Corporate Solutions

Strategy and priorities

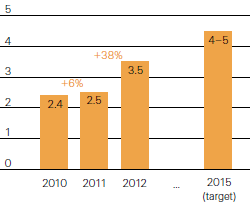

Corporate Solutions’ strategy is to serve large corporations as a lean global player. The product offerings range from traditional property and casualty insurance to customised solutions in innovative areas such as weather risk management. By executing this strategy, Corporate Solutions aims to increase its gross written premium net of intra-group transactions from USD 2.4 billion in 2010 to USD 4–5 billion by 2015.

Corporate Solutions stands out due to a unique combination of large net capacity and innovation capabilities, underpinned by disciplined cycle management and superior underwriting. These strengths give Corporate Solutions a clear advantage in specialised markets and allow it to move away from the pure commodity space. In 2012, Corporate Solutions structured the first insurance transaction for a Chinese hydropower company to provide coverage against the impact of low rainfall on power generation. The deal is a milestone in accessing the world’s largest hydropower market.

Corporate Solutions results

| Download |

|

USD millions |

2011 |

2012 |

Change in % |

|

Revenues |

|

|

|

|

Premiums earned |

1 929 |

2 284 |

18 |

|

Net investment income |

104 |

109 |

5 |

|

Net realised investment gains |

214 |

142 |

–34 |

|

Other revenues |

6 |

1 |

–83 |

|

Total revenues |

2 253 |

2 536 |

13 |

|

|

|

|

|

|

Expenses |

|

|

|

|

Claims and claim adjustment expenses |

–1 461 |

–1 448 |

–1 |

|

Acquisition costs |

–180 |

–300 |

67 |

|

Other expenses |

–442 |

–449 |

2 |

|

Interest expenses |

–2 |

0 |

–100 |

|

Total expenses |

–2 085 |

–2 197 |

5 |

|

|

|

|

|

|

Income before income tax expense |

168 |

339 |

102 |

|

Income tax expense |

–87 |

–143 |

64 |

|

Net income attributable to common shareholders |

81 |

196 |

142 |

|

|

|

|

|

|

Claims ratio in % |

75.7 |

63.4 |

|

|

Expense ratio in % |

32.2 |

32.8 |

|

|

Combined ratio in % |

107.9 |

96.2 |

|

Corporate Solutions regards talent management as a core growth enabler. Since early 2011 the Business Unit has been recruiting top local talent, providing customised training and job rotations. This investment, combined with strong customer centricity and a results orientation, is significantly contributing to Corporate Solutions’ competitive edge. Corporate Solutions is building a global office network to access risks which are placed locally while continuing to service business placed in wholesale centres such as London and Singapore. In 2012, Corporate Solutions opened offices in Amsterdam and Genoa and established a local office in Dubai to reach the Middle East and North Africa. By the end of 2012 Corporate Solutions had more than 40 offices in 17 countries.

Corporate Solutions’ annual survey with 1500+ responses from clients and broker partners revealed continuously improving satisfaction. In particular clients and brokers appreciate Corporate Solutions for its financial stability, client relationship and underwriting expertise.

Performance

Net income was USD 196 million in 2012, an increase of 142% compared to net income of USD 81 million in 2011. The result was primarily driven by profitable business growth. Hurricane Sandy had an estimated cost of USD 144 million for Corporate Solutions. In 2011, by comparison, there were more large losses in the year, most notably the Japan and New Zealand earthquakes, floods in Thailand and Australia, and a number of large fire losses. An increase in the tax rate also had a negative impact on the result.

Premiums

Gross written premiums

(in USD billions, net of intra-group transactions)

Gross written premium net of intra-group transactions increased 38% to USD 3.5 billion in 2012, compared to USD 2.5 billion in 2011. The exceptional growth experienced in 2012 is not expected to repeat in 2013, though the ambition to attain USD 4–5 billion of gross written premium by 2015 is clearly on track. Net premiums earned increased 18% to USD 2.3 billion in 2012, compared to USD 1.9 billion in 2011. The increase in premiums was driven by organic growth across all major lines of business.

Combined ratio

The combined ratio improved by 11.7 percentage points to 96.2% in 2012 from 107.9% in 2011. The quality of the book remained consistently high year on year and the large loss burden for 2012 was in line with expectations, compared to a higher than normal amount of large losses experienced in 2011. The expense ratio was largely flat at 32.8% in 2012, compared to 32.2% in 2011. Set-up costs related to business expansion neutralised the positive effect on the cost ratio from higher premium volumes.

The property combined ratio improved by 32.3 percentage points to 100.7% in 2012, reflecting significantly lower natural catastrophe losses.

The casualty combined ratio improved 12.6 percentage points to 91.7% in 2012, mainly due to the absence of large losses in 2012.

The credit combined ratio was 82.8% in 2012, compared to 57.8% in 2011, primarily driven by a single loss in Australia, a large profit commission effect related to a reinsurance contract and an increased allocation of operating expenses.

In other specialty, the combined ratio decreased slightly to 102.0% in 2012, compared to 103.3% in 2011. Both periods were impacted by satellite and marine losses.

Investment result

Return on investments decreased to 3.2% in 2012 from 4.5% in 2011. While net investment income was up slightly year on year primarily due to mark-to-market gains on indirect private equity positions, this was more than offset by lower realised gains on asset sales and the impact of lower yields. Realised insurance derivative gains (not included in return on investments) were down slightly at USD 55 million in 2012, compared to USD 60 million in 2011. These contracts offer protection against weather perils and other risks related to insurance, but are accounted for as derivatives.

Return on equity

Return on equity increased to 7.4% in 2012, compared to 3.7% in the prior year.

Total financial contribution

The total financial contribution (TFC) of Corporate Solutions accounts for business written within the Swiss Re Group and includes development of historical loss reserves remaining in Reinsurance for the combined ratio and return on equity, as well as related investment income and an additional USD 0.5 billion shareholders’ equity for return on equity. The combined ratio on the TFC basis was 69.6% and return on equity 25.8%.

Outlook

Corporate Solutions will continue its expansion in 2013 consistent with its strategy. The global upward trend in property lines is likely to be sustained, though differences in rate adequacy between geographies and segments will persist. Corporate Solutions is well positioned to capture opportunities thanks to its value proposition, strong balance sheet and expanding geographic reach.