortunately, a typical problem of such traditional crop insurance schemes is that their administration costs are often too high in the early stages when they do not yet have the critical mass of policies necessary to make them viable for its key stakeholders, ie governments, insurance companies and farmers. To overcome this obstacle and scale up the scheme, we have worked closely with the Thai government over the last two years.

As a result of these efforts, the scheme was approved for a milestone budget of THB 3 billion (approximately USD 90 million) in 2016, with the goal to cover a total of two million rice farmers. The plan for the future is to extend the scheme to further crops and to widen the policy covers.

Helping to insure small businesses in Guatemala

After the devastating earthquake that struck Haiti in 2010, Swiss Re helped set up the Microinsurance Catastrophe Risk Organisation, or MiCRO for short (www.microrisk.org). Combining the capital efficiency of the reinsurance market with donor capital, MiCRO specialises in developing attractive and affordable insurance solutions for low-income populations, especially microentrepreneurs and smallholder farmers.

In 2016, MiCRO launched a new product in Guatemala offering insurance protection against losses resulting from excessive rainfall, severe drought or earthquakes. It is an index-based solution, paying out automatically according to predetermined parameters and event data from objective sources, including NASA satellites. Local partners Banrural (www.banrural.com.gt) and Aseguradora Rural (www.aseguradorarural.com.gt) sell the policies. Swiss Re has provided technical assistance during product development and reinsures the risks.

The small business and agriculture sectors are vital to the further development of Central American economies in general, but are highly vulnerable to weather-related risks. On top of this, climate change is expected to aggravate extreme weather events, increasing both their frequency and intensity. MiCRO plans to expand such index-based insurance products to further countries, and has already submitted one for approval in El Salvador. The goal is to reach a total of 250 000 people in the region by 2019.

In 2016, we also helped to launch two large natural catastrophe pilots in two provinces of China. You can read about these programmes in our 2016 Business Report.

Payouts to our clients in 2016

Innovative solutions, as described on these pages, all help to extend insurance protection. Three such solutions we have helped develop in recent years showed their practical benefit in 2016 by making payouts to their clients.

In the Caribbean, Hurricane Matthew caused many casualties and brought widespread destruction across the region. CCRIF SPC (www.ccrif.org, formerly the Caribbean Catastrophe Risk Insurance Facility), which we have been reinsuring since 2008, made payouts totalling USD 29 million to the governments of Haiti, Barbados, St. Lucia, St. Vincent and the Grenadines within two weeks of the disaster. This brought the total number of emergency payouts to 21 since 2008, worth USD 68 million.

In southern China, Typhoon Haima fortunately had a less severe human toll but destroyed many houses and crops. The city of Shanwei in Guangdong Province is one of the prefectures that earlier in the year had signed up to our parametric insurance programme against natural disaster risks and so received a payout less than a week after the impact (see 2016 Business Report).

In Mexico, the MultiCat cat bond, which we helped to develop in 2009 in cooperation with the World Bank, made a payout of USD 50 million to the Mexican government early in the year. The payment was triggered by Hurricane Patricia in October 2015. When the storm formed off Mexico’s western coast, it was one of the strongest hurricanes on record. Fortunately, it weakened before making landfall and took a track over more rural areas, sparing many lives.