Responsible investment approach

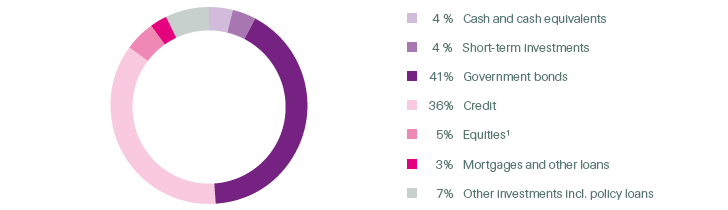

The cornerstone of our investment philosophy continues to be asset-liability management (ALM). To meet future claims and benefits, we invest the premiums generated by our underwriting activities in assets whose cash flows match the durations and currencies of our re/insurance liabilities. Therefore, we generally invest more in higher-quality fixed income securities with stable long-term returns. At the end of 2017, such investments accounted for 80% of our total assets under management2 (see graph below).

We are convinced that including ESG criteria into the investment process makes economic sense, especially for long-term investors, because it improves risk/return profiles and hence reduces downside risks.

We consistently integrate ESG considerations along the three pillars Enhancement, Inclusion and Exclusion, of which Enhancement is strategically the most meaningful pillar for Swiss Re.

OVERALL INVESTMENT PORTFOLIO

1 Includes equity securities, private equity and Principal Investments

2 Asset classes considered are government bonds, credit, and mortgages and other loans.