- Home

- Sustainability

- Investment

- How we engage

How we engage

Stewardship

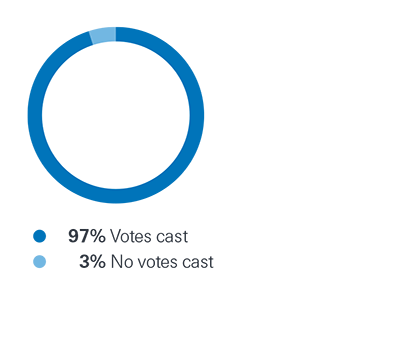

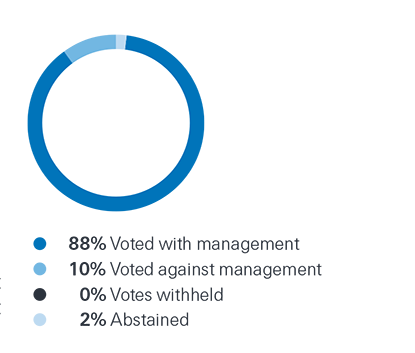

In 2021, 97% of our voting rights of our listed equity assets were exercised. Our external managers voted on 5 366 voting items on our behalf. They voted in line with the respective management resolution recommendation in 4 721 cases (88%) and against it in 535 cases (10%). In 107 cases (2%), they abstained from voting. The remaining votes were withheld.

In addition to shares in listed companies, investments in our equity portfolio include equity exchange-traded funds (ETFs). The fund managers cast votes on these ETFs in line with their own voting policies and processes.

Our voting activities in 2021

Our voting behaviour in 2021

We believe that engagement with the real economy is an integral part of our contribution to limiting global warming to 1.5°C. In line with our commitment to achieve a net-zero investment portfolio, we therefore implemented our own Engagement Framework in 2020. It is designed to support our investee companies in strengthening their business performance and achieving shared long-term responsible investing goals. We work closely with the investment managers of our active listed equity mandates to execute this framework for our portfolio companies in order to further integrate sustainability and, in particular, climate change considerations into investment portfolios.

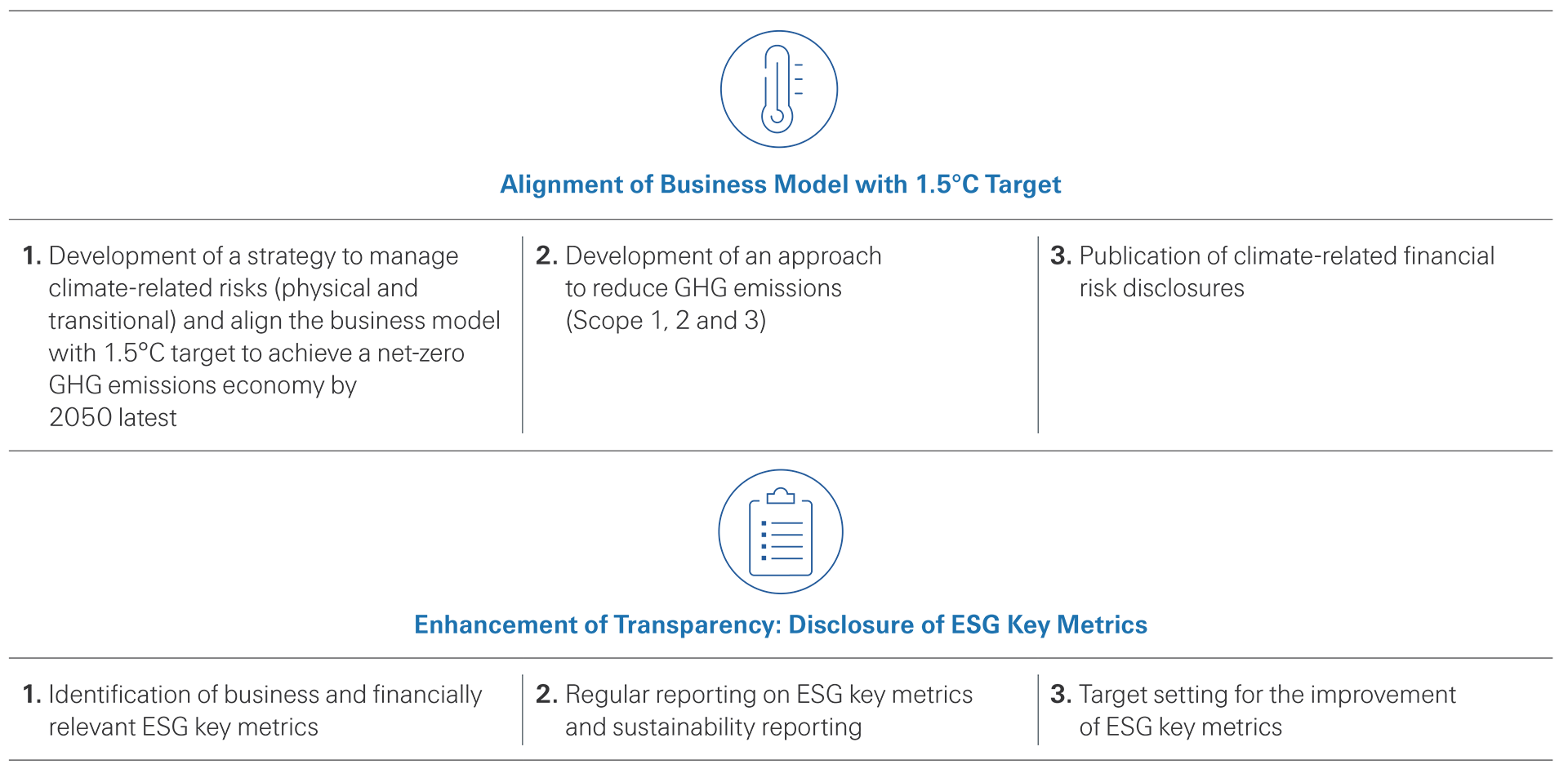

Our engagement topics

We have set targets for engagement frequency and desired outcomes. To monitor the real-world impact of our Engagement Framework in a structured way, our investment managers need to report the level of progress as well as highlights of their engagement activities back to us. The framework also takes into account regulatory requirements such as the Shareholder Rights Directive 2017/828 (SRD II).

The framework comprises two engagement topics, “Alignment of Business Model with 1.5°C Target” and “Enhancement of Transparency: Disclosure of ESG Key Metrics”, each covering three specific focus areas as shown in the illustration above.

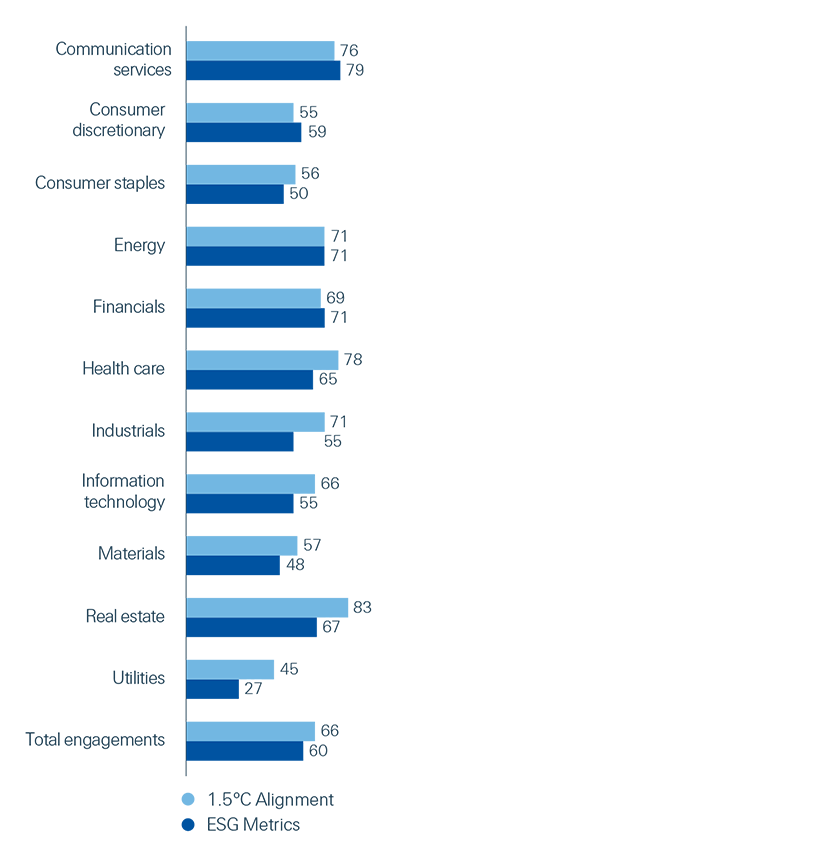

The second year of applying the framework showed encouraging results. In 2021, our investment managers engaged with 66% of our mandate holdings (around 390) on the first topic and with 60% on the second topic. Additionally, according to our investment managers’ reporting, on average 29% of our portfolio companies had already implemented at least one of the focus areas under the first topic. On average, 47% take into account at least one of the focus areas outlined under the second topic.

Through our dedicated climate action, we are working to achieve a net-zero emissions investment portfolio by 2050, setting intermediate targets every five years and regularly reporting on progress. As part of that, we set a carbon intensity reduction target of –35%¹ for our corporate bond and listed equity portfolio to be met by 2025, with base year 2018.

One of the ways in which we aim to achieve this target is by putting specific emphasis on engaging with companies that have a carbon footprint above the aspired intensity level. Additionally, 65% of the top 20 emitters in our listed equity portfolio were engaged throughout the year.

Engagement activities per sector in %

To promote sustainable value creation, consistent and relevant company-level consideration of and reporting on financially relevant ESG matters is vital. It enhances transparency, thus enabling investors to perform a comprehensive assessment of potential underlying sustainability risks. We therefore encourage engagement with investee companies on this matter through our second topic “Enhancement of Transparency: Disclosure of ESG Key Metrics”. In 2021, the investment managers engaged with more than 70% of our investee companies with an MSCI ESG rating of BB and lower. With our restrictions to ESG BB and better, with limited leeway for deviations for active listed equity mandates, such companies only account for a small share of our portfolio.

Promoting responsible investing

Further shifting the large institutional asset base of USD 80+ trillion towards sustainable investments would have an amplifying effect on making the world more resilient. We therefore not only collaborate with our investee companies but also with other key stakeholders to advance this process.

As a founding member of the UN-convened Net-Zero Asset Owner Alliance (AOA), Swiss Re was represented by our Chief Investment Officer in the inaugural Alliance’s Steering Group. Additionally, we co-led the development of the AOA’s first Target Setting Protocol, which was released in 2021 and supports the setting of targets to be achieved by 2025. We also co-led the development the AOA’s first progress report. It summarises the actions, activities and achievements of the AOA and its members since the organisation’s establishment in September 2019 and was released shortly before COP26.

In 2021, we launched the publication “Responsible Investments – Our roadmap to net zero”, to illustrate how we address climate change in our investment process, and outline the key lessons learned and challenges faced. By sharing insights from our journey of reducing GHG emissions and financing the transition to a low-carbon economy, we want to help strengthen the collaboration needed to achieve a 1.5°C world.

In this context, Swiss Re has actively promoted the transition to net-zero emissions by participating in several COP26 side events, such as a panel on Driving Net Zero Finance Integrity, hosted by the Climate Policy Initiative, UNEP FI and the 2° Investing Initiative. This complemented our other activities throughout the year, which included speaking on several panels.

As part of relevant industry organisations such as the Swiss Insurance Association and Swiss Sustainable Finance, we advise on sustainable financial market developments in Switzerland. We are also in an ongoing dialogue with other industry participants to foster greater appreciation of responsible investing as an investment approach.

We first formalised our commitment to responsible investing in 2007 by signing the Principles for Responsible Investment (PRI). Due to a further reassessment of the questionnaire by PRI, the assessment results for 2021 will not be published before the second quarter of 2022.

To share knowledge on responsible investing within Swiss Re, we offer all employees various ESG training opportunities that support consistent know-how across the Group. In addition, we provide regular updates on key developments in Responsible Investing to our senior leadership, for example through the Asset Management Investment Committee, and to our Board of Directors Investment Committee.

- Covering Scope 1 and 2 emissions.