- Home

- Sustainability

- Extending our risk intelligence

- Our ESG Risk Framework

Our ESG Risk Framework

We first introduced a dedicated framework to manage sustainability risks in our core re/insurance business more than ten years ago. It was designed to address an issue facing many businesses, including our own: Some business transactions may be economically beneficial and perfectly legal, yet may still have adverse environmental or social impacts. We believed, and continue to believe, that it is important to recognise the existence of such dilemmas and address them responsibly throughout our business.

Our ESG Risk Framework is therefore an advanced risk management instrument that enables us to identify, assess and address environmental, social and human rights, and governance-related risks potentially associated with our transactions. This framework applies to our entire business, including all our re/insurance transactions and investments, to the extent that we can influence their various aspects.

After a major review completed in 2021, we have changed the name of our framework from Sustainable Business Risk Framework to ESG Risk Framework to reflect its broader scope and intent.

The ESG Risk Framework consists of:

- Three umbrella guidelines on the environment, social aspects and human rights, and governance, as well as specific policies on sensitive sectors or issues

- The ESG Risk Process, comprising an ESG risk rating in a semi-automated assessment (ESG Risk Service), the ESG Referral Tool and an appeals process

- Company exclusions

- Sector exclusions in specified countries beyond mere compliance with international trade controls (ITCs)

Umbrella guidelines and sector-specific policies

Our ESG Risk Framework is based on the overarching principles of protecting the environment, respecting human rights and promoting good corporate governance, encapsulated in three umbrella guidelines that are valid for all our transactions. In addition, specific policies apply these overarching principles to seven sectors or issues in which we perceive major sustainability risks: the defence industry; oil and gas; mining; dams; agriculture, forestry and food; nuclear weapons proliferation; and thermal coal.

We regularly review the guidelines and policies of our ESG Risk Framework to ensure they are in step with new risk developments and changing stakeholder expectations. In 2021, we introduced a revised and expanded Agriculture, Forestry and Food Policy, thus further strengthening our approach to managing nature- and biodiversity-related risks in our core business.

In 2021, we also introduced the Umbrella Guideline on Corporate Governance, which represents the “G” pillar of our ESG Risk Framework. The new umbrella guideline aligns our business conduct with the principles set forth in the UN Global Compact and focuses on issues related to corporate governance as well as corporate behaviour.

However, it should be noted that the name change is only formal in nature, since our former Sustainable Business Risk Framework already covered business transactions involving human rights violations and environmental damage resulting from poor corporate governance and behaviour.

Guidelines and policies of our ESG Risk Framework

The ESG Risk Process

We implement the framework’s policies through a due diligence process consisting of three elements: the ESG Risk Service, the ESG Risk Referral Tool for potentially high-risk transactions and an appeals procedure. This process is firmly embedded in the Group’s underwriting guidelines and processes.

In the course of 2020, we fully embedded the ESG Risk Service in the underwriting processes for direct and facultative transactions. It gives our underwriters an indication of the ESG risk exposures of their transactions, provides them with clear guidance on what to assess in further detail and signals which highly sensitive transactions need to be to referred to our ESG Risk team. The data foundation of our ESG Risk Service is provided by an ESG risk watchlist of companies and projects that are flagged as high-risk to our business practitioners. Currently, the watchlist spans 2 358 sensitive companies and 300 projects.

As 2021 was the first full reporting year in which the ESG Risk Service was integrated in most of our underwriting teams’ tools and processes, we witnessed a significant increase in the number of ESG risk assessments to approximately 92 000. At the same time, the number of ESG risk referrals remained comparatively stable, which indicates that the identification of high-risk transactions was already effective before the ESG Risk Service was fully integrated.

The transactions identified as potentially high-risk are transferred through the ESG Risk Referral Tool to our in-house team of ESG risk experts, who analyse them in detail and issue binding recommendations: to go ahead, to go ahead with certain conditions attached or to abstain. In the event of disagreements, these recommendations can be appealed and escalated.

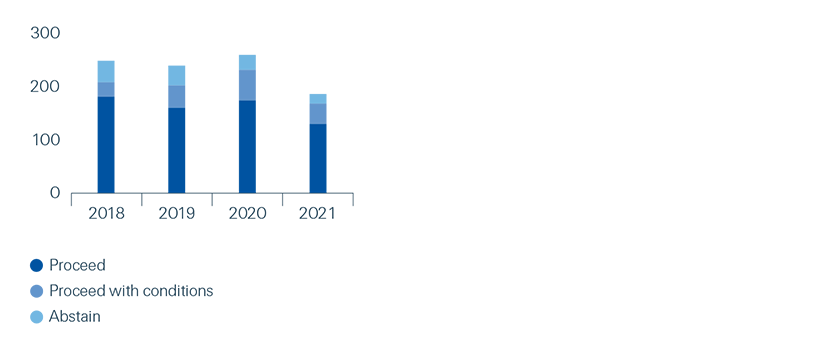

The number of ESG risk referrals declined from 258 to 185 in 2021. In total, we issued negative recommendations in 18 cases and positive recommendations with conditions in 38 cases (see graph on the right). Two recommendations were escalated through the appeals process. The decline in referrals was caused by a more rigorous update process in the data underlying the ESG Risk Service and a clear distinction between low and medium/high-risk industries.

185

ESG risk transactions referred to our team of ESG risk experts (258 in 2020)

ESG risks referred to our expert team in 2021, by sector/issue*

Number of ESG risk referrals and recommendations issued

Training

We offer our employees regular in-house training on the ESG Risk Framework. It is compulsory for all our employees who work in underwriting and with our clients as well as for all our new staff. In 2021, a total of approximately 2 100 employees completed the mandatory training.

Client and industry interaction

Over the year, we had approximately 80 external engagements on sustainability risks with clients, brokers, investors, industry peers and civil society groups such as environmental and humanitarian NGOs. We held meetings with clients operating in sensitive sectors such as agriculture, forestry and mining to discuss potential measures they could take to address their ESG risks.

In partnership with other re/insurers, we promote industry initiatives aimed at strengthening ESG risk management in underwriting portfolios. One example of such a collaboration is our engagement in the CRO Forum. In 2021, we contributed to the publication “Mind the Sustainability Gap”, which has attracted considerable attention since its launch. It provides guidance on how to integrate sustainability considerations into re/insurance risk management and presents Swiss Re’s ESG Risk Framework as a best-practice case study.