Our sustainability risk framework

Sometimes, business transactions that create economic value and are in compliance with all legal and regulatory requirements may nevertheless have negative impacts on the environment or certain vulnerable groups. Furthermore, such transactions may damage our brand and/or reputation.

Based on our long-standing commitment to enabling sustainable progress, we believe that it is important to recognise and address such dilemmas. Doing so requires a well-defined approach and the willingness to make decisions based on ethical principles.

Our Sustainability Risk Framework is an advanced risk management instrument specifically designed to identify and address potentially negative effects of our transactions on local communities, workforces and the environment – helping us to safeguard our reputation in the process. The framework applies to all of our business transactions, re/insurance as well as investments, to the extent that we can influence their various aspects.

The Sustainability Risk Framework consists of:

- Two umbrella policies on human rights and environmental protection, and seven guidelines on sensitive sectors or issues;

- The Sensitive Business Risk (SBR) process with an online assessment tool and a referral tool – due diligence mechanisms to assess our business transactions;

- Company exclusions; and

- Country exclusions beyond mere compliance with international trade controls.

Guidelines and policies

Our Sustainability Risk Framework is based on the principles of respecting human rights and protecting the environment. Through detailed guidelines, the framework applies these umbrella policies to seven sectors in which we perceive major sustainability risks: the defence industry; oil and gas (including oil sands and hydraulic fracturing); mining; dams; animal testing; forestry, pulp & paper and oil palm; and nuclear weapons proliferation. (The list of key concerns addressed by the policies and guidelines can be viewed at reports.swissre.com/corporateresponsibility-report/2016/cr-report/risk-intelligence/our-sustainability-riskframework/policies.html)

The Sensitive Business Risks process

Each of the two umbrella policies and seven sector guidelines of our Sustainability Risk Framework contains criteria and qualitative standards which define precisely when a transaction may present a “sustainability risk”.

7139

Due diligence checks carried out by our underwriters to detect potential sustainability risks

(3 550 in second half of 2015 after introduction)

219

Number of sensitive business transactions referred to our team of sustainability experts

(309 in 2015)

We assess such transactions through our Sensitive Business Risk (SBR) process, which consists of two due diligence mechanisms – the SBR online assessment tool and the SBR referral tool. The online tool, which we introduced in mid-2015, enables our underwriters to quickly screen all transactions for possible impacts on the local environment and on the human rights of the people and workforces affected.

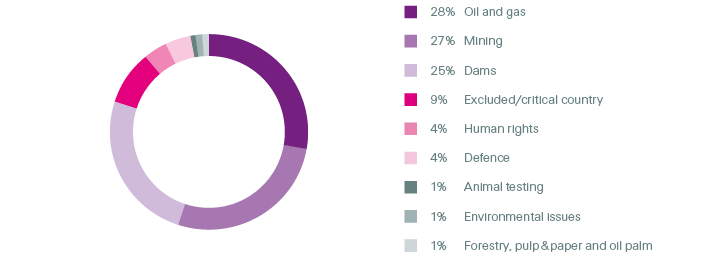

Sensitive Business Risks referred to our expert team in 2016

If this screening reveals any potential issues, the underwriters carry out further due diligence. Finally, the most critical transactions are referred to our team of sustainability experts, who then conduct targeted research to decide whether the transaction at hand is acceptable on ethical grounds.

This decision takes the form of a binding recommendation either to go ahead with the transaction, to go ahead with certain conditions attached or to abstain from it. If there is disagreement about the recommendation, the case can be escalated to the next management level, ultimately to the Group Chief Risk Officer and the Group Executive Committee.

When making these decisions, we refer to internationally recognised ethical principles. Swiss Re is a signatory to the UN Global Compact, which derives its human rights principles from the Universal Declaration of Human Rights, its labour principles from the ILO Declaration on Fundamental Principles and Rights at Work, its environment principles from the Rio Declaration on Environment and Development and its anti-corruption principles from the United Nations Convention against Corruption.

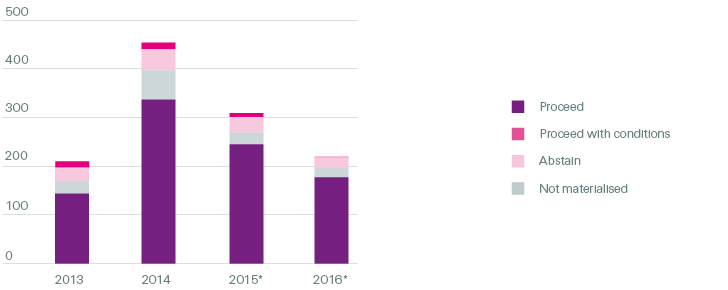

Number of Sensitive Business Risk referrals

* Starting in mid-2015, we have refined our SBR process, which has led to a decrease in the number of referrals

The online SBR assessment tool is now fully implemented. In 2016, our underwriters used it to carry out sustainability checks on 7 137 transactions. As the tool precisely identifies those transactions that require further assessment from our sustainability experts, the number of referrals has fallen since its introduction in mid-2015. Of the 219 transactions referred in 2016, we issued negative recommendations in 21 cases and positive recommendations with conditions attached in 20 cases.

Integrating anti-bribery & corruption guidance

Swiss Re prohibits all forms of bribery and corruption, as expressed by our Code of Conduct. We clearly state this position and explain what it means for daily business conduct through our Group Anti-Bribery and Corruption (ABC) Policy and detailed Group ABC Guidelines. In 2016, we took further steps to mitigate our potential exposure to bribery and corruption risks by integrating corresponding guidance in our SBR assessment tool, thus ensuring appropriate due diligence on our counterparties.

This guidance specifies both the countries and industries with a heightened risk of bribery and corruption, and instructs our underwriters how to carry out additional due diligence in order to assess the risk. In grave cases, our due diligence procedure leads to an automatic requirement to abstain from the transaction. If there is disagreement about this, the transaction needs to be discussed with our internal legal and compliance team who will provide additional advice.

Company exclusions

The policies of our Sustainability Risk Framework specify certain criteria that may lead to the exclusion of a company from both our re/insurance transactions and our investments, to the extent that such an exclusion is permissible (eg by virtue of mandatory law or internal policies) and possible (eg if existing documentation relating to such re/insurance transactions and investments provide for it). These criteria include: involvement in prohibited war material; verifiable complicity in systemic, repeated and severe human rights violations; causing repeated, severe and unmitigated damage to the environment; unregulated proliferation of nuclear weapons; and unethical/cruel animal testing practices.

Country exclusions

Swiss Re also excludes certain countries from its business, beyond compliance with international trade controls (ITCs). The criterion for these country exclusions is a particularly poor human rights record. Our goal is not to directly underwrite risks or make investments in entities that are based in these countries. At the end of 2016, the countries excluded from our business for human rights reasons were the Central African Republic, Chad, DR Congo, North Korea, Somalia, Sudan (both North and South) and Syria. We review this list annually based on independent human rights assessments and update it if warranted. The review carried out in 2016 did not produce any changes.