Leadership Performance Plan (LPP)

In March 2012 the previous long term incentive scheme was replaced with the LPP. The purpose of the LPP is to provide an additional incentive for Swiss Re’s senior management to achieve exceptional business performance over a three-year period. The LPP is a forward-looking instrument focusing on motivating top executives to take decisions that are in the shareholders’ long-term interest.

The LPP is awarded to a select group of key decision makers. The intention is to:

- focus participants’ energies on earnings, capital efficiency and our position against peers, all of which are critical to long-term shareholder value creation;

- focus participants on long-term goals which are forward-looking;

- attract and retain individuals of exceptional skill; and

- provide a competitive compensation that rewards long-term performance.

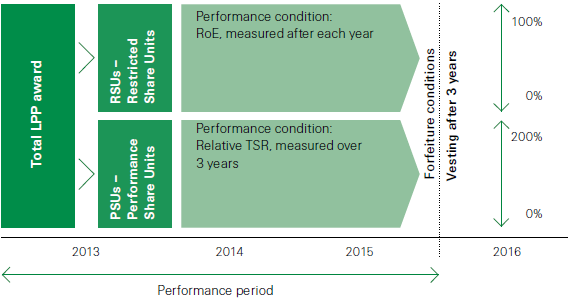

At grant date, the award is split into two equal underlying components – Restricted Share Units (RSUs), and Performance Share Units (PSUs), as explained below.

Leadership Performance Plan

Restricted Share Units (RSUs)

The return on equity (RoE) performance condition is based on a linear vesting line with 0% vesting for an RoE at risk free rate* and 100% vesting for an RoE at a predefined premium above risk free rate. The premium is set at the beginning of the plan period. At the end of each year, the performance against the RoE condition is assessed and one third of the RSUs are locked in within a range from 0–100%. At the end of the three-year period, the total number of units locked in at each measurement period will vest.

Performance Share Units (PSUs)

Swiss Re total shareholder return (TSR) performance is assessed relative to TSR of the peer group. A peer group is set at the beginning of the plan period and consists of companies that are similar in scale, have a global footprint or have a similar business mix as Swiss Re. The current list of peers is: Ace LTD, Aegon NV, Allianz SE, The Allstate Corporation, Aviva PLC, AXA SA, ING Groep NV, Metlife Inc, Muenchener Rueckversicherungs-Gesellschaft AG, PartnerRe Ltd, Prudential Financial Inc, QBE Insurance Group Ltd, SCOR SE and Zurich Insurance Group AG.

The performance condition for PSUs is relative TSR measured over 3 years. The PSUs can then vest within a range of 0–200%. In the case of a negative TSR over three years, the Compensation Committee retains the right to reduce the level of vesting.

Final Settlement

For the full three-year performance measurement period, forfeiture conditions apply. Additionally, clawback provisions apply to downward financial restatement which is caused or partially caused by the LPP participant’s fraud or misconduct. In this case, the company is entitled to seek repayment of any vested and settled award. At the end of the three-year measurement period, both components will be settled in Swiss Re shares.

LPP grant

The amounts disclosed under LPP in the section Compensation decisions in 2012 reflect the grants made in March 2013. This LPP award will be measured over the period 2013–2015.

The targets for this grant have been set as follows: The RSUs has a performance condition for vesting of 900 basis points above risk free rate. The PSUs vesting curve starts at the 35th percentile of TSR relative to peers. At the 50th percentile there is 50% vesting, and at the 75th percentile there is 200% vesting.

* Annual risk free rate is defined as the average of 12 monthly rates for 5-year US Treasury Bonds of the corresponding performance year.