Natural catastrophes and climate change

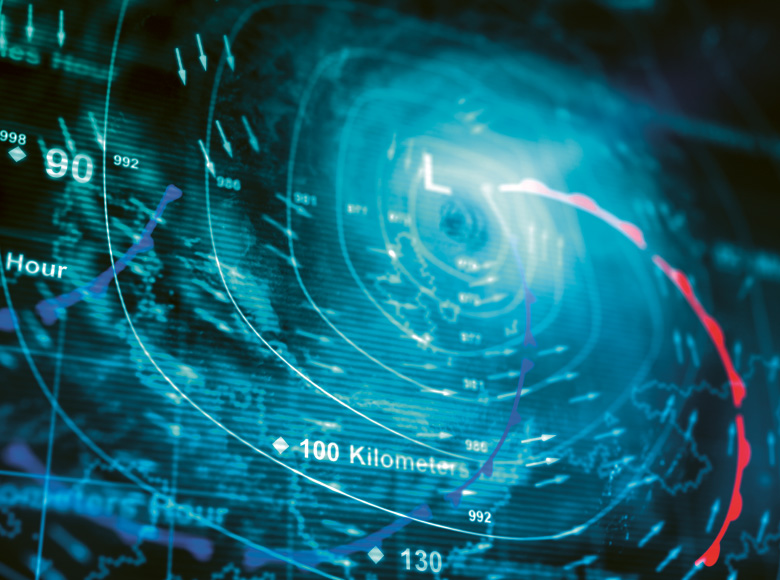

Natural catastrophes are a key risk in our property and casualty (P&C) business. The damage caused by storms, floods, droughts, earthquakes and other natural catastrophes can affect millions of lives and the economies of entire countries. In 2019, large natural catastrophe losses were mainly driven by typhoons Hagibis and Faxai in Japan, Hurricane Dorian in the Atlantic, and wildfires, floods and hailstorms in Australia.

USD 2.94bn

(USD 2.29 billion in 2018)

Natural catastrophe premiums in our P&C Reinsurance business

Providing effective re/insurance protection against such large natural catastrophes creates significant benefits for our clients and for society at large. In 2019, our clients in P&C Reinsurance paid us USD 2.94 billion of natural catastrophe premiums (for losses larger than USD 20 million), equivalent to approximately 15% of total premiums in this business segment.

In the section Strengthening risk resilience: 2019 highlights you can read about some of the innovative solutions we have developed to offer our clients protection against natural catastrophe and other risks.

Worldwide economic as well as insured losses from natural catastrophes were high in each of the past three years, but have steadily increased on average for more than 20 years. The main reasons for this are economic development, population growth, urbanisation and a higher concentration of assets in exposed areas.

This general trend will continue. But, crucially, economic losses will be further aggravated by climate change. The scientific consensus is that a continued rise in average global temperatures will have a significant effect on weather-related natural catastrophes. According to the Fifth Assessment Report (AR5, 2014) and the Special Report on Global Warming of 1.5°C (SR15, 2018), published by the Intergovernmental Panel on Climate Change (IPCC), a changing climate gradually leads to shifts in the frequency, intensity, spatial extent, duration and timing of extreme weather events.

Natural catastrophe data

In our 2019 Financial Report, we provide detailed quantitative information on natural catastrophe perils: the four perils with the highest expected annual losses (Climate metrics and targets) and the liquidity requirements stemming from four extreme loss scenarios (Insurance risk stress tests).

If climate change remains unchecked, the makeup of the main drivers will thus gradually shift, with climate change accounting for an increasingly large share of natural catastrophe losses.

To assess our property and casualty business accurately and to structure sound risk transfer solutions, we need to clearly understand the economic impact of natural catastrophes and the effects of climate change. This is why we invest in proprietary, state-of-the-art natural catastrophe models, developed and advanced by a team of around 40 scientists, as well as from regular collaboration with universities and scientific institutions.

The link between climate change and natural catastrophes continues to be of high relevance for Swiss Re. In our Group Sustainability Strategy we have devoted one of its 2030 Sustainability Ambitions to this topic: Mitigating climate risk and adancing the energy transition.

Based on our research, there is a trend towards increasing losses from secondary perils1. These are often highly localised small to mid-sized events, or a resulting effect of a primary peril that can include hurricane-induced rainfall, storm surge, as well as drought and wildfire outbreaks. We explicitly factor the main risk trends into our modelling to underwrite catastrophe business sustainably, and build global resilience.

While the impact of climate change will increase gradually over the coming decades, most of our business is renewed and re-priced annually, and our risk models are refined regularily. Risks are normally covered for 12 months (up to five years for catastrophe bonds). Thus, re/insurance premiums do not reflect expected loss trends over the coming decades. Rather, for underwriting and risk management purposes, our models provide an estimate of the current risk. But as natural catastrophe losses continue to rise as a result of the different factors listed above, our models will gradually factor in this trend.

In addition to providing re/insurance covers, we offer our clients strategic expertise and integral risk assessments of natural disasters and climate adaptation. These include free client access to Swiss Re’s CatNet® tool, which includes our recently launched Global Storm Surge Zones service, and our expertise publications (for examples, see Dialogue on our 2030 Sustainability Ambitions).