Funding of the Annual Performance Incentive and Leadership Performance Plan pools

The Compensation Committee focuses on both financial results and qualitative criteria in determining global variable compensation pools.

The Compensation Committee receives proposals from management requesting the total funding for variable compensation pools for both API and LPP. The management proposal for the annual API pool is generally based on the Group’s overall performance for the year. The LPP pool is reviewed in the context of sustainable business performance and affordability. The Compensation Committee considers these proposals and recommends a total pool to the full Board of Directors for approval. The Compensation Committee and the Chairman of the Board of Directors also propose an individual award for the Group CEO within this overall pool. The VAI is not funded as a separate pool: the API pool will include amounts paid in immediate cash and amounts to be deferred into the VAI.

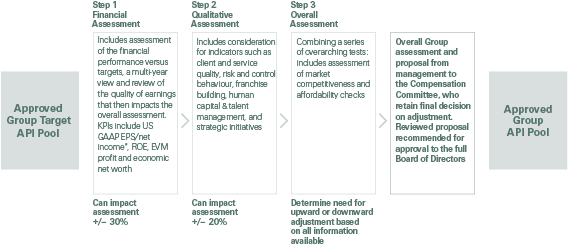

Swiss Re uses a three-step process to assess business performance to help determine the overall Group API pool. The process comprises a financial, a qualitative and an overall assessment. The financial assessment covers US GAAP EPS/net income*, ROE, EVM profit and economic net worth measures for both the Group and each Business Unit individually. Also, multi-year comparisons and an assessment of the quality of earnings are considered. The chart below gives more detail on the criteria used to determine the size of the pool. The Business Units then allocate their pools following a similar assessment.

* EPS for the Group and net income for the Business Units.

Group API pool funding process