Compensation decisions for the Group EC

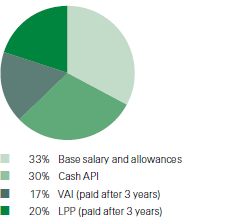

Compensation mix for Group EC 2011

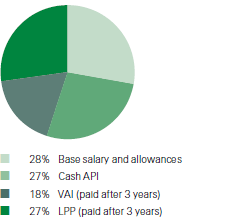

Compensation mix for Group EC 2012

The variable compensation awarded to all members of the Group EC (including the Group CEO) totalled CHF 33.2 million for 2012, compared to CHF 21.2 million in 2011. Reflecting its new corporate structure and operating model, Swiss Re further strengthened its Group EC in 2012. Four additional members were appointed to the Group EC in 2012, taking up the newly created positions of Regional President (one each for the Americas, Asia, and EMEA region) and of Group Chief Strategy Officer. The following table covers payments to sixteen members for 2012, of whom seven were employed for the full year. The 2011 payments cover nine members, of whom eight were employed for the full year.

| Download |

|

|

9 members |

16 members | ||||||||||

|

CHF thousands |

2011 |

2012 | ||||||||||

| ||||||||||||

|

Base salary and allowances1 |

10 687 |

12 985 | ||||||||||

|

Funding of pension benefits |

1 397 |

1 656 | ||||||||||

|

Total fixed compensation |

12 084 |

14 641 | ||||||||||

|

Cash Annual Performance Incentive2 |

9 573 |

12 394 | ||||||||||

|

Value Alignment Incentive (VAI) |

5 378 |

8 359 | ||||||||||

|

Long-term Incentives (LPP)3 |

6 250 |

12 400 | ||||||||||

|

Total variable compensation |

21 201 |

33 153 | ||||||||||

|

Total fixed and variable compensation4 |

33 285 |

47 794 | ||||||||||

|

Compensation due to members leaving |

1 448 |

2 268 | ||||||||||

|

Total compensation5 |

34 733 |

50 062 | ||||||||||

Compensation decisions for the Group CEOs

Stefan Lippe, Group CEO from February 2009 until January 2012

Michel M. Liès, Group CEO since February 2012

| Download |

|

CHF thousands |

2011 |

20122 | ||||

| ||||||

|

Base salary and allowances |

2 180 |

1 663 | ||||

|

Funding of pension benefits |

175 |

175 | ||||

|

Total fixed compensation |

2 355 |

1 838 | ||||

|

Cash Annual Performance Incentive |

3 000 |

1 450 | ||||

|

Value Alignment Incentive (VAI) |

0 |

1 450 | ||||

|

Long-term incentives (LPP)1 |

0 |

2 000 | ||||

|

Total variable compensation |

3 000 |

4 900 | ||||

|

Total compensation |

5 355 |

6 738 | ||||

All amounts reported are stated prior to the deduction of any social security contributions. Amounts reported under base salary and allowances include the base salary which is paid in cash, as well as benefits or allowances paid in cash.

Total Fixed Compensation reflects the portion of the Total Compensation that is fixed and therefore not performance related. For 2012, the portion of Group EC compensation that is fixed amounts to 28% (compared to 33% for 2011).

The LPP 2012 represents the fair value of the LPP award made in March 2012. This LPP may lead to a payment in March 2015, subject to return on equity and relative total shareholder return performance conditions from 2012 to 2014. In the same way, the LPP 2013 represents the fair value of the LPP award made in March 2013, which may (subject to the performance conditions from 2013 to 2015) lead to a payment in March 2016. The LPP is described in detail in chapter Leadership Performance Plan.

The members of the Group EC including the Group CEO, participate in a defined-contribution pension scheme. The funding of pension benefits shown in the table above reflects the actual employer contributions.

Shares held by members of the Group EC

The following table reflects total current Swiss Re share ownership by members of the Group EC as of 31 December:

| Download |

|

|

2012 | ||||||||

| |||||||||

|

Michel M. Liès, Group CEO1 |

129 562 | ||||||||

|

Guido Fürer, Group Chief Investment Officer2 |

1 500 | ||||||||

|

Agostino Galvagni, CEO Corporate Solutions |

69 371 | ||||||||

|

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

12 287 | ||||||||

|

Christian Mumenthaler, CEO Reinsurance |

50 000 | ||||||||

|

Moses Ojeisekhoba, CEO Reinsurance Asia3 |

1 139 | ||||||||

|

George Quinn, Group CFO |

57 987 | ||||||||

|

Matthias Weber, Group Chief Underwriting Officer4 |

24 237 | ||||||||

|

Thomas Wellauer, Group Chief Operating Officer |

16 714 | ||||||||

|

Total |

362 797 | ||||||||

Unvested restricted shares held by members of the Group EC

Prior to the introduction of the LPP, Swiss Re did not grant employee stock options or restricted share units (RSUs) on a regular basis, except for events such as exceptional business cycles, significant acquisitions or the replacement of forfeited equity for new executive hires.

The following table reflects unvested restricted share ownership by members of the Group EC as of 31 December:

| Download |

|

|

2012 |

|

Moses Ojeisekhoba, CEO Reinsurance Asia |

13 093 |

|

Total |

13 093 |

Vested options held by members of the Group EC

The following table reflects total vested option ownership by members of the Group EC as of 31 December:

| Download |

|

|

2012 |

|

Weighted average strike price in CHF |

82.32 |

|

Michel Liès, Group CEO |

66 000 |

|

Guido Fürer, Group Chief Investment Officer |

7 500 |

|

George Quinn, Group CFO |

26 000 |

|

Matthias Weber, Group Chief Underwriting Officer |

9 500 |

|

Total |

109 000 |

Swiss Re granted options to senior management in the past and the last grant was made in 2006. The remaining vested options held by active members of the Group EC will expire between 2013 and 2015, and have a weighted average exercise price of CHF 82.32 (within a range between CHF 67.65 and CHF 93.00).

Long Term Incentive units held by members of the Group EC

The following table reflects total outstanding Long Term Incentive units held by members of the Group EC as of 31 December. This includes both awards under the previous LTI and the current LPP:

| Download |

|

|

2012 |

|

Michel Liès, Group CEO |

125 480 |

|

David Cole, Group Chief Risk Officer |

51 595 |

|

Guido Fürer, Group Chief Investment Officer |

50 925 |

|

Agostino Galvagni, CEO Corporate Solutions |

101 790 |

|

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

37 240 |

|

Christian Mumenthaler, CEO Reinsurance |

91 390 |

|

Moses Ojeisekhoba, CEO Reinsurance Asia |

20 765 |

|

George Quinn, Group CFO |

110 340 |

|

J. Eric Smith, CEO Swiss Re Americas |

20 765 |

|

Matthias Weber, Group Chief Underwriting Officer |

73 370 |

|

Thomas Wellauer, Group Chief Operating Officer |

60 140 |

|

Total |

743 800 |

Loans to members of the Group EC

All credit is secured against real estate or pledged shares. The terms and conditions of loans and mortgages are the same as those available to all employees of the Swiss Re Group in their particular locations. Fixed-rate mortgages have a maturity of five years and interest rates that correspond to the five-year Swiss franc swap rate plus a margin of 10 basis points.

Variable-rate mortgages have no agreed maturity dates. The basic preferential interest rates equal the corresponding interest rates applied by the Zurich Cantonal Bank minus one percentage point. To the extent that fixed or floating interest rates are preferential, the value of this benefit has been included in the line item “base salary and allowances”.

| Download |

|

CHF thousands |

2012 |

|

Total mortgages and loans to members of the Group EC |

3 710 |

|

Highest mortgages and loans to an individual member of the Group EC: |

|

|

Christian Mumenthaler |

2 143 |

|

Total mortgages and loans not at market conditions to former members of the Group EC |

4 300 |

Compensation for former members of the Group EC

In 2012, in the context of the outstanding mortgages and loans not at market rates above as well as of risk benefits, the equivalent of circa CHF 60 000 was provided to three former members of the Group EC as a benefit in kind. No other compensation was paid to former members of the Group EC in 2012.