2018 Key highlights

Expanding our global footprint

Throughout 2018, Swiss Re took steps to strengthen its position in Asia in particular. In January, it launched its regional headquarters in Singapore and appointed a new regional Board of Directors.

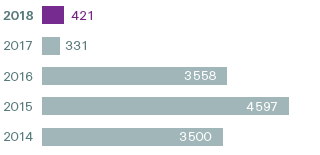

Net income

(USD millions)

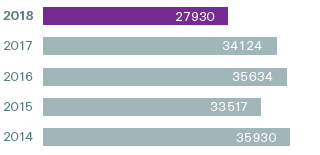

Shareholders’ equity

(USD millions)

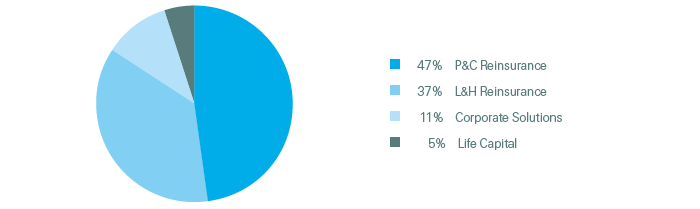

Net premiums and fees earned by business segment, 2018

Total: USD 34.5 billion

Seeking out new risk pools

In 2018, Swiss Re explored new potential risk pools, including research into new financial risks, algorithmic risk to business processing and various emerging cyber risks.

Strengthens commitment to promoting sustainability

Swiss Re continued and deepened its commitment to implementing policies that minimise sustainability risks. As of July 2018, the company ceased providing re/insurance to businesses with more than 30% exposure to thermal coal across all lines of business.

Proposed regular dividend per share for 2018

(CHF)

5.60

(CHF 5.00 for 2017)