impact

solutions

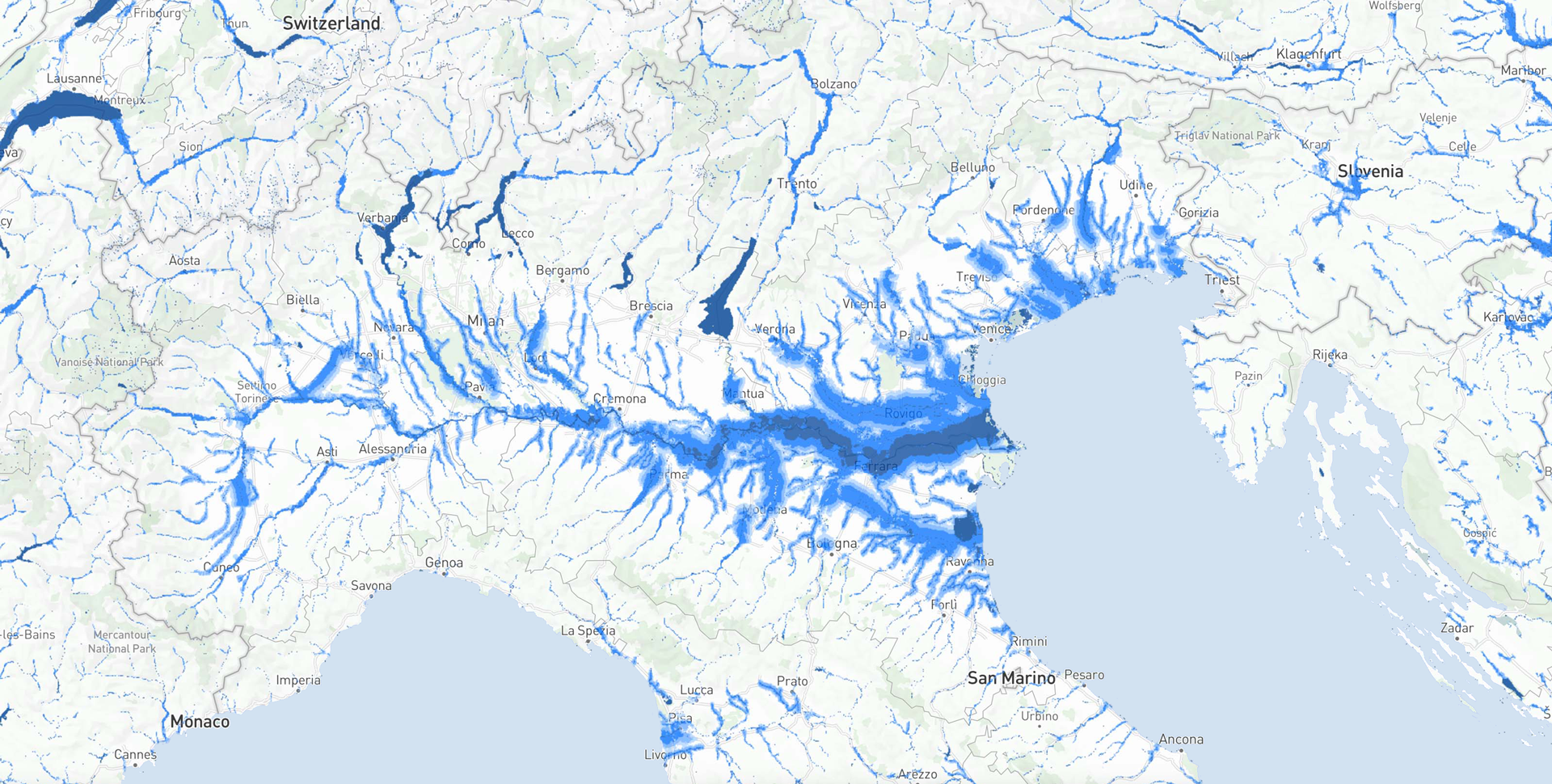

This image shows satellite data captured by Swiss Re's partner ICEYE following significant flooding around the town of Kempsey in eastern Australia in 2021. The highly granular flood data provided the insights for Swiss Re’s experts to deliver an initial risk assessment for clients within just three days.

Source: ICEYE, Google maps.

- Home

- Strategy in action

- Risk insights

The data revolution: Creating value from risk insights

Swiss Re’s risk insights fuel the models and tools that underwriters use to assess risk, write profitable business and enable cutting-edge, innovative risk solutions. Given the complexity and size of the modern global risk pool, a high-tech approach to claims and underwriting is essential. Satellite imagery and data is an important part of Swiss Re’s quest to lead a data-driven revolution for insurance.

Orbiting 500 kilometres above the earth’s surface, Swiss Reʼs partner ICEYE, a Finnish microsatellite manufacturer, has a fleet of suitcase-sized satellites collecting real-time data on the behaviour of water and the earth’s surface.

Using advanced radar-based technology, these satellites can peer through cloud cover, volcanic ash and even the most violent of hurricanes to measure how floods and other natural catastrophes are impacting specific regions as they occur.

The data-driven revolution is already yielding results for Swiss Reʼs clients. In March 2021, for example, Swiss Re used satellite images of large-scale flooding in Eastern Australia to provide clients with a damage assessment of the emergency.

This work combined a satellite data analysis of the depth of the flood water with an in-depth portfolio analysis of the insured risks in the affected area. Without needing to access the flood region, Swiss Reʼs experts could accurately calculate the impact across clients’ portfolios.

This analysis took three days. Previously, the process would have taken months, with experts needing to first gain access to the region before conducting lengthy assessment processes.

ICEYE is just one cutting-edge data partner working with Swiss Re to develop new products and services. For example, together with Dutch satellite data provider, VanderSat, Swiss Re has developed drought covers based on satellite measurements of soil moisture. Another initiative includes livestock protection based on publicly available satellite data in Kenya.

CatNet® and climate solutions

Swiss Re’s flagship underwriting platform CatNet® is the backbone of the companyʼs natural catastrophe risk business. This platform is an online atlas that allows insurance experts to understand exposure to a variety of natural catastrophe hazards anywhere in the world.

In 2021, CatNet® was upgraded to provide even more accurate real-time insights into natural catastrophe risks such as floods, storms and earthquakes. With the latest upgrades to CatNet® Premium, clients can upload 10 000 single locations to give them a customised view of their global portfolios. This makes it one of the richest and most versatile climate risk insight platforms in the re/insurance industry.

A further specialised offering from Swiss Re Corporate Solutions is the Climate Risk Score, which allows companies to assess the impact of physical climate risk on their portfolios. The tool combines forward-looking climate data with known risk zones to create a high-resolution assessment of climate risk on a companyʼs assets. Advice on mitigation techniques and risk transfer options are offered as part of the Climate Risk Score solutions suite.

Mitigation as a risk service

In recent years, many governments and their agencies have drawn on Swiss Reʼs risk knowledge to better prepare for disasters and develop strategies to minimise the impact of natural catastrophes.

This work has a rich history beginning with the ground-breaking “Economics of Climate Adaptation” methodology from 2009, which laid out an approach for calculating the cost efficiency of climate mitigation measures.

In 2021, Swiss Re could draw on this experience to support the mitigation of bushfire losses for AusNet Services, which operates electricity networks in some of the most bushfire-prone areas of Australia.

The energy and utilities sector is highly exposed to wildfire losses. In one case, a Californian energy company was driven into bankruptcy following more than USD 15 billion of losses resulting from wildfire liability claims.

After the Australian bushfires in the summers of 2019 and 2020, AusNet wanted to better understand the key risk drivers of bushfire, including the impact of climate change on this peril.

Swiss Reʼs team drew on its risk insights from related work in California as well as its expertise on the climate science behind increasing wildfire risks.

Swiss Re recommended a host of mitigation measures, as well as novel risk transfer possibilities for AusNet to explore, particularly around the latest technologies such as drone and satellite imagery, as well as making use of insurance-linked securities.

Stronger business

A high-tech, data-driven and scientific approach to claims and underwriting is critical for the future of the insurance industry. This is especially so in areas such as urbanisation or changing social liability trends where historical data may not give an accurate picture of the current vulnerability of a certain risk.

As a result, Swiss Reʼs underwriting teams continue to push for rich data sources that can improve their risk knowledge. In many cases, the teams need to think outside of the box. Swiss Reʼs Biodiversity and Ecosystem Services Index, for example, maps the economic decline of reduced biodiversity. This data now feeds directly into CatNet®.

Swiss Reʼs Casualty Research and Development team have also been tracking the spend of US law firms and incorporating this data into forward-looking casualty models for liability business.

Whether powered by a suitcase-sized satellite or via public data sources, Swiss Reʼs risk insights keep us at the forefront of the re/insurance industry, driving innovation and supporting underwriting across Swiss Reʼs entire portfolio.