Partners in prevention

Worldwide, one in 11 adults is diabetic, costing the global community approximately USD 1.3 trillion annually. In Thailand, a staggering 4.2 million people are living with the disease.

“Modifiable risks are key drivers of Asia’s USD 1.8 trillion health protection gap. Holistic insurance solutions can be an efficient means to help customers manage their health and close the protection gap.”

Sohila Kwan

Asia Head of Health & Medical Solutions, Swiss Re

Fortunately, Type 2 diabetes can be prevented, enter into remission or have its complications reduced by managing risk factors relating to diet and lifestyle.

To this end, Swiss Re and Muang Thai Life Assurance joined forces in 2018 to create a new dynamic-pricing health insurance product to address this modifiable risk. Personalised customer premiums are adjusted based on HbA1C, a key health indicator, reflecting their lifestyle decisions. It uses a smartphone app to encourage at-risk individuals to eat right, exercise regularly, monitor their glucose levels and see their doctor every six months. The result is healthier customers, fewer claims and a reduction in potentially catastrophic complications.

Digital health solutions

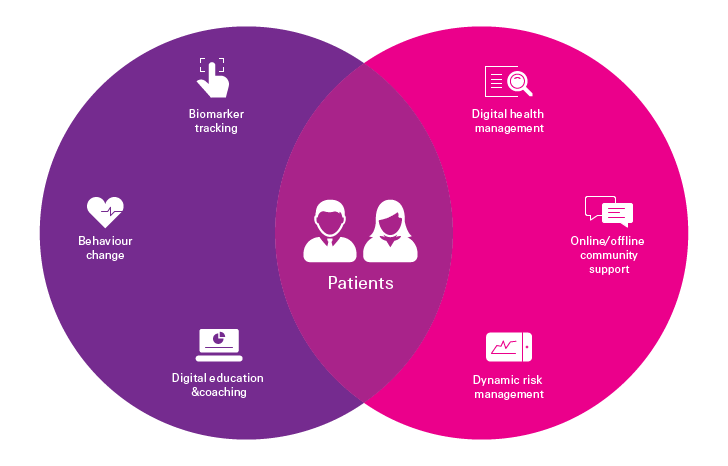

On/Offline Community Support

Digital care and protection services help patients reach a better health outcome.

Digital Education & Coaching

Wellness programme app transforms data (e.g. diet, exercise) into actionable insights.

Digital Health Management

Digital tools allow users to manage and track their health condition.

Dynamic Risk Management

Dynamic underwriting and pricing features incentivise behaviour change to prevent and manage risks.

Behaviour Change

Change in lifestyle behaviour can significantly influence health outcome.

Biomarker Tracking

The new generation of wellness trackers allow users to give insurers access to their clinical health data.