Value Alignment Incentive

Purpose

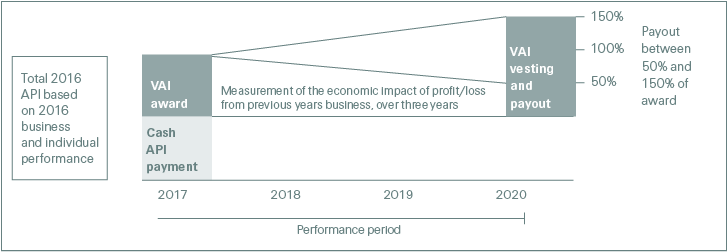

The VAI is a mandatory deferral of a portion of the API and introduces a time component to this performance-based, variable compensation. This supports the Group’s business model by aligning a portion of variable compensation with sustained long-term results. The aim is to ensure that the ultimate value of the deferred variable compensation through VAI is affected by the longer-term performance of the relevant Business Unit and the Group.

Plan duration

The VAI supports a longer-term perspective by linking awards to performance over a three-year period.

Performance measurement

Starting with the 2015 award, the performance measurement calculation has been simplified to increase transparency. This was achieved by using fewer performance factors (at the Business Unit and Group level) and, where possible, published EVM information.

The payout factor of the VAI is calculated based on the three-year average EVM previous years’ business profit margin for all prior underwriting years. EVM is Swiss Re’s proprietary integrated economic valuation and accounting framework for planning, pricing, reserving, and steering the business (please refer to the EVM section of this Financial Report). The EVM previous years’ business profit margin is the ratio of EVM previous years’ business profit to EVM capital allocated to previous years’ business in the current year.

A higher EVM previous years’ profit margin (for all prior underwriting years) results in a higher payout factor. Conversely, a lower EVM previous years’ profit margin results in a lower payout factor. The payout factor is a linear function that ranges from 50% to 150%.

Structure

The higher the API granted, the greater the amount of compensation that remains at risk through deferral into the VAI, as shown in the table below.

Portion of API that is deferred

| Download |

|

Deferral into VAI |

Group CEO |

50% of API |

Group EC members |

45% of API |

Other key executives |

40% of API |

All other employees |

50% of the amount exceeding USD 100 000 with a minimum deferral amount of USD 5 000 at USD 100 000 and up to a maximum of 40% of API |

Settlement

At the end of the deferral period, VAI will be settled in cash. For the full three-year performance measurement period, forfeiture conditions apply.

Additionally, clawback provisions apply in a range of events as defined in the VAI plan rules, enabling Swiss Re to seek repayment of settled awards. Examples of such events are the participant’s conduct or acts which can be considered as malfeasance, fraud or misconduct.