Swiss Re Institute’s work centred on assessing the so-called technical profitability of the business. In simple terms, this is whether the pricing for a portfolio of risk is enough to cover the claims, capital costs and operating expenses that come from the business.

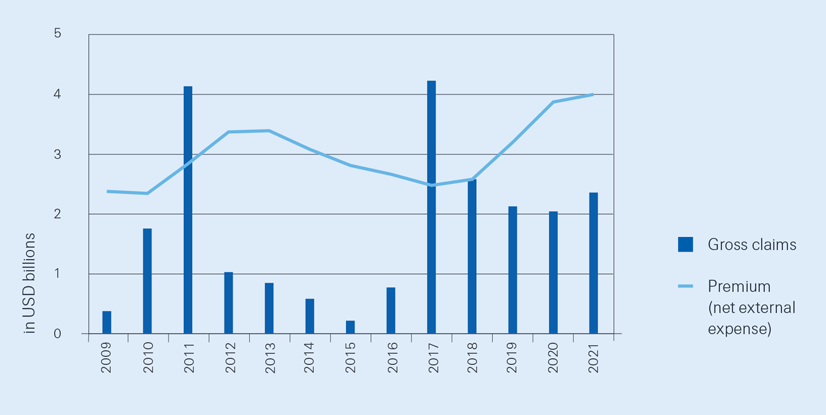

The analysis focused on the 13 years from 2009 to 2021, where the underlying data was comparable and robust. In this period, the premium income for climate-driven natural catastrophe business was adequate to cover claims in 11 of those years.

There were two extraordinary years when claims exceeded premiums during that period. One was in 2011, when there was extensive flooding in Thailand and Australia, an earthquake in New Zealand and an earthquake and tsunami in Japan. The second was in 2017, when hurricanes Harvey, Irma and Maria occurred, as well as Cyclone Debbie, wildfires in California and an earthquake in Mexico. Both years resulted in claims of more than USD 4 billion each.

When considering the entire 13-year period, the analysis showed that profits from the natural catastrophe book remained strong. Over the period, Swiss Re paid out more than USD 23.6 billion in natural catastrophe claims. However, the Group’s risk insights, reflected in its pricing approach, allowed Swiss Re to absorb those claims and achieve a technical underwriting margin of USD 16.4 billion.

Providing accurate underwriting is critical for Swiss Re to support clients and deliver returns to shareholders. Risk modelling for natural catastrophe risks is becoming broader and more sophisticated, with a data-driven approach that builds on vast and constantly updated data sets. Ongoing analysis helps to identify long-term trends that are often masked by high volatility across single years. In-depth risk insight is also instrumental in helping Swiss Re grow its property insurance book, which is the main driver for Swiss Re’s natural catastrophe business.

The business opportunity is there: over the next 20 years, Swiss Re Institute estimates that property insurance premium globally will triple to USD 1.3 trillion. Swiss Re’s underwriting provides an excellent basis to continue as the world’s leading reinsurer for climate-related natural catastrophe risks.