Specific approaches per asset class

In addition to the overarching approach described above, we have identified some key investment areas where we apply further, specific ESG criteria to cater for the different risk characteristics of responsible investment. These key investment areas include rates products, credit products, equities and real estate:

Rates products

Rates products1 constitute the largest asset class in our investment portfolio, with a share of 55% at the end of 2014. With 39% of total assets under management, government bonds (incl. agency) are the largest holding within rates products.

At a country level, we have implemented political risk and sustainability assessments to guide on responsible investment decisions and to guarantee the quality of our government bond portfolio in this respect. Our rates products portfolio is screened against political country risk and sustainability rating considerations on a semi-annual basis. Furthermore, the rating measures are used to define investment mandates for our portfolio managers.

Political Country Risk Rating

The Political Country Risk Rating comprehensively measures the political risk in a country, which is defined as events of a political, economic or social nature that harm business operations or adversely affect the business climate. The overall country score is derived from multiple external and internal data sets and Swiss Re’s expert assessment.

Sustainability Rating

The Sustainability Rating, a derivative of the Political Country Risk Rating, measures the overall social, environmental and human rights situation in a country, and supports Swiss Re’s alignment with relevant United Nations principles.

Credit products, equities and hedge funds

At the end of 2014, close to 40% of our investment portfolio was externally managed. This portfolio is mainly comprised of credit products, equities and hedge funds.

Approximately 90% of Swiss Re’s externally managed assets are managed by PRI signatories themselves. All of them have contractual provisions with Swiss Re, specific to responsible investments.

We work closely with the managers to ensure they consider ESG aspects in their investment processes. Before external managers are appointed, Swiss Re performs thorough due diligence to confirm their compliance with our responsible investment principles. This includes ESG considerations in investment decisions and monitoring, as well as a review of the managers’ commitment to responsible investment. After being mandated, the managers’ individual performances are monitored in line with our Responsible Investment Policy, and they are required to report regularly on their responsible investment activities.

For more systematic and regular monitoring of the actual integration of ESG factors into our externally managed portfolio, we have engaged the services of a leading ESG research company. We apply the ratings provided by them to our investment portfolio to assess the quality of the portfolio and gain further insight into ESG risk exposures.

Real estate

Our investment portfolio consists of direct investments in properties, principally in Switzerland and in Germany. Comprising buildings for both residential and commercial use, the total value of the portfolio was USD 2.5 billion at the end of 2014.

For these real estate investments we apply ambitious sustainability standards. For projects in Switzerland, the applicable criteria are defined in the Energy Mission Statement of Swiss Re. This stipulates that all new buildings need to conform to the MINERGIE® standard (www.minergie.ch), a Swiss quality label specifying high levels of energy efficiency and superior user comfort. When an existing building in the portfolio is due for renovation, this standard is applied whenever it is feasible from an architectural, technical and financial point of view.

By the end of 2014, the combined value of our MINERGIE®-certified buildings had reached USD 0.4 billion, or 19.5% of our Swiss portfolio of direct real estate investments. The total energy consumption surface in accordance with the MINERGIE® standard was 82 497 m2 at the end of 2014. In addition, more than 56 000 m2 had been sold on to third parties in previous years.

In 2014, construction of a new property, built to the MINERGIE-ECO® standard, was completed: In addition to environmental specifications, this residential complex with 40 flats also meets health criteria and demands on building materials. Furthermore, construction of a new building with 16 flats which will meet the MINERGIE® standard is currently underway; it is expected to be completed in 2016.

Voting

Voting activities in 2014

Voting behaviour in 2014

As an asset owner, and in particular as a shareholder, we recognise our rights and responsibilities as an integral part of our commitment to responsible investment.

We believe that ESG considerations, and especially good corporate governance and transparency towards shareholders, are key drivers for sustainable value creation. Therefore, we actively exercise our rights to enhance portfolio value.

In the case of internally managed assets, we use our influence as a responsible shareholder by directly exercising our voting rights, and with externally managed portfolios, by facilitating the relevant portfolio managers to execute our proxy votes and related engagement activities.

In line with our voting framework, we review the voting policies of external managers during due diligence processes to confirm compliance with our own policy. In addition, external managers are required to report on voting activities conducted on Swiss Re’s behalf, including providing an explanation of any votes against management.

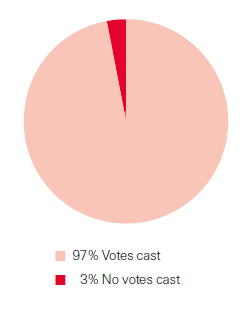

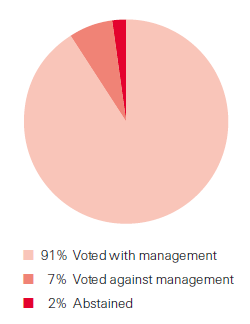

In 2014, we exercised our voting rights on 97% of our listed equity portfolio. We voted on 4 171 ballots through our external managers, and we voted in favour of the respective management resolution in 3 817 cases (91%), against it in 280 cases (7%) and abstained from voting in 74 cases (2%).

In addition to shares in listed companies, investments in our equity portfolio include equity exchange-traded-funds (ETFs). The fund managers cast votes on these ETFs for all investors in accordance with the fund managers’ own voting policies and processes.

Due to our large- and mid-cap company focus and the moderate total size of our equity exposure, we generally hold a very small portion of total issued share capital. This means Swiss Re rarely controls the outcome of a vote.

1 Rates products consist of cash, short-term investments, government bonds (incl. agency), and derivatives thereof.