- Home

- Sustainability

- Driving sustainable operations

- Our CO2NetZero Programme

- Introducing our Carbon Steering Levy

Introducing our Carbon Steering Levy

The UN Global Compact has long called on companies to price carbon at a minimum of USD 100 per tonne of CO₂. In September 2020, Swiss Re became the first multinational company to announce such a triple-digit real internal carbon price on both direct and indirect operational greenhouse gas emissions, ie on all Scope 1, all Scope 2 and a significant part of our upstream Scope 3 emissions (business travel, energy transmission/distribution, paper, water and waste) across all Business Units and countries of operations.

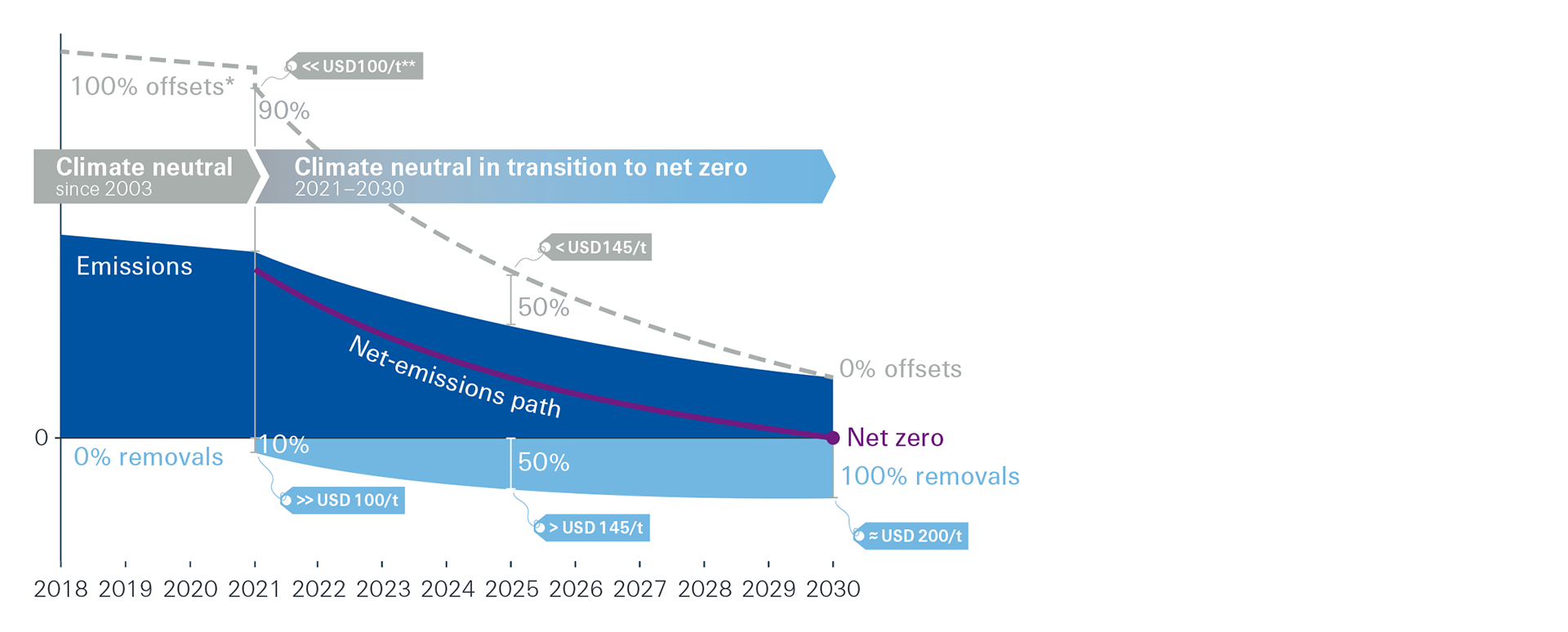

When we introduced our Carbon Steering Levy in January 2021, our previous carbon tax was pushed up from USD 8 to USD 100 per tonne of CO₂. By 2030, the levy will gradually increase to USD 200 per tonne of CO₂. This corresponds to the market price we expect for high-quality removals at that point in time, based on cost projections in scientific literature and current market intelligence.

The levy is the overarching element of our CO2NetZero Programme, as it helps us meet both the “Do our best, …” and “… remove the rest” objectives simultaneously.

We expect that placing a stringent price on carbon and increasing it on an annual basis will help us achieve further emission cuts by incentivising concrete reduction measures and low-carbon behaviour – hence the name Carbon Steering Levy. To this end, we are making sure that the levy is displayed at all times and at all levels of decision-making, for instance in the travel booking tool when different flight options are compared.

At the same time, the levy will secure the funds required to compensate the remaining emissions in line with our net zero by 2030 target by gradually moving from conventional carbon offsetting to supporting high-quality, ie durable and scalable, carbon removal projects (see illustration in section Our CO2NetZero Programme for the difference). This gradual transition means that we will be able to uphold the climate neutrality claim of our former Greenhouse Neutral Programme, while preparing to balance all remaining emissions through carbon removal by 2030, our net-zero target year (see illustration below).

Swiss Re’s operational emissions (stylised), including share and price tag of offsets and removals

** The price tags show the price of offsets and removals relative to the level of the Carbon Steering Levy in that year.

Since the carbon removal industry is still in its infancy, this new way of compensating emissions comes at a price. Costs will decrease over time as technologies and markets mature, but prices for high-quality removals will likely remain above the level of our Carbon Steering Levy until the end of the decade. Conventional carbon offsets – including the high-quality offsets we have bought in the past and will continue to buy – are expected to remain available at prices well below our levy. Mixing cheaper offsets with higher-cost removals will enable us to control the average carbon certificate price, so it never exceeds the level of the Carbon Steering Levy in any given year.

Finally, the use of a ten-year carbon pricing policy to secure sufficient funding for the right carbon certificates helps eliminate planning uncertainty. In particular, it allows us to source certificates through long-term purchase agreements, thus sending a strong signal to the market (see link below for more information).