How can we build resilience in the wake of COVID-19?

In 2020, our role in helping make the world more resilient became critical. We provided support to societies through our financial strength, innovative solutions and risk knowledge.

As a leader, we will focus on going beyond insurance and finding solutions that help our partners to do so. In this section, we look at how we have supported our clients over the year, worked with governments and stayed one step ahead through our sophisticated pandemic research and risk modelling.

Insurance will have a central role in the process of rebuilding the global economy, protecting the vulnerable and making the world more resilient.

Thierry Léger

Group Chief Underwriting Officer

For more than 150 years, we have supported our clients through challenging times with our financial strength and expertise. In this respect, the COVID-19 pandemic has been no different.

We care for our clients and partners by fulfilling our role of covering losses, providing capacity, sharing knowledge and innovating.

We are a risk knowledge company, but we know that every event, like every client, is unique. For this reason, we continue to learn and share our learnings with our clients and partners.

Innovation is also key if we are to stay in step with our customers and the new risks that they face. By driving change, we play our role in developing resilient societies.

Supporting our clients through risk expertise

Find out how Swiss Re supported its clients and partners during this challenging year through event monitoring, data collection and assessment and claims handling, among many other activities.

Our teams of experts have been actively monitoring developments and collecting data since the first cases of infection with the novel coronavirus were reported in China, long before COVID-19 was officially declared a pandemic. As the situation unfolded, Swiss Re’s strong global crisis management set-up and robust IT infrastructure kept the business running without any operational disruptions, even as most employees had to work from home. Swiss Re staff continued to handle claims, renew contracts, share their knowledge and innovate.

In total, Swiss Re set aside USD 3.9 billion in 2020 to pay for claims related to the COVID-19 pandemic. Our experts went through a very detailed and thorough analysis to arrive at this figure because the level of actual claims has so far been low.

On the P&C side, our teams collected bottom-up data from clients, actively researched cancelled or postponed events, made a detailed analysis of contract wordings both in Reinsurance and in Corporate Solutions and integrated assessments from internal and external legal counsel. On the L&H side, a different team built a top-down mortality model, based on emerging population data across the world and progressively refined it as more granular data became available.

This COVID-19 process was ongoing throughout 2020. It also ran in parallel to a record number of large loss assessment processes, which were triggered by the extraordinary number of hurricanes in the North Atlantic. In total, the team conducted 13 such assessments; more than 2018 and 2019 combined.

Apart from analysing Swiss Re’s own exposure, our pandemic experts developed the Risk Resilience Center in partnership with Palantir Technologies, collecting health, economic and social data onto one unique platform. We shared this knowledge and pandemic expertise with our clients through webinars and online meetings. We also actively engaged with governments around the world to develop solutions to ensure that we, as a society, are better prepared for the next pandemic.

Strengthening the commitment to our clients in 2020

USD3.9bn

COVID-19-related claims

and reserves

USD1.9bn

COVID-19 claims and reserves:

P&C Re

USD943m

COVID-19 claims and reserves:

Corporate

Solutions

80%

IBNRs1 P&C Re 2020 COVID-19

reserves

USD999m

COVID-19 claims and reserves:

L&H Re

200-250%

within new Group SST target range

as of 1 January 2021

1 “Incurred but not reported” reserves for events that have occurred but the client has not yet filed a claim.

Extra backing for clients and society

We are going the extra mile to back up our clients and society during the COVID-19 pandemic. Here are two examples of how we supported the financing of SMEs in emerging markets and provided free underwriting support to insurers through Swiss Re's Life Guide:

In emerging markets, access to local credit is critical for small and medium-sized enterprises (SMEs) as they employ the vast majority of the local workforce. Due to COVID-19, many local banks were forced to freeze or restrict lending in 2020, as their access to financing dried up.

To combat this problem, the International Finance Corporation (IFC) developed a rapid response facility that provides financing to local banks, who can in turn offer loans to local SMEs.

Swiss Re is a global leader in the credit and surety business. Through our Corporate Solutions Business Unit, and in conjunction with a panel of other insurers, we support the IFC by sharing underlying credit risk for the facility.

As the pandemic took hold, Swiss Reʼs L&H underwriting team opened access to Life Guide, Swiss Reʼs market-leading life and health underwriting manual. The 90-day free offer helped more life and health insurers address the emerging risks associated with COVID-19.

By applying our global perspective and research, Swiss Re was the first to provide this underwriting guidance. Many clients cited this as critical support that gave them greater confidence in their underwriting decisions, as the world continued to discover more about the virus and its effects.

The team continues to update Life Guide as more research emerges on COVID-19. For example, in the third quarter of 2020, we included new guidance for individuals participating in vaccine trials and considerations for broader antigen and antibody testing.

life and health insurers benefitted from accessing Life Guide

days free period for Life Guide

Why public-private partnerships are key to insure pandemic risk

To address the challenge of insuring widespread societal risk, such as pandemics, public-private partnerships (PPPs) are key. Ivo Menzinger describes how PPPs create a more sustainable risk-sharing model and thereby help to close the insurance protection gap. He explains what Swiss Re is doing in this rapidly evolving area.

Ivo Menzinger

Head Public Sector Solutions EMEA

Unlike natural disasters, pandemics are of a global systemic nature and this makes them uninsurable on a purely private basis. For example, the loss in economic output over 2020 and 2021 due to COVID-19 is estimated at USD 12 trillion, far exceeding the capital of the entire insurance industry. As a result, governments are called upon to absorb the majority of financial risk.

There are three essential elements: prevention and preparedness; intervention and emergency management; and financing. Re/insurance plays an important role through its risk knowledge. Furthermore, it is vital to ensure that financial support – whether public or private – gets to those enterprises that are significantly impacted by such an event. The private insurance market has the deep client relationships and industry expertise to make that happen.

Swiss Re is actively engaged in discussions with governments, legislators, regulators and the insurance industry to share its experience in establishing new risk-sharing arrangements. As experts in parametric insurance solutions and technological innovation, this year Swiss Re successfully closed more than 30 new PPP transactions. In doing so, we participated in supporting food security in India, Vietnam and Kazakhstan, and enhancing disaster resilience in Morocco, Puerto Rico and Indonesia, as well as facilitating investment in housing through credit life products in Ghana.

Ivo Menzinger

Head Public Sector Solutions EMEA

Swiss Re is a global leader in pandemic modelling

We have long been preparing for a potential widespread disease outbreak though Swiss Re’s pandemic model. It is an important tool for steering our business and a cornerstone of our financial strength. We look at how the model works and the recent developments since COVID-19.

Origins of the model

The SARS epidemic in the early 2000s showed the importance of understanding how pandemics affect our balance sheet.

Created in 2006, the pandemic model was developed to allow us to stress test our portfolio as we do for large natural catastrophes. This understanding has allowed us to steer key decisions around risk appetite and our capital position. Since its inception in 2006, the model has received regulatory approval and is regularly audited.

How the model works

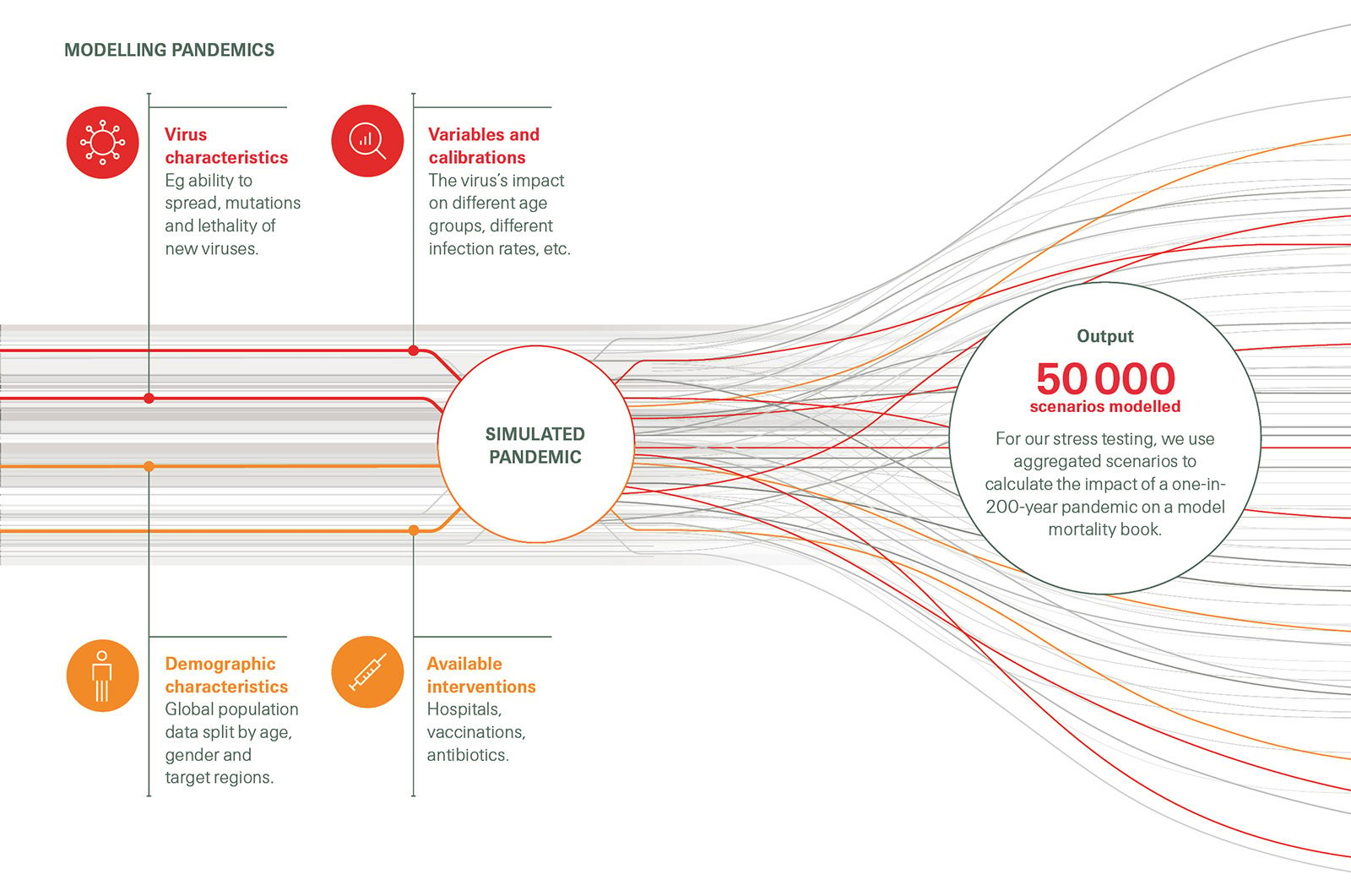

Our pandemic model uses large data sets to calculate the likely losses from different pandemic scenarios. It is based on both the characteristics of diseases that could result in a pandemic and society’s ability to cope with any given pandemic event.

The model draws on data around which viruses might cause a pandemic, how quickly they can spread and how lethal they are likely to be. It then incorporates insights on available medications that might decrease the rates of infection and the progression of the disease once people have been infected. It also includes factors such as healthcare structures and demographic data.

The output and usage

The model statistically analyses 50 000 different pandemic scenarios to see what the impact of a certain strength of a modelled pandemic might be on a certain portfolio.

The output from this scenario analysis can be applied to our existing life portfolios to stress test what our financial position would be.

COVID-19 and our model

It is important to remember that the model is not a predictive tool for the eventual costs of COVID-19 or any other pandemic, but is a tool to understand the impact of certain scenarios on our financial strength.

Going forward, the huge influx of knowledge that we acquired in 2020 will flow into the model, allowing for further refinements. For example, we are now much more aware of the potential economic impact from lockdowns and the accumulation potential from business interruption.

These factors are being incorporated into our model as part of its ongoing evolution. This will allow us to better understand the possible impact of future pandemics.

Our COVID-19 pandemic research drives value for our clients

Swiss Re Institute's Chief Research Officer Christoph Nabholz is one of the experts engaged in helping our clients learn about the COVID-19 pandemic and ensuring our research keeps us abreast of developments.

Christoph Nabholz

Chief Research Officer, Swiss Re Institute

We knew, in general terms, that a pandemic would cause economic fallout, but the scale of the global containment measures due to COVID-19 was unprecedented and therefore we needed to accelerate our research.

Swiss Re Institute took early steps to make sure we had the data and resources to report on the true scale of the pandemic in a highly connected world. We took steps to secure access to reliable data on critical areas, such as the virus’s lethality, and the impact on both our business and that of our clients.

Demand has been strong. Since our business is based on understanding our clients’ needs, much of our team’s energy has been spent on gauging the right kind of expertise and information needed by different clients at different times.

Reaching out and talking to our clients through digital channels helped us to maintain a continuous dialogue despite the social distancing restrictions. In fact, in Asia alone, we connected with over 9 000 clients through our webinars.

Clearly, we cannot stop learning. We know that a global pandemic is a one-in-30-year event, so clearly ongoing research, monitoring and preparation are essential. It is also vital that we incorporate the learnings – such as the economic impact of lockdowns – into our financial models and underwriting tools. We need to look at technical issues such as contract wordings. We also have to continue to develop the best possible risk management solutions to ensure the impact of a future pandemic is minimal and to partner with our clients. Only then can we be sure our underlying business is more resilient to future pandemics.

Christoph Nabholz

Chief Research Officer, Swiss Re Institute

Swiss Re joins The Trinity Challenge

The Trinity Challenge is a knowledge-transfer partnership that enables us to better prepare for the next pandemic. Find out why we joined this global coalition and how we are contributing.

In October 2020, Swiss Re became part of The Trinity Challenge, a global coalition that aims to better predict and prevent disease outbreaks by harnessing the power of data and analytics.

Swiss Reʼs participation is based around the Risk Resilience Center, developed in partnership with leading big data analytics company Palantir Technologies.

This Risk Resilience Center is the world’s richest COVID-19 data platform. It integrates publicly available global data from more than 100 sources.

The Trinity Challenge participants thereby have the tools to analyse pandemics and prepare possible responses to mitigate their impact.

By contributing to The Trinity Challenge, we are joining a coalition of leaders across the academic, non-profit and private sectors, including Google, Microsoft, McKinsey & Company, the Bill & Melinda Gates Foundation, the University of Cambridge and Imperial College London.

Having access to this wealth of data and analytics creates a tremendous opportunity for academics, researchers and analysts. It provides the basis for new modelling, groundbreaking analyses and actionable solutions.

Dame Sally Davies

Master of Trinity College Cambridge