Life & Health Reinsurance

Net income for 2016 was USD 807 million compared to USD 968 million for 2015. Current year results were impacted by lower performance in the UK portfolio versus our expectations. The prior-year result benefited from more favourable valuation adjustments, especially interest rate updates to disabled life reserves. The return on equity was 12.8%, exceeding the upper end of the target range of 10%–12%, though lower than the 16.2% reported for 2015. This was mainly due to the lower net income and an increase in shareholders’ equity, driven by higher unrealised gains that reflected a decline in interest rates.

Life & Health results

| Download |

USD millions |

2015 |

2016 |

Change in % |

Revenues |

|

|

|

Premiums earned |

10 567 |

11 486 |

9 |

Fee income from policyholders |

49 |

41 |

–16 |

Net investment income – non-participating business |

1 330 |

1 279 |

–4 |

Net realised investment gains/losses – non-participating business |

311 |

232 |

–25 |

Net investment result – unit-linked and with-profit business |

42 |

15 |

–64 |

Other revenues |

4 |

5 |

25 |

Total revenues |

12 303 |

13 058 |

6 |

|

|

|

|

Expenses |

|

|

|

Life and health benefits |

–8 012 |

–8 963 |

12 |

Return credited to policyholders |

–60 |

–39 |

–35 |

Acquisition costs |

–1 965 |

–1 943 |

–1 |

Operating expenses |

–774 |

–763 |

–1 |

Total expenses before interest expenses |

–10 811 |

–11 708 |

8 |

|

|

|

|

Income before interest and income tax expense |

1 492 |

1 350 |

–10 |

Interest expenses |

–323 |

–301 |

–7 |

Income before income tax expense |

1 169 |

1 049 |

–10 |

|

|

|

|

Management expense ratio in % |

6.5 |

6.0 |

|

Net operating margin in % |

12.2 |

10.4 |

|

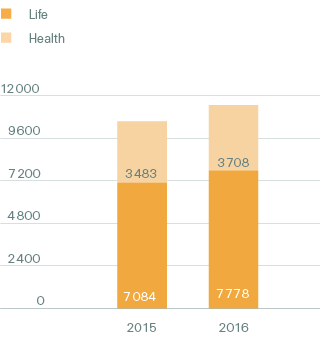

Net premiums earned and fee income

Premiums earned and fee income increased by 8.6% to USD 11.5 billion compared to USD 10.6 billion for 2015. Premiums were higher stemming from transactions in the US and successful renewals and new business wins in Asia. At constant exchange rates, premiums earned and fee income were 11.4% higher compared to 2015.

Net operating margin

Premiums earned by line of business, 2016

(Total: USD 11.5 billion)

The net operating margin for 2016 was 10.4%, compared to 12.2% in 2015. The current year was impacted by adverse experience in the UK and less favourable valuation adjustments compared to the prior year.

Management expense ratio

The management expense ratio was 6.0%, an improvement over the prior-year period, driven by a slightly lower expense base and higher premiums in the current year.

Lines of business

Life

The Life segment reported income before interest and income tax expense (EBIT) of USD 783 million for 2016, compared to USD 725 million for 2015. The prior year benefited from favourable mortality experience and recapture impact. The current period was mostly supported by favourable valuation updates, partially offset by adverse experience in the UK life portfolio.

Health

The Health segment reported EBIT of USD 352 million for 2016, compared to USD 587 million for 2015. The prior-year period result benefited from favourable valuation adjustments such as interest rate updates to disabled life reserves but was adversely impacted by reserve strengthening in the UK. The current period was impacted by lower performance of the UK health portfolio.

Investment result

The return on investments for 2016 was 3.6% compared to 3.4% in 2015, reflecting an increase in the investment result of USD 110 million.

Net investment income increased by USD 11 million to USD 1 100 million in 2016, driven by the impact of large transactions which increased the invested asset base, partially offset by the impact of lower reinvestment yields. The fixed income running yield for 2016 was 3.4%.

Net realised gains were USD 184 million in 2016 compared to net realised gains of USD 85 million in 2015, which included losses on interest rate derivatives as well as a lower contribution from sales of fixed income securities.

Insurance-related investment results as well as foreign exchange remeasurement are not included in the figures above.

Shareholders’ equity

Common shareholders’ equity was USD 6.8 billion at the end of 2016, compared to USD 5.8 billion as of 31 December 2015. The increase was mainly due to net income for the year and an increase in unrealised gains reflecting a decline in interest rates, partially offset by a dividend payment to the Group of USD 400 million.

Outlook

We expect life and health reinsurance business to be relatively flat in mature markets and to increase in high growth markets.

In mature markets the prolonged low interest rate environment continues to have an unfavourable impact on primary sales. Cession rates in the US have decreased and have now generally flattened as primary insurers retain more risk. However, we see a strong focus on capital, risk and balance sheet optimisation in mature markets, leading to positive opportunities for large transactions.

Recent political instability has given rise to uncertainty for growth in many regions of the world that could last two years or more. Market volatility is increasing in the short-term, with uncertain impact on Swiss Re’s new business overall.

We believe high growth markets will continue to see strong increases in primary life and, in particular, health volumes, while cession rates are expected to be stable.

We will continue to pursue growth opportunities in high growth markets and in large transactions, including longevity deals. We are responding to the expanding need for health protection driven by ageing societies and we will apply our experience to help reduce the protection gap in all regions.