Property & Casualty Reinsurance

Property & Casualty Reinsurance reported a net income for 2018 of USD 370 million compared to a net loss of USD 413 million in 2017. Both years were affected by large natural catastrophe losses, while 2018 also saw a significant impact from large man-made losses. Estimated total large natural catastrophe and man-made losses amounted to USD 2.3 billion in 2018, mainly stemming from the Ituango dam collapse in Colombia, the Camp and Woolsey wildfires in California, hurricanes Michael and Florence in the Americas, floods and winter storms in Japan, also hit by typhoons Jebi and Trami, the Sydney hailstorm and a fire at a shipyard in Germany. The net operating margin was 4.3% in 2018, up from –1.3% in 2017.

The overall investment result was USD 1.4 billion in 2018 compared to USD 1.6 billion in 2017. Net investment income was USD 1.4 billion in 2018, reflecting the impact of rising interest rates. Net realised losses amounted to USD 16 million, compared to significant realised gains from equity sales in 2017. The losses were driven by market value losses and lower realised gains from fixed income securities. The return on investments was 2.4%.

Property & Casualty results

| Download |

USD millions |

2017 |

2018 |

Change in % |

Revenues |

|

|

|

Gross premiums written |

16 544 |

16 545 |

0 |

Net premiums written |

16 031 |

16 098 |

0 |

Change in unearned premiums |

636 |

–3 |

— |

Premiums earned |

16 667 |

16 095 |

–3 |

Net investment income |

1 017 |

1 380 |

36 |

Net realised investment gains/losses |

613 |

–16 |

— |

Other revenues |

48 |

36 |

–25 |

Total revenues |

18 345 |

17 495 |

–5 |

|

|

|

|

Expenses |

|

|

|

Claims and claim adjustment expenses |

–13 172 |

–11 614 |

–12 |

Acquisition costs |

–4 253 |

–4 012 |

–6 |

Operating expenses |

–1 159 |

–1 114 |

–4 |

Total expenses before interest expenses |

–18 584 |

–16 740 |

–10 |

|

|

|

|

Income/loss before interest and income tax expense/benefit |

–239 |

755 |

— |

Interest expenses |

–280 |

–313 |

12 |

Income/loss before income tax expense/benefit |

–519 |

442 |

— |

Income tax expense/benefit |

125 |

–72 |

— |

Net income/loss before attribution of non-controlling interests |

–394 |

370 |

— |

Income/loss attributable to non-controlling interests |

|

|

|

Net income/loss after attribution of non-controlling interests |

–394 |

370 |

— |

Interest on contingent capital instruments, net of tax |

–19 |

|

— |

Net income/loss attributable to common shareholders |

–413 |

370 |

— |

|

|

|

|

Claims ratio in % |

79.0 |

72.2 |

|

Expense ratio in % |

32.5 |

31.8 |

|

Combined ratio in % |

111.5 |

104.0 |

|

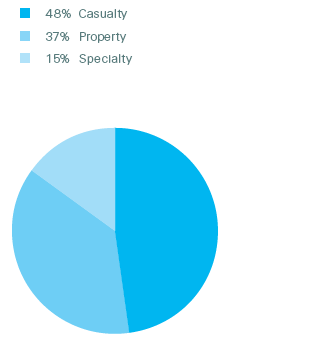

Premiums

Premiums earned by line of business, 2018

Total: USD 16.1 billion

Net premiums earned were USD 16.1 billion for 2018, down from USD 16.7 billion in the prior period, reflecting a reduction mainly in the Chinese quota share business and in the US casualty business, partly offset by business volume increase in Asia. Gross premiums written of USD 16.5 billion in 2018 were in line with the prior-year period.

Combined ratio

Property & Casualty Reinsurance reported a combined ratio of 104.0% for 2018, compared to 111.5% in 2017. The impact from natural catastrophes of USD 2.0 billion in 2018 was 5.0 percentage points above the expected level for the year, which was 7.1 percentage points. The favourable development of prior accident years improved the combined ratio by 0.9 percentage points in 2018, compared to a 3.3 percentage point improvement in 2017.

Administrative expense ratio

The administrative expense ratio was 6.9% in 2018 compared to 7.0% in 2017, reflecting continuous focus on productivity measures.

Lines of business

The Property combined ratio decreased to 99.9% in 2018, compared to 119.9% a year earlier. Both periods include a high loss burden, with 2017 impacted by events such as Cyclone Debbie, hurricanes Harvey, Irma and Maria in the Americas, two earthquakes in Mexico and wildfires in California.

The Casualty combined ratio slightly increased to 110.6% in 2018, compared to 108.8% in 2017. The current period includes the impact from non-renewal of business in the US and reduced volumes in EMEA, mainly in the motor line of business.

The Specialty combined ratio improved to 93.4% for 2018, compared to 98.4% in 2017. This is a result of positive prior-year development across all lines of business, predominantly in marine.

Investment result

The return on investments was 2.4% for 2018, compared to 3.5% in 2017, reflecting a reduction in the investment result of USD 329 million.

Net investment income increased by USD 352 million to USD 1.3 billion for 2018, mainly due to a higher invested asset base alongside the impact of rising interest rates.

Net realised losses were USD 63 million for 2018, compared to net realised gains of USD 590 million for the prior period. The decrease is largely related to the contribution from equity securities, as the 2017 figure reflected significant realised gains from equity sales, while the current period was negatively impacted by the recent change in US GAAP accounting guidance, which entered into effect on 1 January 2018. Losses on interest rate derivatives and a reduction of gains from sales of fixed income securities also contributed to the lower result.

Insurance-related investment result and foreign exchange gains/losses are not included in the figures above.

Shareholders’ equity

Common shareholders’ equity decreased to USD 9.5 billion as of 31 December 2018 from USD 10.8 billion as of 31 December 2017, primarily driven by dividends paid to the Group of USD 1.3 billion, unfavourable foreign exchange movement and the net change in unrealised gains/losses, partly offset by net income. The return on equity for 2018 was 3.7% compared to –3.5% in 2017.

Outlook

Renewals of loss-affected natural catastrophe business experienced rate increases. We had opportunities to grow our natural catastrophe business in North America at attractive terms. In non-loss-affected markets, rates remain stable overall, with some minor volatility.

We observed notable differences within Specialty lines with rate increases for loss-affected lines and markets, and otherwise stable terms and conditions. For Casualty, rates increased in segments where improvements were needed due to claims emergence. We continued to seize good opportunities for transactions,

For Property and Casualty we will increase our market share where prices, terms and conditions meet our expectations. Our differentiation model and the solutions we offer will allow us to access further attractive opportunities.