Swiss Re at a glance

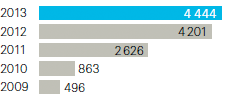

Net income

(USD millions)

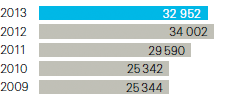

Shareholders’ equity

(USD millions)

Proposed dividend per share for 2013 (CHF)*

3.85

(CHF 3.50 for 2012)

* Swiss withholding tax exempt distribution out of legal reserves from capital contributions.

4.15

Proposed special dividend per share for 2013 (CHF)*

* Swiss withholding tax exempt distribution out of legal reserves from capital contributions.

Financial highlights

For the twelve months ended 31 December

| Download |

|

USD millions, unless otherwise stated |

2012 |

2013 |

Change in % |

||||

|

|||||||

|

Group |

|

|

|

||||

|

Net income attributable to common shareholders |

4 201 |

4 444 |

6 |

||||

|

Premiums earned and fee income |

25 446 |

28 818 |

13 |

||||

|

Earnings per share in CHF |

11.13 |

12.04 |

8 |

||||

|

Shareholders’ equity |

34 002 |

32 952 |

–3 |

||||

|

Return on equity1 in % |

13.4 |

13.7 |

|

||||

|

Return on investments in % |

4.0 |

3.6 |

|

||||

|

Number of employees2 (31.12.2012/31.12.2013) |

11 193 |

11 574 |

3 |

||||

|

|

|

|

|

||||

|

Property & Casualty Reinsurance |

|

|

|

||||

|

Net income attributable to common shareholders |

2 990 |

3 292 |

10 |

||||

|

Premiums earned |

12 329 |

14 542 |

18 |

||||

|

Combined ratio in % |

80.7 |

83.3 |

|

||||

|

Return on equity1 in % |

26.7 |

26.4 |

|

||||

|

|

|

|

|

||||

|

Life & Health Reinsurance |

|

|

|

||||

|

Net income attributable to common shareholders |

739 |

356 |

–52 |

||||

|

Premiums earned and fee income |

9 122 |

10 023 |

10 |

||||

|

Operating margin in % |

8.6 |

5.2 |

|

||||

|

Return on equity1 in % |

8.9 |

5.4 |

|

||||

|

|

|

|

|

||||

|

Corporate Solutions |

|

|

|

||||

|

Net income attributable to common shareholders |

196 |

279 |

42 |

||||

|

Premiums earned |

2 284 |

2 922 |

28 |

||||

|

Combined ratio in % |

96.2 |

95.1 |

|

||||

|

Return on equity1 in % |

7.4 |

9.6 |

|

||||

|

|

|

|

|

||||

|

Admin Re® |

|

|

|

||||

|

Net income attributable to common shareholders |

183 |

423 |

131 |

||||

|

Premiums earned and fee income |

1 705 |

1 330 |

–22 |

||||

|

Return on equity1 in % |

2.6 |

6.8 |

|

||||