- A message from Moses Ojeisekhoba

- Swiss Re partners to transform automotive insurance

- Swiss Re and Daimler launch online motor insurance company Movinx

- Partnering with our client against diabetes

- How our tech-driven partnerships help close the health insurance gap

- Andreas Schertzinger on how iptiQ is growing into P&C

How can partnerships help us close protection gaps?

Partnerships give us the means to assess the risk landscape, explore the future of risk coverage and drive forward industry change. The most successful journeys are the ones that we take together with our partners: clients, companies, academic institutions and sovereigns.

In this section, we look at how our partnerships help us to tackle the big industry challenges and find solutions that enable societies to become more resilient together.

- - A message from Moses Ojeisekhoba

- - Swiss Re partners to transform automotive insurance

- - Swiss Re and Daimler launch online motor insurance company Movinx

- - Partnering with our client against diabetes

- - How our tech-driven partnerships help close the health insurance gap

- - Andreas Schertzinger on how iptiQ is growing into P&C

You can only move forward when you move together. Working with our partners, we build new relationships and co-create new solutions.

Moses Ojeisekhoba

Chief Executive Officer Reinsurance

Ever since its inception, Swiss Re has been centred around partnerships – many of which have endured over generations.

We are proud that several of our innovations today are linked to these ongoing collaborations. It is no coincidence, for example, that our ground-breaking work on diabetes management in 2020 was undertaken with one of our strongest long-term partners in the UK.

Today, we are also building partnerships with a wider range of businesses – from retailers and car manufacturers to software companies. Many of these partnerships centre around the incorporation of new technologies. This enables us to develop new products, allowing our partners to confidently provide the best possible insurance solutions to their customers.

In this way, we collectively unlock new business models across the industry, push the boundaries of insurance and close protection gaps.

Swiss Re partners to transform automotive insurance

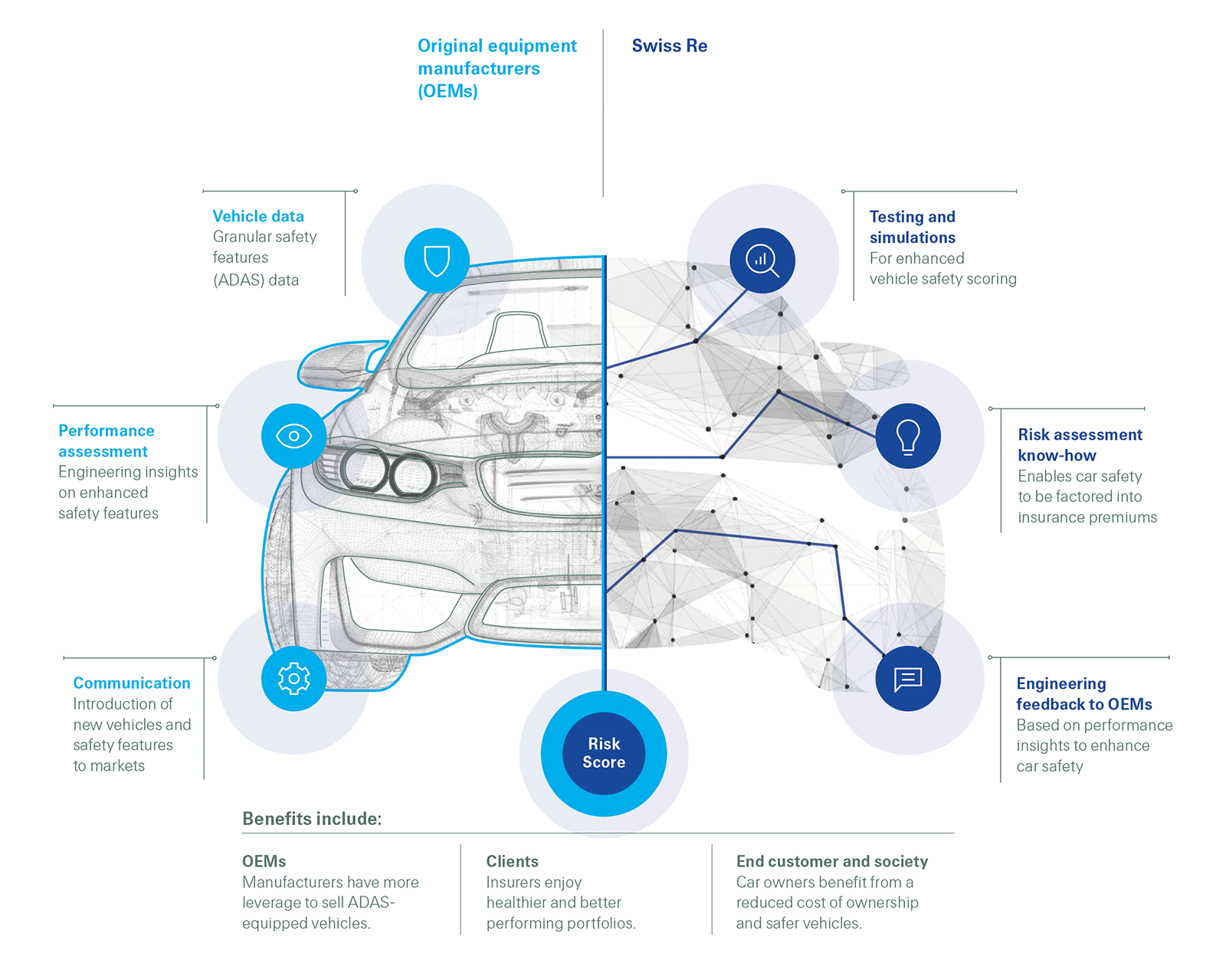

In 2019, we launched the ADAS Risk Score, a new vehicle-specific insurance rating, with BMW Group. We took this a step further in 2020 by partnering with Toyota Insurance Services. Find out how this innovative solution benefits manufacturers, clients and society overall.

On the road to successful risk scoring

Vehicles equipped with Advanced Driver Assistance Systems (ADAS) help drivers to more easily avoid accidents. This should lead to more accurate insurance premiums for car owners. However, until recently, insurers had no way of knowing which vehicles were equipped with which safety features.

With the ADAS Risk Score, primary insurers worldwide can calculate insurance premiums for selected vehicles while taking the safety of driver assistance systems into account. Put simply: drivers can benefit from a reduced cost of ownership and safer vehicles; manufacturers can more easily sell ADAS-enabled vehicles; and our clients, the car insurers, can enjoy healthier and better performing portfolios.

Swiss Re intends to integrate other major car brands into the ADAS platform, creating an industry standard for motor insurance.

Swiss Re and Daimler launch online motor insurance company Movinx

In October 2020, Swiss Re and Daimler Insurance Services jointly launched a new insurance company, Movinx, to cater to the changing needs of car manufacturers and customers. The aim is to enable Mercedes-Benz customers to conveniently purchase and manage motor insurance products online that are specifically tailored to their automobile model and usage type. For instance, the products are being developed based on characteristics such as a vehicleʼs safety features or whether an automobile will be owned or shared.

Sebastiaan Bongers

Managing Director, Chief Product Officer, Movinx

Andreas Roth

Managing Director, Chief Financial Officer, Movinx

We have a strong joint vision to transform motor insurance.

Andreas Roth

Sebastiaan Bongers: With the rise of e-mobility, automated driving and more flexible car usage, the automotive sector is undergoing a significant transformation. Our aim is to create a new international insurance intermediary where product development, pricing, marketing and servicing are closely aligned with the changing needs of car manufacturers and customers.

Andreas Roth: Daimler was looking for a solid partner to create a new insurance set-up. Its vision requires launching innovative insurance products across the globe – at high pace and frequency. To make that easier, we created Movinx in partnership with Swiss Re, so that Daimler only has to discuss its needs and ideas with one partner (Movinx). We jointly develop the customer journey and Movinx takes care of the insurance components such as the product development.

Andreas Roth: The openness and close collaboration is what really impressed me. We have a strong joint vision to transform motor insurance.

Andreas Roth: Due to COVID-19, Daimler and Swiss Re had a long-distance relationship. So, we had to be organised about exchanging information and ideas.

Sebastiaan Bongers: The other challenge was building a scalable global proposition right from the beginning.

Andreas Roth: We are not just another white-label programme. Movinx is unique because it involves a strategic alliance between Daimler and Swiss Re that is purely dedicated to the new automotive and mobility era of connected, autonomous, shared and electric vehicles. The Movinx strategy is to eventually expand in order to form a closer and stronger cooperation between the wider insurance and automotive industry.

Sebastiaan Bongers

Managing Director, Chief Product Officer, Movinx

Andreas Roth

Managing Director, Chief Financial Officer, Movinx

We have a strong joint vision to transform motor insurance.

Andreas Roth

Partnering with our client against diabetes

Type 2 diabetes is one of the major global health concerns. However, it can be managed and prevented. Gro Health is an innovative app with a successful track record for improving health and putting diabetes into remission. In 2020, we piloted Gro Health with Aviva’s employees. This is what we learned:

The incidence of type 2 diabetes is growing in the UK, with the number of people suffering from the condition set to grow to 4.5 million by 2025.

Gro Health is an app that helps people change their behaviour regarding nutrition, fitness, sleep and mental well-being. The user-friendly platform includes coaching, exercises and diet plans, among many other features.

Building a long-term partnership

We piloted Gro Healthʼs Low Carb Programme with Aviva employees via their MyAviva wellness app. During the scheme, the employees followed Gro Health’s diet and exercise plans and then provided feedback on their experiences.

More than 260 employees joined the pilot and the results were very positive. For instance, weight reduction was recorded by over a quarter of the participants. The app also received a very high satisfaction rating from its users.

Adapting to COVID-19

COVID-19 caused only minimal disruption to the pilot. Gro Health even introduced lockdown-specific content such as indoor workouts and mindfulness exercises, which had a positive effect on uptake.

Opportunity for growth

In addition to supporting Aviva’s employees, the pilot has given us insights into how we can develop other diabetes solutions. Growth opportunities are not limited to the UK. We are already seeing opportunities to offer this solution in several key global markets and also within different client segments.

Benefits of the industry

With one in 11 adults globally suffering from diabetes, rolling out more programmes such as this will likely benefit insurers by reducing the frequency and cost of claims – and, even more importantly, help improve the lives of millions of people around the globe.

How our tech-driven partnerships help close the health insurance gap

Our partners provide the technology and consumer outreach to bring large numbers of people within the insurance safety net. Here are two examples:

In 2019, Swiss Re entered into a strategic partnership with JD Technology Group, a business group under the Chinese company JD.com.

The partnership focuses on providing industrial enterprises, financial institutions and governments with technological products and solutions, including the application of insurtech in the area of life and health insurance.

In 2020, the partnership led to the launch of a simplified health product. Based on a co-created risk selection process, the product covers 15 critical diseases for children from birth to 17 years of age.

Verily is a subsidiary of Alphabet that focuses on making health data useful so that people can enjoy healthier lives. Its tools and devices collect, organise and activate health data, and enable appropriate measures to prevent and manage disease.

Swiss Re Corporate Solutions and Verily have partnered to form Granular Insurance. The company’s first solution to enter the market will help self-funded employers to manage their healthcare costs through an innovative stop-loss product. This product reimburses employers for claims above a defined amount and therefore allows them to protect themselves from unexpected and large employee health benefit claims.

Andreas Schertzinger on how iptiQ is growing into P&C

Originally launched as a white-label insurance platform for new life and health distributors, iptiQ significantly grew its new property and casualty business in 2020. Andreas Schertzinger takes us through how he led this work in EMEA and explains the real value of iptiQ.

Andreas Schertzinger

CEO, iptiQ P&C EMEA

iptiQ’s end-to-end technology gives new partners everything they need to enter into insurance. It is also useful for insurers to extend their reach into new products and distribution channels.

iptiQ is set to become a growth engine for Swiss Re. In 2020, we reached USD 370 million in gross premiums written, with a 70% annual growth rate since 2017. Our implied market valuation is USD 2 billion, making it a very exciting business.

iptiQ P&C onboarded six new distribution partners across Europe in 2020, offering a variety of products from cyber to motor to home insurance. It’s early days, but judging by the calibre of our partners, we’re on the right track.

Simplicity. iptiQ makes insurance easy for companies, who in turn make it easier for their customers. We offer a technological platform from which to underwrite and administer business and manage claims. We also provide services such as behavioural economics to design a great customer journey.

Given our global footprint, we help distributors with local issues, such as specific product requirements or accessing local insurance partners to support them.

Visit www.iptiq.com

Andreas Schertzinger

CEO, iptiQ P&C EMEA