Asset management in high growth markets

Swiss Re’s investments in high growth markets (HGM), mainly in government and corporate bonds, have more than doubled to around USD 5 billion over the past three years. Thus far these assets have performed well, returning on average around 9%–13% per year across asset classes since 2002. We continue to find HGM assets attractive, particularly US dollar-denominated bonds issued by HGM sovereigns and corporates residing in HGM countries.

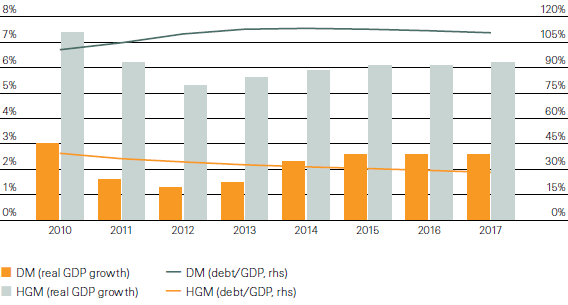

Among the many factors underlying the HGM investment case are stronger economic growth than in developed markets (DM); lower government and household indebtedness; sounder fiscal policies (with many countries in surplus); and more favourable demographics. The latest International Monetary Fund (IMF) forecasts expect the growth gap between HGM and DM gross domestic product (GDP) to remain at over 3% for the next five years. Meanwhile, government debt/GDP ratio in HGM is set to fall to below 30% over the same period, whereas the ratio in DM is expected to remain above 100% (see figure). These macro trends have enhanced institutional investors’ interest in HGM countries, which has been reinforced by the numerous country rating upgrades over the last 5–10 years. As the institutional credibility of HGM develops, the longer-term outlook becomes ever more positive. Last but not least, investing in HGM also makes sense from an underlying business perspective.

Real GDP growth and government debt/GDP for HGMs and DMs

Source: IMF World Economic Outlook, October 2012

Building the investment case

Demographics – a key factor that drives financial markets over the longer-term – are favourable in HGM, with relatively younger populations in most countries. Barring HGM where population aging already is or will be a challenge over the next decade (notably China, Russia and Eastern Europe), these countries will experience an increase in the working age population that, combined with effective public policies, would facilitate even more rapid economic growth.

Asset markets in HGM countries could benefit from structural changes. These assets, with a total market capitalisation estimated at approximately USD 16 trillion (around 20% of the size of world equity and debt markets), are under-represented in the global context, given that HGM countries account for around 38% of global GDP and about 70% of global GDP growth in 2012. Credit ratings are also improving, as the average rating of HGM debt in various market indices has improved to “BBB” today from an average rating of “BB” in 2002, as several HGM sovereigns have been upgraded to investment grade over the past few years. The markets for HGM assets should therefore grow in terms of depth and breadth.

The investment case is especially strong for the re/insurance sector. According to Swiss Re’s sigma study from October 2012, growth in commercial insurance (with annual premiums of USD 600 billion globally) is becoming more concentrated in HGM: over the past decade, premiums from HGM have grown by an average of 14% per year, or two to three times faster than in DM (5.4%)1. This means that investments in HGM will be increasingly important to the entire re/insurance sector, and especially to Swiss Re, which aims to earn 20%–25% of premiums in these markets by 2015. The need to align HGM investments with our insurance liabilities will be fundamental to meeting these targets.

Investing in HGM is not without risks and challenges. Financial assets in these markets are likely to exhibit higher volatility and be more exposed to the risk of contagion from global economic shocks despite improvements in risk perception by market participants. Also, lower liquidity of HGM assets, higher transaction costs and restrictions placed on foreign investors are further potential deterrents for some investors.

Despite these risks, the merits of investing in HGM assets cannot be ignored. The macro outperformance, yield enhancement and diversification benefits, as well as a widening investor base make the longer-term case for investing in HGM assets strong.

1 Swiss Re sigma No 5/2012, Insuring ever-evolving commercial risks.