Capital management

We have already achieved USD 6 billion of deleveraging ahead of our 2016 target of USD 4 billion.

During 2015, Swiss Re continued deleveraging, maintained its strong capitalisation and further directed excess capital from its Business Units to the Group’s holding company, Swiss Re Ltd.

Optimised Group capital structure

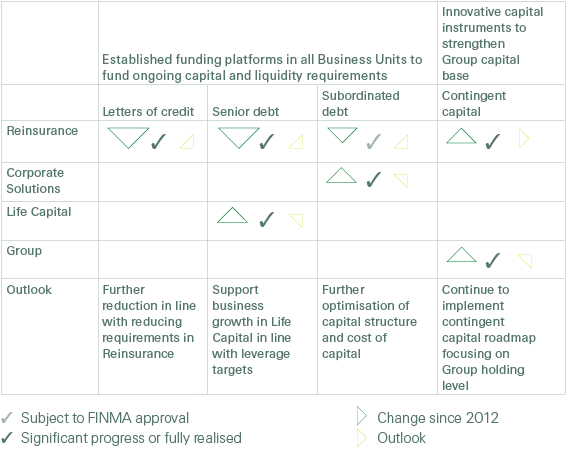

Swiss Re’s level of capitalisation and its capital structure are driven by regulatory and rating capital requirements, and management’s view of risks and opportunities arising from our underwriting and investing activities. As announced at the June 2013 Investors’ Day, we set a target capital structure objective that aims to operate efficiently within these constraints by maximising financial flexibility. The structure focuses on the reduction of senior leverage, including letters of credit (LOCs), the issuance of contingent capital to replace traditional subordinated debt and extending the Group’s funding platform.

Target deleveraging achieved

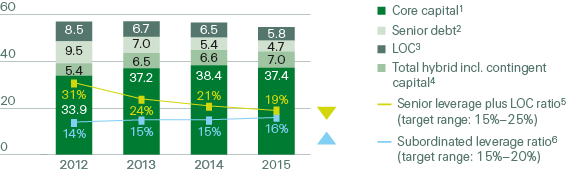

1 Core capital of Swiss Re Group is defined as economic net worth (ENW).

2 Senior debt excluding non-recourse positions.

3 Unsecured LOC capacity and related instruments (usage is lower).

4 Includes subordinated debt facility by Swiss Re Ltd.

5 Senior debt plus LOCs divided by total capital.

6 Subordinated debt divided by sum of subordinated debt and ENW.

Achievements since year-end 2012

- Letters of Credit reduction of net USD 2.7 billion.

- USD 4.7 billion deleveraging of senior debt.

- Entry into GBP 550 million revolving credit facility for Admin Re®.

- First Corporate Solutions subordinated debt issuance of USD 500 million.

- First Group holding company subordinated debt facility of USD 700 million.

Key milestones achieved in 2015

6 billion

Net deleveraging since year-end 2012 (USD)

Two further important milestones towards full implementation of the target capital structure were achieved in 2015:

In November 2015, Swiss Re Ltd established a USD 700 million subordinated debt facility at an attractive interest rate of 5.75%. The transaction establishes a funding platform at the holding company and brings the Group closer to its target capital structure objective in contingent capital form, further enhancing the Group’s financial flexibility. Unlike previous contingent capital transactions, this platform allows Swiss Re to decide when to reinforce its capital position at locked-in rates.

Overall Group deleveraging has totalled USD 6 billion since year-end 2012, and achieved the deleveraging target of USD 4 billion ahead of 2016. Net senior deleveraging in 2015 amounted to USD 1.2 billion, driven by USD 0.7 billion senior debt maturities and redemptions and a net USD 0.7 billion reduction in LOCs and related instruments, offset by new senior issuances and bank funding of USD 0.2 billion.

The Group capital structure is comfortably within our senior leverage (15%–25%) and subordinated leverage (15%–20%) target ranges, providing further financial flexibility.

In addition we managed our subordinated debt maturity profile by replacing part of the EUR 1 billion subordinated perpetual loan notes issued by Swiss Reinsurance Company Ltd in 2006 with new EUR 750 million perpetual subordinated callable loan notes with a first call date in 2025 at a coupon of 2.6%.

Legal entity capital management

Our regulated subsidiaries are subject to local regulatory requirements, which for our EU subsidiaries include Solvency II. At the subsidiary level we set the target capital at a level tailored to each entity’s business and the market environment in which it operates. Our underwriting and investment decisions are steered so as to make capital and liquidity fungible to the Group wherever possible, while complying with local regulations and client needs.

Cash dividends paid to Swiss Re Ltd totalled USD 3.7 billion in 2015.

External dividends to shareholders

Based on the Group’s capital strength, the Board of Directors proposes an 8.2% increase in the 2015 regular dividend to CHF 4.60 per share, up from CHF 4.25 in 2014. In addition, the Board of Directors proposes a public share buy- back programme of up to CHF 1.0 billion purchase value, exercisable until the AGM in 2017. The programme will only be launched if excess capital is available, no major loss event has occurred, other business opportunities do not meet Swiss Re’s strategic and financial objectives and the necessary regulatory approvals have been obtained.

These capital measures are expected to bring the total amount of capital returned to shareholders to USD 12.1 billion since the implementation of the new Group structure in 2012, even excluding the upcoming proposed share buy-back.

Swiss Re Group’s capital adequacy

Regulatory capital requirements

Swiss Re is supervised at Group level and for its regulated legal entities domiciled in Switzerland by FINMA. FINMA supervision comprises minimum solvency requirements, along with a wide range of qualitative assessments and governance standards.

Swiss Re provides regulatory solvency reporting to FINMA under the rules of the Insurance Supervision Ordinance. This SST report is based on an economic view. We calculate available capital based on our Economic Value Management (EVM) framework and required capital under the SST using our internal risk model (see Economic Value Management for further information on EVM). The minimum requirement for the SST is a ratio of 100%. Swiss Re’s SST ratio materially exceeds the minimum requirement.

Swiss Re’s capital management aims to ensure our ability to continue operations following an extremely adverse year of losses from insurance and/or financial market events.

Rating agency capital requirements

Rating agencies assign credit ratings to the obligations of Swiss Re and its rated subsidiaries.

The agencies evaluate Swiss Re based on a set of criteria that include an assessment of our capital adequacy.

Each rating agency uses a different methodology for this assessment; A.M. Best and S&P base their evaluation on proprietary capital models.

A.M. Best, Moody’s and S&P rate Swiss Re’s financial strength based upon interactive relationships. The insurance financial strength ratings are shown in the table below.

On 30 November 2015, S&P affirmed the AA- financial strength of Swiss Re and its core subsidiaries. The outlook on the rating is “stable”. S&P revised upward its assessment of Swiss Re’s management and governance score. S&P believes that Swiss Re’s management team has established a track record of strong execution against its strategy and groupwide financial targets.

On 11 December 2015, A.M. Best affirmed the A+ financial strength rating of Swiss Re and its core subsidiaries. The outlook for the rating is “stable”. The rating reflects Swiss Re Group’s excellent consolidated risk-adjusted capitalisation, strong operating performance and superior business profile as a leading global reinsurer.

On 15 December 2015, Moody’s affirmed Swiss Re’s insurance financial strength rating and outlook at “Aa3” stable. The rating affirmation reflects Swiss Re’s excellent market position, very strong business and geographic diversification and strong balance sheet in terms of capital and financial flexibility.

Swiss Re’s financial strength ratings

| Download |

As of 15 December 2015 |

Financial strength rating |

Outlook |

Last update |

Moody’s |

Aa3 |

Stable |

15 December 2015 |

Standard & Poor’s |

AA– |

Stable |

30 November 2015 |

A.M. Best |

A+ |

Stable |

11 December 2015 |