Funding the Annual Performance Incentive and Leadership Performance Plan pools

The Compensation Committee focuses primarily on financial results and qualitative criteria in determining global variable compensation pools. The Compensation Committee views these results in the context of sustaining and increasing Swiss Re’s shareholder value through retaining key talent and protecting strongly performing business areas.

The Compensation Committee receives proposals from management requesting the total funding for variable compensation and allocating between the Annual Performance Incentive (API) and the Leadership Performance Plan (LPP). The management proposal for the annual API pool is based on the Group’s overall performance for the year. The LPP pool is reviewed in the context of sustainable business performance and affordability, but generally remains stable. The Compensation Committee considers these proposals and recommends a total pool to the full Board of Directors for approval. The Compensation Committee and the Chairman also propose an individual award for the Group CEO within this overall pool. The Value Alignment Incentive (VAI) is not funded as a separate pool, and the API pool will include amounts paid in cash as well as the amounts to be deferred in the VAI.

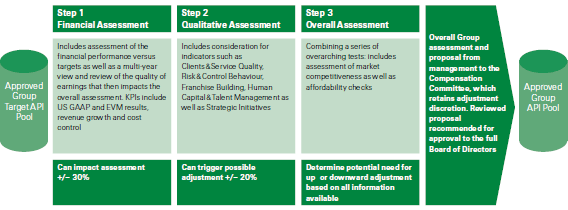

In 2012 Swiss Re introduced a three-step process based on business performance to determine the overall Group API pool. The process comprises a financial, a qualitative and an overall assessment including a series of sense checks. The financial assessment is primarily based on profitability as measured by EVM and US GAAP, although quality of earnings is also considered. The chart below gives more detail on the criteria used to determine the size of the pool. The Compensation Committee requires that the Business Units follow the same process when allocating their pools.

Group API Pool funding process