Our business

Swiss Re is a leader in wholesale reinsurance, insurance and risk transfer solutions. Our clients include insurance companies, mid-sized and multinational corporations and public sector bodies. Our capital strength and knowledge enable the risk-taking on which economies depend.

The Swiss Re Group

Reinsurance

We cover the reinsurance needs for non-life and life insurers through the Property & Casualty and Life & Health segments.

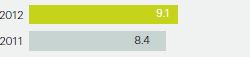

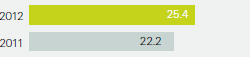

Net premiums earned and fee income (USD billions)

Property & Casualty

Life & Health

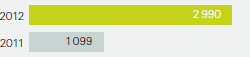

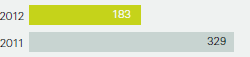

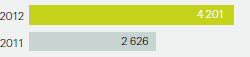

Net income (USD millions)

Property & Casualty

Life & Health

Return on equity

Property & Casualty

26.7%

(11.0% in 2011)

Life & Health

8.9%

(21.2% in 2011)

Operating performance

Property & Casualty

80.7%

(104% in 2011)

Combined ratio

Life & Health

75.5%

(74.5% in 2011)

Benefit ratio

Corporate Solutions

We offer innovative, high-quality insurance capacity to mid-sized and large multinational corporations.

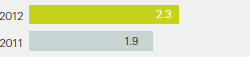

Net premiums earned and fee income (USD billions)

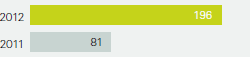

Net income (USD millions)

Return on equity

7.4%

(3.7% in 2011)

Operating performance

96.2%

(104% in 2011)

Combined ratio

Admin Re®

We acquire closed in-force life and health books of business, which we administer through Admin Re®.

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

2.6%

(5.0% in 2011)

Operating performance

1 196 m

(USD 302m in 2011)

Gross cash generation

Total

(after consolidation)

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

13.4%

(9.6% in 2011)

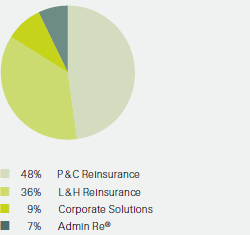

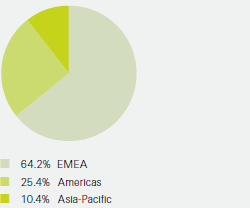

Diversified and global

Net premiums earned in 2012

(Total: USD 25.4 billion)

Employees

(Total: 11 193 regular staff1)

1 as of 31 December 2012