Enhancement

Enhancement refers to the systematic integration of ESG criteria along the entire investment process, from Strategic Asset Allocation (SAA) to monitoring and reporting. Today, close to 100% of our SAA considers ESG aspects.

Based on our experience, including ESG criteria along the investment process makes economic sense, as it improves risk-adjusted return profiles and reduces downside risks, especially over the long term.

Swiss Re Asset Management invests in companies that are well-prepared for future sustainability challenges and opportunities, by taking into account their exposure and ability to manage underlying ESG risks.

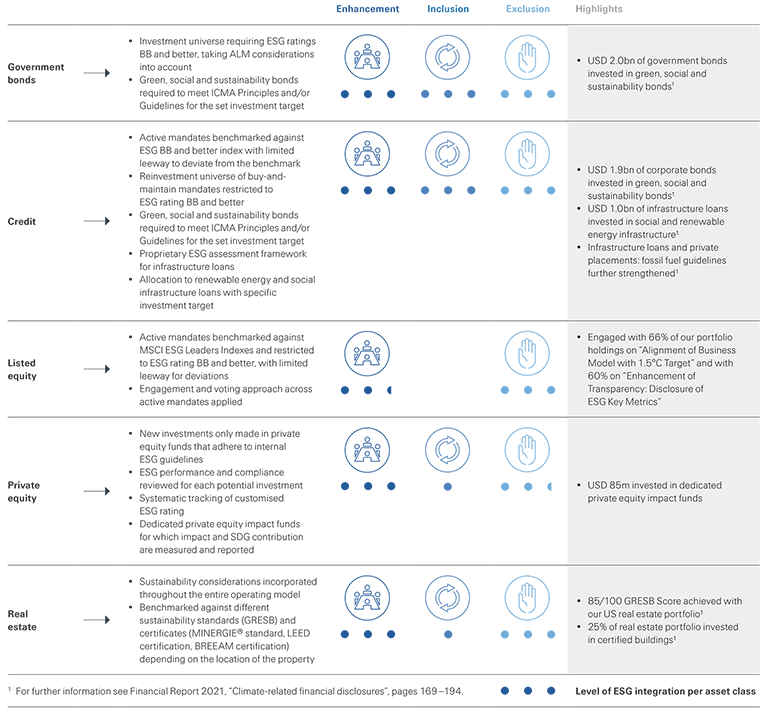

Overview of ESG considerations in Swiss Re's investment portfolio

We have been applying a minimum ESG rating threshold to sovereign, supranational and agency bonds for several years, where available. Any possible exception would be driven by ALM considerations, which are outlined above. In 2017, ESG benchmarks were implemented for our actively managed listed equity and corporate bond portfolios, with limited leeway given for deviations. If benchmarks are not applicable, a minimum ESG rating threshold is applied to our mandates, such as the buy-and-maintain corporate bond mandates (see overview above and, for more details “Minimum ESG rating thresholds”).

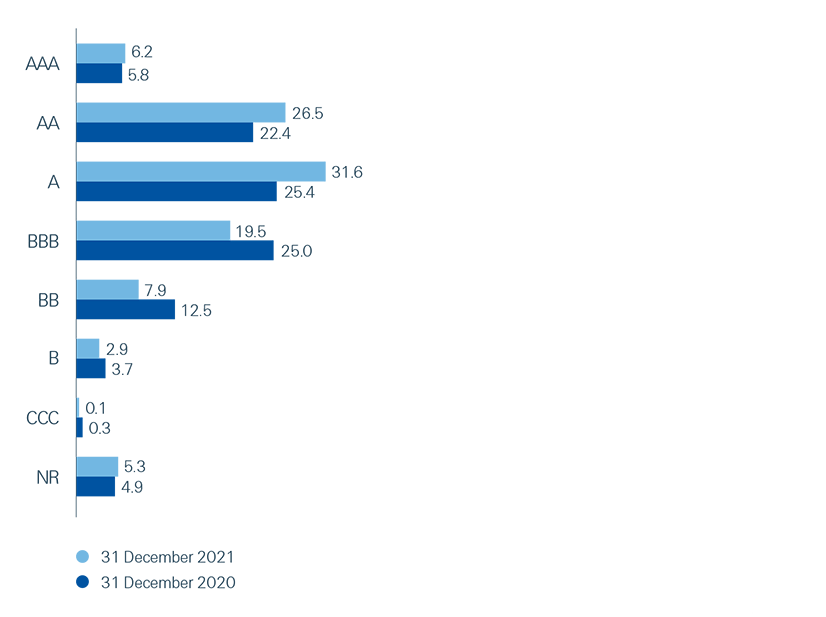

By consistently applying these prerequisites, we were able to further improve the ESG profile of our investment portfolio throughout the year, as shown in the graph below.

ESG rating distribution across our corporate bond and listed equity portfolio in %

For our real estate portfolio, we benchmark our US investments against GRESB, an industry-driven organisation sharpening the way capital markets assess the ESG performance of real assets. In 2021, our US portfolio outperformed the GRESB average of 73/100 with a score of 85/100.

At the end of 2021, approximately 40% of our investment portfolio was managed externally, and 97% of those assets were managed by signatories to the Principles for Responsible Investment (PRI).

An important part of our Enhancement cornerstone is our approach as an active shareholder, which we describe in the “How we engage”.