Significant shareholders and shareholder structure

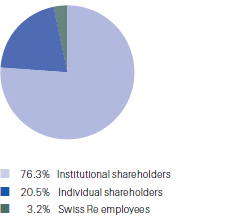

Registered shareholders by type

as of 31 December 2012

Under the Swiss Federal Act on Stock Exchanges and Securities Trading (SESTA), anyone holding shares in a company listed on the SIX Swiss Exchange is required to notify the company and the SIX Swiss Exchange if their direct or indirect holding reaches, falls below or exceeds the following thresholds: 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights entered into the commercial register, whether or not the voting rights can be exercised. Notifications must also include financial instruments, regardless of whether cash or physically settled, constituting a purchase or a sale position. Upon receipt of such notifications, the company is required to inform the public. The following table provides a summary of the current disclosure notifications. In line with the SESTA requirements, the percentages indicated were calculated in relation to the share capital reflected in the commercial register at the time of the respective notification.

Significant shareholders

| Download |

|

Shareholder1 |

Number of |

% of voting rights and share capital |

Creation of the obligation to notify | ||

| |||||

|

Franklin Resources, Inc. |

18 277 452 |

4.93 |

2 August 2012 | ||

|

Dodge & Cox |

12 639 368 |

3.48 |

10 June 2011 | ||

|

MFS Investment Management |

11 485 890 |

3.16 |

10 June 2011 | ||

|

Berkshire Hathaway Inc. |

11 262 000 |

3.10 |

10 June 2011 | ||

|

BlackRock, Inc. |

11 134 246 |

3.09 |

26 September 2011 | ||

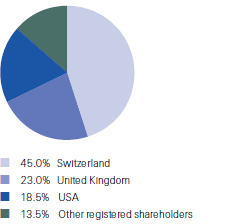

Registered shareholdings by country

as of 31 December 2012

In addition, Swiss Re Ltd and Group companies held, as of 31 December 2012, directly and indirectly, 27 560 372 shares, representing 7.4% of voting rights and share capital. Neither the company nor the Group companies can exercise the voting rights of the own shares they hold themselves. All notifications received in 2012 are published at Disclosure of shareholdings and at Major shareholders.

Shareholder structure

Registered – unregistered shares

| Download |

|

As of 31 December 2012 |

Shares |

in % | ||

| ||||

|

Shares registered in the share register1 |

199 866 789 |

53.9 | ||

|

Unregistered shares1 |

143 279 770 |

38.7 | ||

|

Shares held by Swiss Re |

27 560 372 |

7.4 | ||

|

Total shares issued |

370 706 931 |

100.0 | ||

Registered shares with voting rights by shareholder type

| Download |

|

As of 31 December 2012 |

Shareholders |

in % |

Shares |

in % |

|

Individual shareholders |

52 073 |

88.7 |

40 947 141 |

20.5 |

|

Swiss Re employees |

3 428 |

5.8 |

6 415 572 |

3.2 |

|

Total individual shareholders |

55 501 |

94.5 |

47 362 713 |

23.7 |

|

Institutional shareholders |

3 221 |

5.5 |

152 504 076 |

76.3 |

|

Total |

58 722 |

100.0 |

199 866 789 |

100.0 |

Registered shares with voting rights by country

| Download |

|

As of 31 December 2012 |

Shareholders |

in % |

Shares |

in % |

|

Switzerland |

53 231 |

90.7 |

89 938 981 |

45.0 |

|

United Kingdom |

594 |

1.0 |

45 958 094 |

23.0 |

|

USA |

436 |

0.7 |

37 041 441 |

18.5 |

|

Other |

4 461 |

7.6 |

26 928 273 |

13.5 |

|

Total |

58 722 |

100.0 |

199 866 789 |

100.0 |

Registered shares with voting rights by size of holding

| Download |

|

As of 31 December 2012 |

Shareholders |

in % |

Shares |

in % |

|

Holdings of 1 – 2 000 shares |

53 453 |

91.0 |

22 200 855 |

11.1 |

|

Holdings of 2 001 – 200 000 shares |

5 171 |

8.8 |

48 985 559 |

24.5 |

|

Holdings of > 200 000 shares |

98 |

0.2 |

128 680 375 |

64.4 |

|

Total |

58 722 |

100.0 |

199 866 789 |

100.0 |

Cross-shareholdings

Swiss Re has no cross-shareholdings in excess of 5% of capital or voting rights with any other company.