Group results

Group results – Swiss Re’s net income significantly impacted by large losses and recent change in US GAAP accounting guidance on equity securities.

“Our extraordinary financial strength enabled us to support our clients in these tough times, and in 2018 we absorbed USD 3.0 billion of large claims.”

Christian Mumenthaler

Group Chief Executive Officer

2018 was dominated by large catastrophic events that made it the second consecutive challenging year for Swiss Re, with our property and casualty businesses taking the heaviest toll. Swiss Re’s estimated insurance claims from large natural catastrophes, including typhoons Jebi and Trami in Japan, the Camp and Woolsey wildfires in California, as well as hurricanes Florence and Michael in the Americas, amounted to USD 2.2 billion in 2018, net of retrocession and before tax. In addition, multiple large man-made disasters generated USD 0.8 billion in claims. Swiss Re’s net income, which amounted to USD 421 million for the year, was above 2017 when natural catastrophe claims and man-made losses totalled USD 4.7 billion.

The 2018 net income was also impacted by a lower investment result, reflecting challenging financial markets, and an estimated negative pre-tax impact of USD 599 million due to the recent change in US GAAP accounting guidance on recognition and measurement of equity investments that took effect on 1 January 2018. Excluding the accounting guidance, net income would have been USD 894 million.

Reinsurance generated a net income of USD 1.1 billion, compared to USD 679 million in 2017.

Property & Casualty Reinsurance reported a net income of USD 370 million in 2018, compared to a net loss of USD 413 million in 2017. Both periods were strongly impacted by natural catastrophes, totalling USD 2.0 billion in 2018 and USD 3.7 billion in 2017, net of retrocession and before tax. The net operating margin was 4.3%, compared to –1.3% in the prior-year period.

Life & Health Reinsurance contributed a net income of USD 761 million in 2018, down from USD 1.1 billion in 2017, driven by a lower underwriting result due to unfavourable mortality experience as well as reduced investment performance. The net operating margin decreased to 9.4% in 2018 from 13.1% in the previous year.

Corporate Solutions incurred a net loss of USD 405 million in 2018, compared to a net loss of USD 741 million in 2017. Both years were significantly impacted by large natural catastrophes and man-made losses, totalling USD 0.7 billion in 2018 and USD 1.2 billion in 2017, net of retrocession and before tax. The net operating margin was –11.1% and –23.5% for 2018 and 2017, respectively.

Life Capital delivered a net income of USD 23 million in 2018, compared to USD 161 million in 2017, impacted by unfavourable UK investment market performance. As a result, Life Capital’s net operating margin declined to 3.9% in 2018, compared to 10.9% for 2017.

The Group’s net operating margin for 2018 was 2.9%, a slight increase from 2.8% in the prior year.

Common shareholders’ equity, excluding non-controlling interests and the impact of contingent capital instruments, decreased to USD 27.9 billion at the end of 2018, down from USD 33.4 billion at the end of 2017. The decline mainly reflected a payment to shareholders of USD 2.9 billion for the 2017 regular dividend and the share buy-back programmes, as well as a decrease in unrealised investment gains of USD 2.8 billion.

Swiss Re achieved a return on equity of 1.4% for 2018, above the 2017 return of 1.0%. Excluding the impact of the recent change in US GAAP accounting guidance, the estimated return on equity would have been 2.9%.

Earnings per share for 2018 were USD 1.37 or CHF 1.34, compared to USD 1.03 or CHF 1.02 for 2017.

Book value per common share stood at USD 93.09 or CHF 91.72 at the end of 2018, compared to USD 106.09 or CHF 103.37 at the end of 2017. Book value per common share is based on common shareholders’ equity and excludes non-controlling interests and the impact of contingent capital instruments.

Business performance

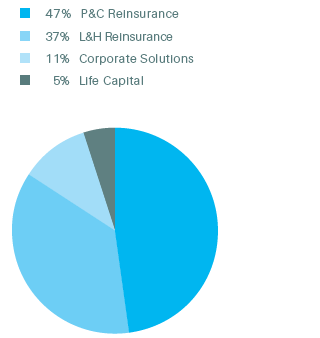

Net premiums and fees earned by business segment, 2018

Total: USD 34.5 billion

Premiums earned and fee income for the Group amounted to USD 34.5 billion for 2018, an increase of 2.2% year-on-year. Gross premiums written increased in the same period by 4.7% to USD 36.4 billion, primarily driven by premium growth across the Group’s life and health businesses.

Property & Casualty Reinsurance contributed USD 16.1 billion of premiums earned in 2018, down from USD 16.7 billion in 2017. The decline is mainly in the Chinese quota share business and in the US casualty business. The Property & Casualty Reinsurance combined ratio was 104.0% in 2018, down from 111.5% as the prior year included larger natural catastrophe impacts.

Life & Health Reinsurance premiums earned and fee income totalled USD 12.8 billion in 2018, an increase of 7.1% year-on-year, mainly reflecting growth across all markets and a positive impact of intra-group retrocession agreements.

Corporate Solutions premiums earned were USD 3.9 billion for 2018, up by 7.5% compared to the previous year. The Corporate Solutions combined ratio was 117.5% in 2018, compared to 133.4% in the previous year, reflecting less significant large natural catastrophe losses in 2018.

Premiums earned and fee income for Life Capital increased by 14.1% to USD 1.6 billion, mainly driven by growth in the open book life and health insurance business combined with intra-group retrocessions. Life Capital continued to generate exceptional gross cash amounting to USD 818 million in 2018 compared to USD 998 million in 2017.

Investment result and expenses

Swiss Re’s return on investments for 2018 was 2.8%, compared to 3.9% in 2017, reflecting a negative impact from the recent change in US GAAP accounting guidance. Non-participating net investment income increased to USD 4.1 billion in 2018 compared to USD 3.7 billion the prior year. The Group reported non-participating net realised investment gains of USD 0.1 billion in 2018, compared to USD 1.7 billion in 2017, as the prior year benefited from significant realised gains from sales within the equity portfolio versus market value losses in 2018.

Acquisition costs for the Group amounted to USD 6.9 billion in 2018, slightly down from USD 7.0 billion in 2017.

Operating expenses of USD 3.4 billion in 2018 increased by 3.7% year-on-year.

Interest expenses were USD 555 million, down by 1.9% year-on-year.

The Group reported a tax charge of USD 69 million on a pre-tax income of USD 550 million for 2018, compared to a tax charge of USD 132 million on a pre-tax income of USD 525 million for 2017. This translated into an effective tax rate in the current and prior-year reporting periods of 12.5% and 25.1%, respectively. The tax rate in 2018 was largely driven by tax benefits from foreign currency translation differences between statutory and US GAAP accounts, the release of valuation allowances on net operating loss and tax benefits from intra-entity transfers, partially offset by profits earned in higher tax jurisdictions and tax charges from unrecognised tax benefits.