2017 Key highlights

Seizing opportunities

In 2017, Swiss Re entered several new partnerships, including working with the World Bank to co-structure their pandemic risk bond – the first of its kind. We also strengthened our footprint in Asia by establishing a dedicated reinsurance regional legal entity in Singapore and we received a branch license to operate in India, as one of the first foreign reinsurers.

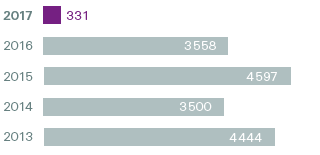

Net income

(USD millions)

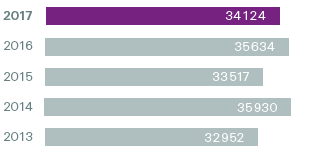

Shareholders’ equity

(USD millions)

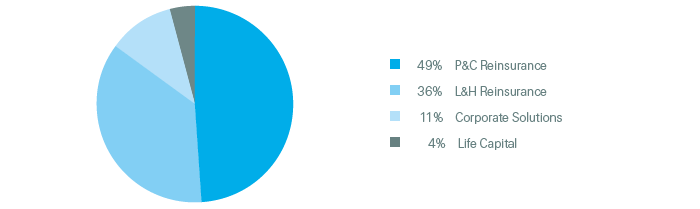

Net premiums and fees earned by business segment, 2017

(Total: USD 33.7 billion)

Research and development

Throughout 2017, with the development of the Swiss Re Institute, we reaffirmed our commitment to investing in developing and publishing industry-relevant research from internal experts and external partners, in an effort to close the protection gap and make the world more resilient.

Enhancing our investment portfolio

Our knowledge-based approach continues to guide our capital allocation strategy, as we target the optimal mix of assets and liabilities. In 2017, we became one of the first in the re/insurance industry to integrate environmental, social and governance (ESG) benchmarks into our investment decisions.

Proposed regular dividend per share for 2017

(CHF)

5.00

(CHF 4.85 for 2016)