Other solutions for resilience

FLOW: Parametric water-level insurance

Here’s another example of how re/insurance innovation is helping tackle weather-related challenges. In 2018, a very dry and warm summer left the water levels of rivers in Europe at record lows. Companies using the rivers to transport their goods were faced with higher costs and decreased production volumes.

Swiss Re Corporate Solutions developed FLOW, a new parametric water-level insurance, designed to protect businesses from the financial impact of low (or high) river water levels.

Unlike traditional insurance covers, which often require loss investigations, FLOW pays fixed amounts based on a customised index, tracking each client’s water level exposure.

Defined thresholds for water levels

First-in-market protection solutions for the ”sandwich generation”

Besides enabling modern infrastructure, re/insurance also helps communities cope with increasing longevity.

In Singapore, one in every four working adults is part of the ”sandwich generation“ – those who are “sandwiched” between taking care of their ageing parents and their children. Longer lives, rising cost of living and other trends are adding to the pressure on these caregivers.

Together with leading insurers in Singapore, Malaysia and Hong Kong, Swiss Re developed a series of first-in-market health protection solutions that ease the financial and emotional burden on the members of the sandwich generation. These critical illness plans protect three generations of a family – policyholders, their children and their parents – at once.

*Policy coverage may differ by markets.

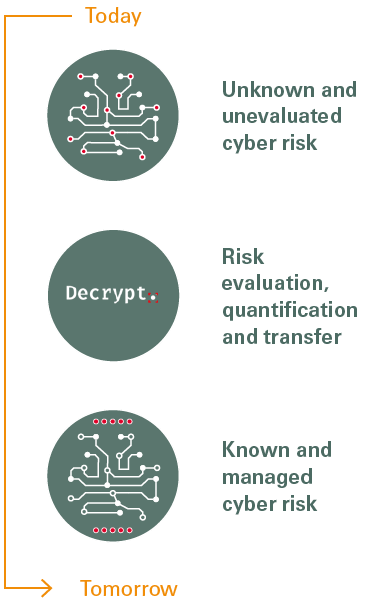

Decrypt – a new holistic cyber reinsurance solution

Improvements in technology have led to greater access and a higher potential to close the protection gap, but digitalisation is also leading to new and complex exposures that have not traditionally been considered by the insurance industry.

Developed by Swiss Re with cyber reinsurance broking specialist Capsicum Re, Decrypt provides a single, flexible, end-to-end solution. It starts by analysing policy wordings and mapping accumulation scenarios, quantifying the exposures and delivering bespoke reinsurance solutions to facilitate risk transfer.

Decrypt gives insurance companies a unique understanding of the cyber exposures across their portfolios, and offers protection against the aggregation of cyber losses across different lines of business. It also helps them meet growing legal, regulatory and internal requirements.

Cyber risk management