The Sensitive Business Risk process

178

Sensitive business transactions referred to our team of sustainability experts

(219 in 2016)

Each of the two umbrella policies and seven sector guidelines of our Sustainability Risk Framework contains criteria and qualitative standards which define precisely when a transaction may present a “sustainability risk”. We assess such transactions through our Sensitive Business Risk (SBR) process, which consists of two due diligence mechanisms – the SBR online assessment tool and the SBR referral tool.

The online tool stores the relevant sustainability risk information for these sectors and is regularly updated to reflect new risk developments. It thus provides our underwriters with an efficient means to check the potential impact of their transactions on human rights, labour rights and the environment. For transactions that reveal low to medium risks, they need to carry out additional due diligence based on industry and country advice provided by the tool.

If the potential human rights or environmental risks of a transaction are assessed as high but the responsible underwriter wants to pursue it, it is automatically transferred through the SBR referral tool to Swiss Re’s in-house team of sustainability experts. These specialists then conduct targeted research to decide whether the transaction at hand is acceptable on ethical grounds.

This decision takes the form of a binding recommendation either to go ahead with the transaction, to go ahead with certain conditions attached, or to abstain. If there is disagreement about the recommendation, the case can be escalated to the next management level and, ultimately, to the Group Chief Risk Officer and the Group Executive Committee.

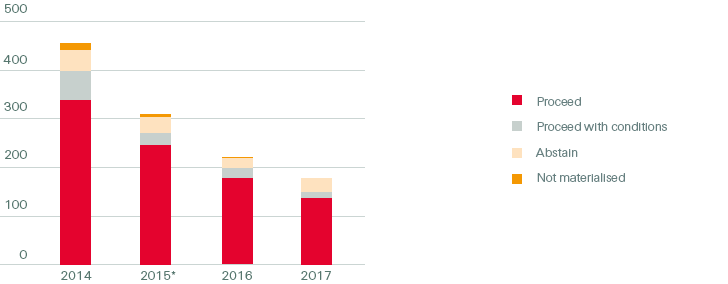

We first introduced the online SBR assessment tool midway through 2015 and have continuously fine-tuned it since, gradually strengthening our underwriters’ ability to integrate sustainability risk assessment into their decision-making. This has resulted in a steady decrease of SBR referrals to our in-house sustainability experts, from 454 in 2014 to 178 in 2017. Of those transactions, we issued negative recommendations in 29 cases and positive recommendations with conditions attached in 12 cases.

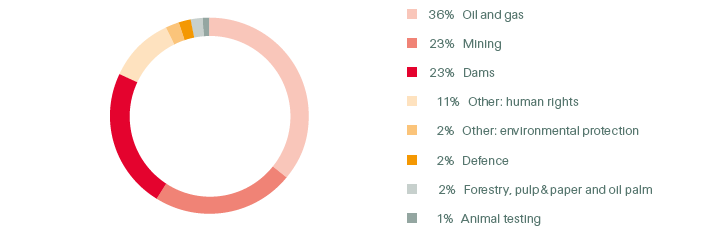

SENSITIVE BUSINESS RISKS REFERRED TO OUR EXPERT TEAM IN 2017, BY SECTOR/ISSUE

NUMBER OF SENSITIVE BUSINESS RISK REFERRALS AND DECISIONS TAKEN

*Starting in mid-2015, we have refined our SBR process, which has led to a steady decrease in the number of referrals